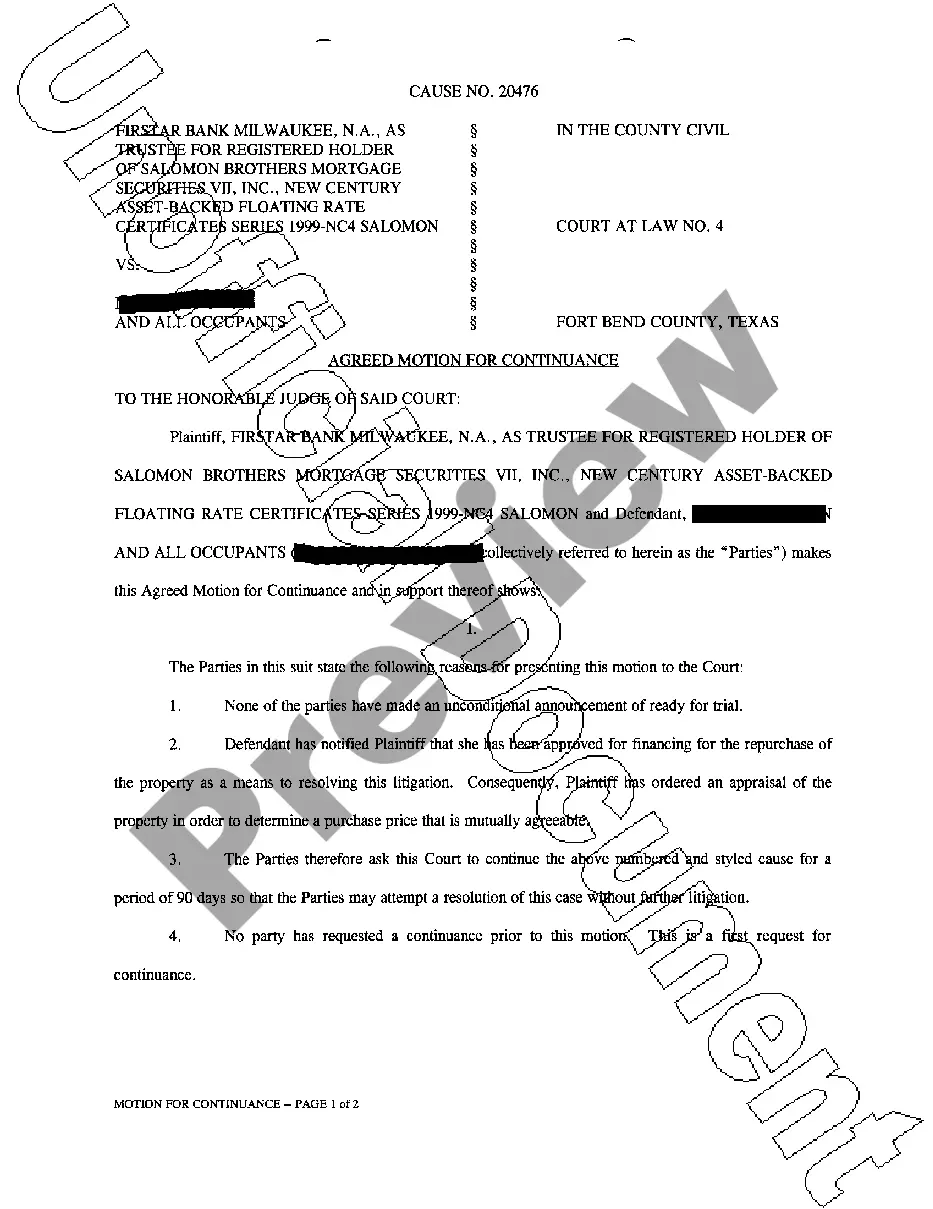

Riverside California Assignment of Debt is a legally binding agreement that allows a debtor to transfer their debt obligation to another party, known as the assignee. This process allows the assignee to assume the rights and responsibilities of the original creditor, including collecting outstanding payments and enforcing collection actions, such as filing lawsuits or obtaining judgments. Keywords: Riverside California, Assignment of Debt, debtor, transfer, obligation, assignee, creditor, outstanding payments, collection actions, lawsuits, judgments. There are different types of Riverside California Assignment of Debt, each with its specific characteristics and purposes: 1. Standard Assignment of Debt: This is the most common type of debt assignment where the original creditor transfers the debt to a third-party assignee. The assignee becomes the new owner of the debt and is entitled to collect payments directly from the debtor. 2. Factoring: Factoring is a type of debt assignment commonly used in business finance. In this scenario, a business sells its accounts receivable or invoices to a third-party known as a factor at a discounted rate. The factor assumes responsibility for collecting the outstanding payments from the debtor. 3. Securitization: Securitization is a complex financial process where a company bundles together multiple debts, such as loans or mortgages, and sells them as securities to investors. Through this assignment of debt, the original creditor receives immediate cash flow while investors earn a return by receiving payments from the debtors. 4. Collateralized Debt Obligation (CDO): CDO is a type of debt assignment commonly associated with mortgage-backed securities. Financial firms package a pool of mortgages into a security, often divided into tranches with different levels of risk and return. Investors who purchase these tranches receive payments from the debtors, and the assignee manages the collection process. 5. Assignment for Collection: Occasionally, creditors hire collection agencies to pursue delinquent debts. In this arrangement, the credit remains with the original creditor, but the collection agency is assigned to recover the unpaid amounts from the debtor. Once the debt is collected, the agency will often retain a percentage of the amount as a fee. Overall, Riverside California Assignment of Debt allows for the legal transfer of debt obligations from one party to another. It is crucial for all involved parties to understand the terms and implications of the assignment to ensure compliance with state laws and protect their rights and interests.

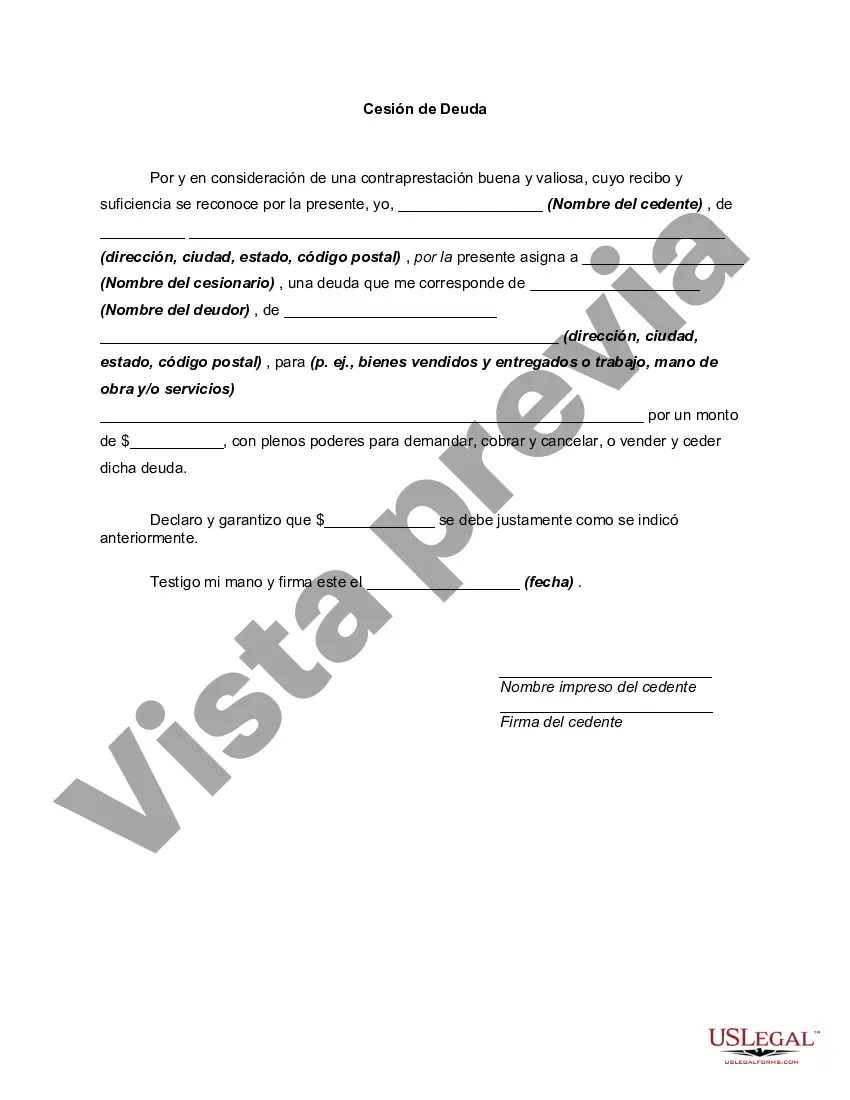

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Cesión de Deuda - Assignment of Debt

Description

How to fill out Riverside California Cesión De Deuda?

How much time does it typically take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Riverside Assignment of Debt meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Riverside Assignment of Debt, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Riverside Assignment of Debt:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Riverside Assignment of Debt.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!