Salt Lake Utah Assignment of Debt is a legal process where a debt owed by one party, known as the assignor, is transferred or assigned to another party, known as the assignee, in the Salt Lake City, Utah area. This transfer relieves the assignor from their responsibility of repaying the debt, as the assignee takes over the obligation to collect the debt. The Assignment of Debt process in Salt Lake Utah involves a written agreement between the assignor and the assignee, outlining the terms and conditions of the transfer. This agreement typically includes details such as the amount of the debt, the interest rate (if any), the due date, and any other relevant provisions. Both parties must willingly enter into this agreement for the assignment to be valid. In Salt Lake Utah, there are various types of Assignment of Debt agreements that can be utilized depending on the specific circumstances: 1. Assignment of Debt for Business Accounts: This type of assignment commonly occurs when a business owes a debt to another business or individual. The assignee may be a debt collection agency or a third-party company specializing in purchasing and collecting debts. 2. Assignment of Debt for Personal Loans: Individuals in Salt Lake Utah who have borrowed money from financial institutions or private lenders may opt to assign their debt to another individual or a company specialized in debt purchasing. This allows the original debtor to transfer their financial burden to someone else. 3. Assignment of Debt for Medical Bills: In situations where individuals are unable to repay their medical expenses, hospitals or medical service providers may assign the debt to a collections' agency that specializes in healthcare debts. 4. Assignment of Debt for Credit Cards: Credit card companies may transfer their outstanding debts to debt collection agencies or sell them to debt buyers in order to recover the delinquent or uncollectible amounts. 5. Assignment of Debt for Government Debts: Government entities, such as local authorities, may employ assignment of debt strategies to transfer unpaid fines, taxes, or other debts to collection agencies or specialized departments responsible for debt recovery. It is important to note that each type of Assignment of Debt has its own legal implications and requirements in Salt Lake Utah. Parties involved should seek legal advice to ensure compliance with applicable laws and regulations. Additionally, individuals who find themselves assigned a debt should evaluate the terms and conditions of the assignment agreement to fully understand their rights and obligations.

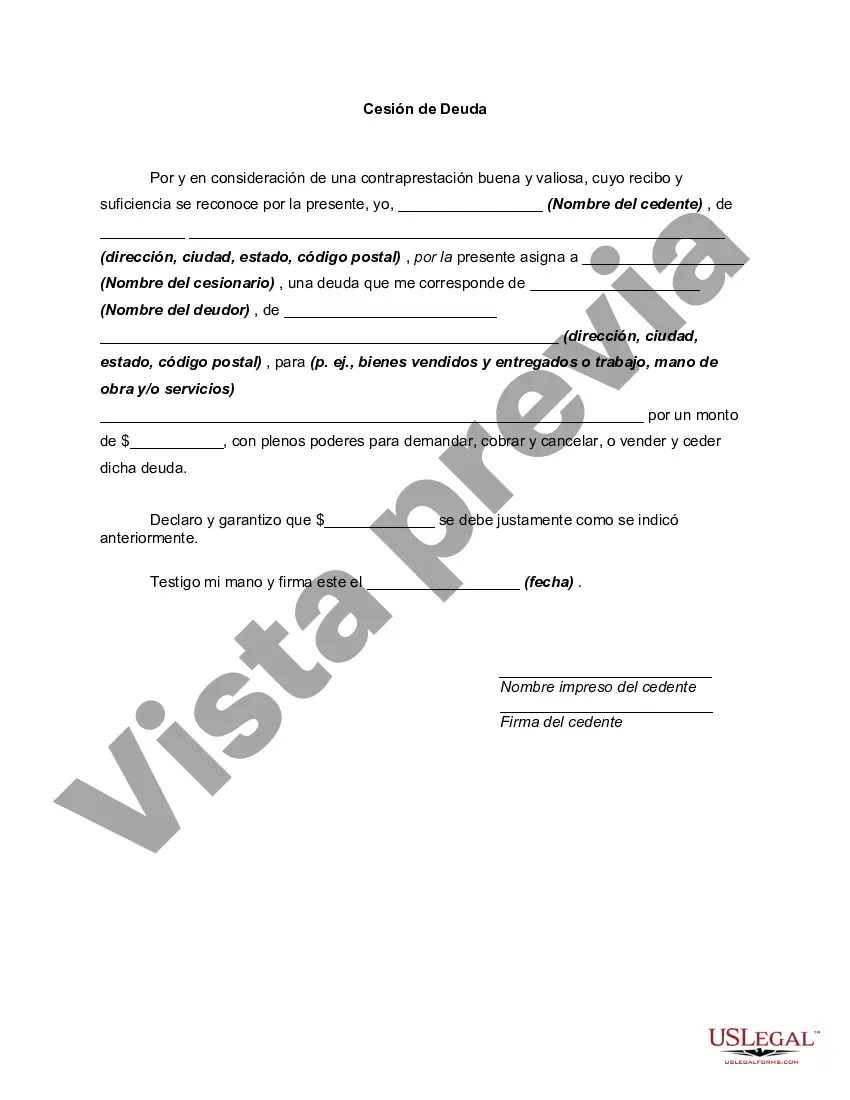

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Cesión de Deuda - Assignment of Debt

Description

How to fill out Salt Lake Utah Cesión De Deuda?

Drafting documents for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Salt Lake Assignment of Debt without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Salt Lake Assignment of Debt on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Salt Lake Assignment of Debt:

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any use case with just a few clicks!