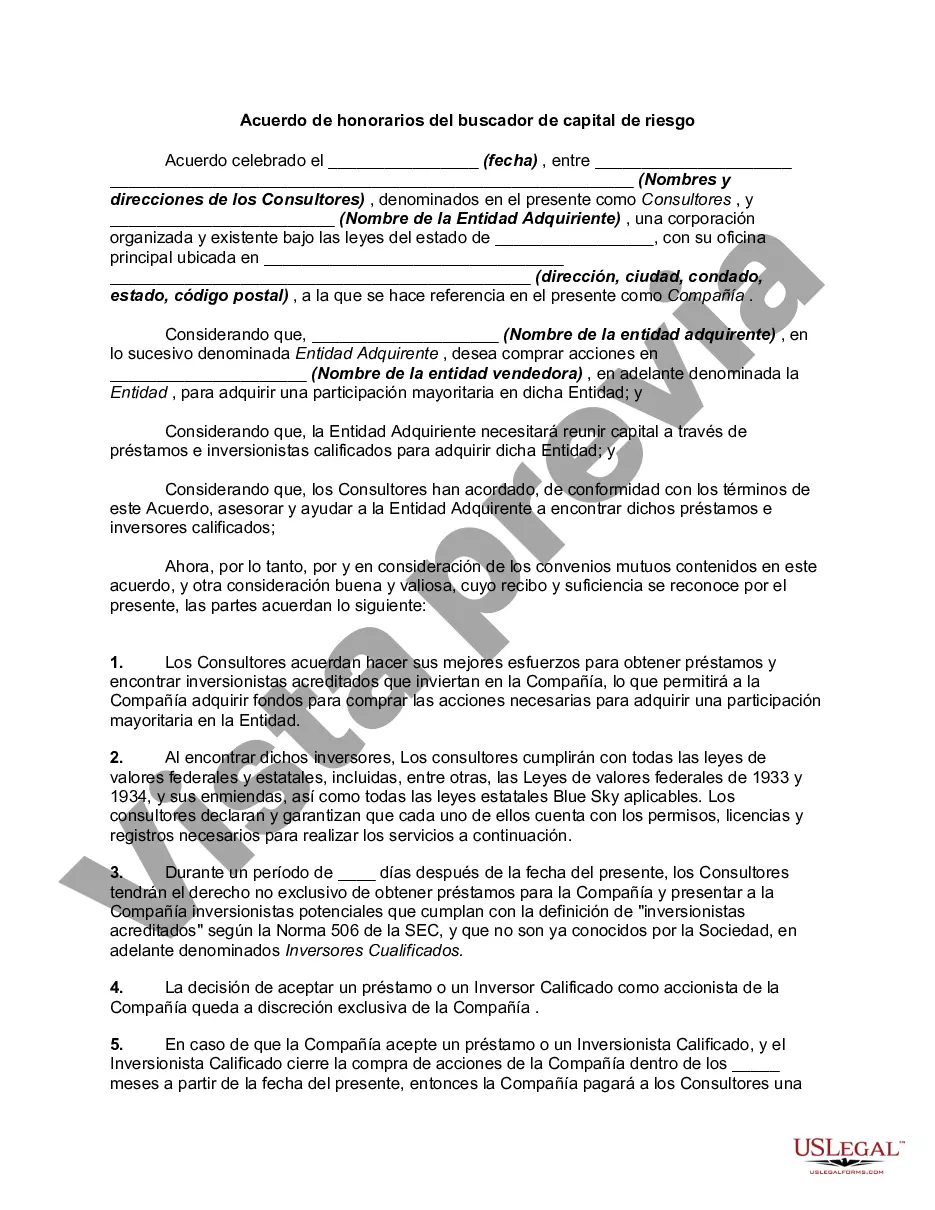

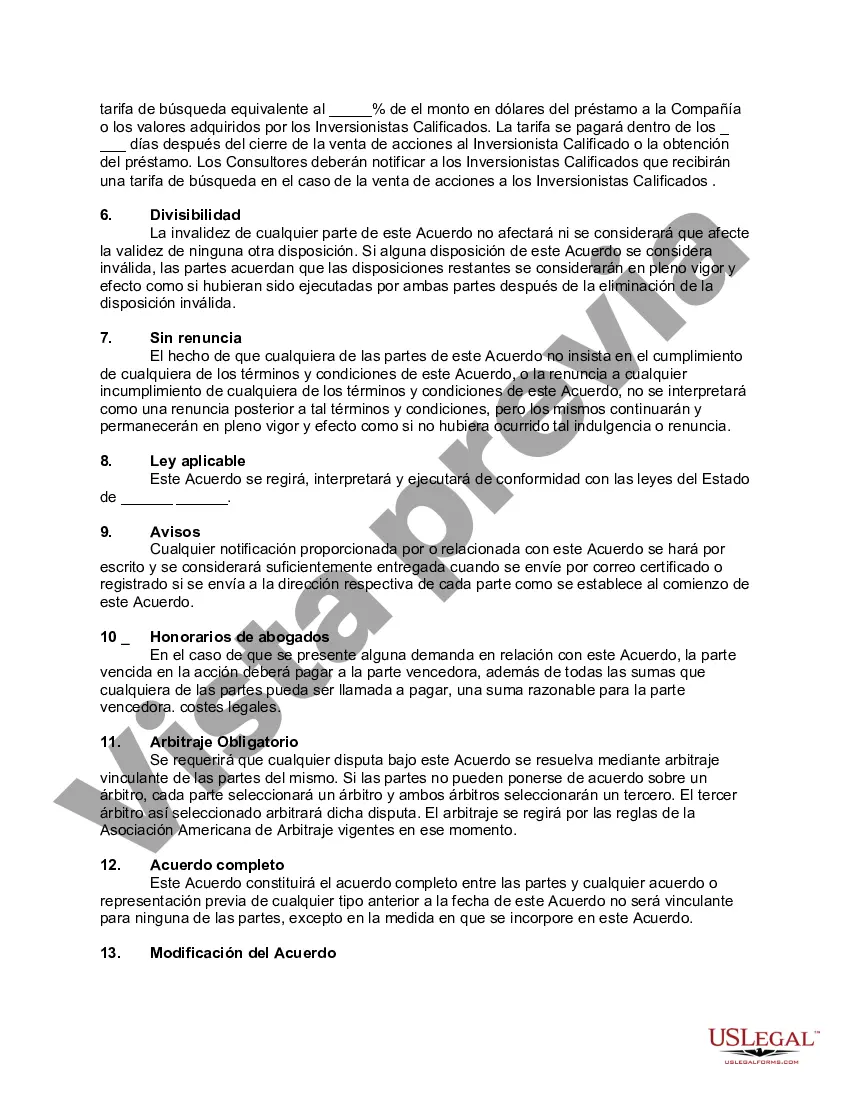

Clark Nevada Venture Capital Finder's Fee Agreement is a legal contract that outlines the terms and conditions between a venture capital firm and a finder, who assists in locating potential investment opportunities. This agreement typically includes various clauses and provisions regarding the compensation, responsibilities, and obligations of both parties involved. Keywords: Clark Nevada, Venture Capital, Finder's Fee Agreement, contract, terms and conditions, compensation, responsibilities, obligations, investment opportunities. Different types of Clark Nevada Venture Capital Finder's Fee Agreements may include: 1. Traditional Finder's Fee Agreement: This type of agreement establishes a standard compensation structure, where the finder receives a fixed percentage of the total investment made by the venture capital firm. 2. Success-Based Fee Agreement: In this agreement, the finder's compensation is determined based on the success of the investment opportunity they discover. The finder may receive a percentage of the actual profit or return on investment achieved. 3. Exclusive Finder's Fee Agreement: This agreement grants exclusivity to the finder, ensuring that they are the sole representative of the venture capital firm in searching for potential investment opportunities within a specific industry or region. 4. Retainer Fee Agreement: This type of agreement involves a finder being paid a fixed amount as a retainer fee for their services, regardless of whether an investment opportunity is successfully sourced or not. 5. Multi-party Finder's Fee Agreement: Sometimes, multiple finders or intermediaries may collaborate to find investment opportunities. This agreement defines how the finder's fee will be distributed among the different parties involved in the scouting and referral process. 6. Performance-Based Fee Agreement: In this arrangement, the finder is compensated based on predefined performance metrics, such as the number of qualified investment prospects presented to the venture capital firm or the quality of due diligence performed on potential opportunities. Regardless of the specific type, a Clark Nevada Venture Capital Finder's Fee Agreement serves as a vital legal tool that establishes the scope of work, compensation structure, and expectations for both the venture capital firm and the finder, ensuring a fair and transparent partnership in the process of discovering potential investment ventures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo de honorarios del buscador de capital de riesgo - Venture Capital Finder's Fee Agreement

Description

How to fill out Clark Nevada Acuerdo De Honorarios Del Buscador De Capital De Riesgo?

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Clark Venture Capital Finder's Fee Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the current version of the Clark Venture Capital Finder's Fee Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Clark Venture Capital Finder's Fee Agreement:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Clark Venture Capital Finder's Fee Agreement and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!