Nassau New York Venture Capital Finder's Fee Agreement is a legally binding contract between a venture capital firm and a finder or intermediary who is responsible for identifying potential investment opportunities. This agreement outlines the terms and conditions for compensating the finder for their services in successfully connecting the venture capital firm with suitable investment prospects. The main purpose of the Nassau New York Venture Capital Finder's Fee Agreement is to establish clear guidelines regarding the finder's compensation, responsibilities, and the obligations of both parties involved. It ensures that the finder is duly rewarded for their efforts in locating and facilitating the introduction of potential investment opportunities that align with the venture capital firm's investment criteria. The agreement typically includes several key provisions such as: 1. Compensation Structure: The agreement outlines the specific fee structure and payment terms that will apply to the finder's services. It may include a percentage-based commission on the final investment amount or a fixed fee. The compensation terms may vary depending on the size and complexity of the investment opportunity. 2. Exclusivity and Term: The agreement may specify whether the finder has an exclusive or non-exclusive arrangement with the venture capital firm. It also establishes the duration of the agreement, stating the period during which the finder's services will be considered for compensation. 3. Scope of Services: The agreement defines the scope of services expected from the finder. This may include conducting market research, identifying potential investment targets, verifying their suitability, and facilitating introductions between the venture capital firm and the prospects. 4. Responsibilities and Obligations: Both parties' obligations are detailed in the agreement, providing clarity on the expected level of involvement and the responsibilities of the finder and the venture capital firm throughout the investment evaluation process. 5. Confidentiality and Non-Disclosure: The agreement may include provisions to protect sensitive information shared during the engagement, ensuring that the finder maintains strict confidentiality and non-disclosure obligations regarding the venture capital firm's proprietary information. In terms of different types of Nassau New York Venture Capital Finder's Fee Agreements, they can be categorized based on the industry or sector specialization. For instance, there may be specific agreements tailored for technology-focused ventures, biotech or healthcare startups, real estate investments, or renewable energy projects. These specialized agreements may include additional terms and conditions related to the particular sector, specific investment criteria, or regulatory requirements. In summary, the Nassau New York Venture Capital Finder's Fee Agreement serves as a crucial legal instrument in formalizing the relationship between a venture capital firm and a finder. It ensures the fair compensation of the finder's services while outlining the roles, responsibilities, and obligations of both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de honorarios del buscador de capital de riesgo - Venture Capital Finder's Fee Agreement

Description

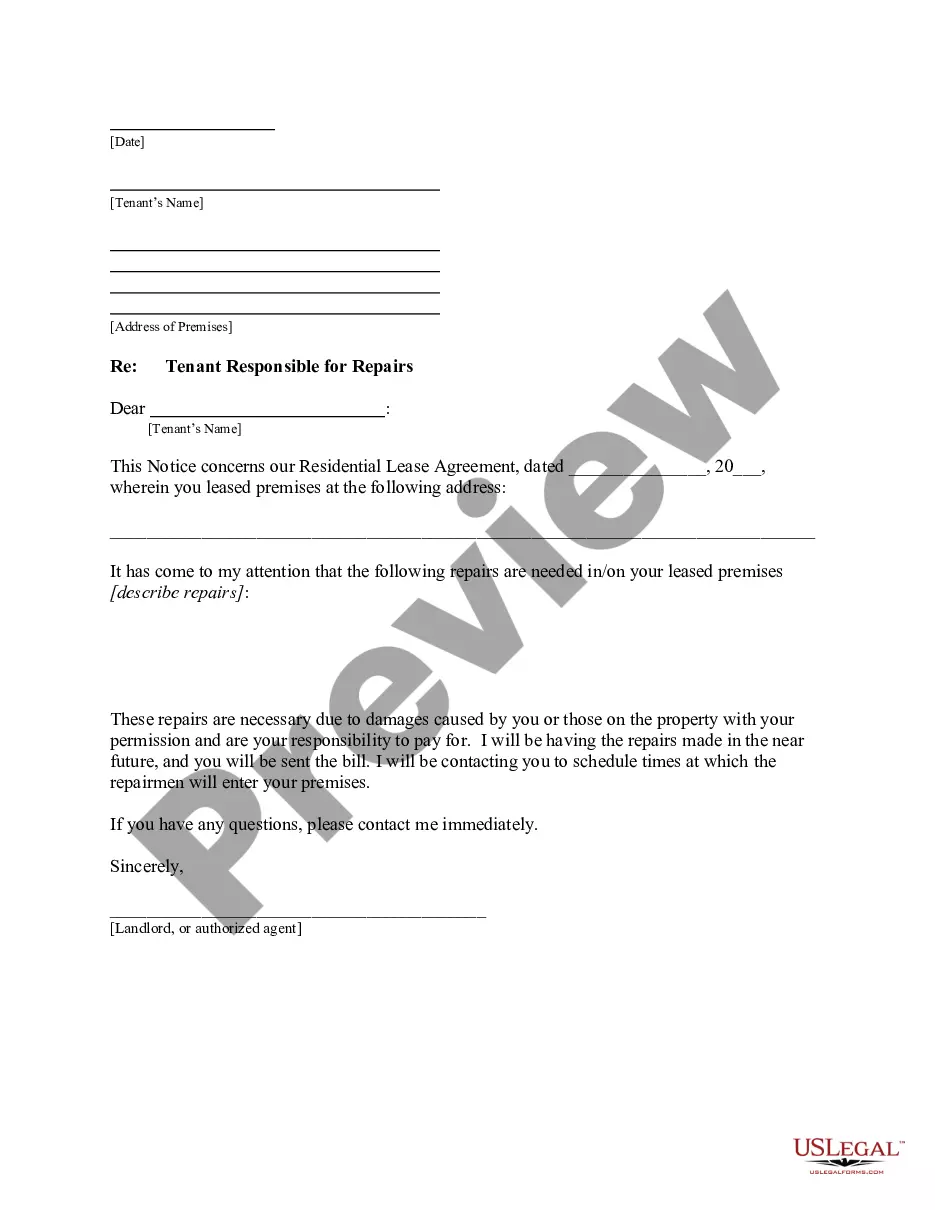

How to fill out Nassau New York Acuerdo De Honorarios Del Buscador De Capital De Riesgo?

Draftwing paperwork, like Nassau Venture Capital Finder's Fee Agreement, to manage your legal matters is a difficult and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents crafted for various scenarios and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Nassau Venture Capital Finder's Fee Agreement template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before downloading Nassau Venture Capital Finder's Fee Agreement:

- Ensure that your template is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a quick intro. If the Nassau Venture Capital Finder's Fee Agreement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and download the document.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!