The Riverside California Venture Capital Finder's Fee Agreement is a legally binding document that outlines the terms and conditions between a venture capital firm and a finder who aids in sourcing potential investment opportunities in Riverside, California. This agreement serves as a crucial tool in formalizing the relationship between the parties involved and ensures fair compensation for the finder's services. Keywords: Riverside California, venture capital, Finder's Fee Agreement, agreement, terms and conditions, investment opportunities, compensation, services, legally binding, formalizing, relationship. There are typically two main types of Riverside California Venture Capital Finder's Fee Agreements: 1. Exclusive Finder's Fee Agreement: This type of agreement ensures that the finder exclusively works with the venture capital firm. It outlines the duration of exclusivity, terms of engagement, and the commission structure for successful deals brought by the finder. This agreement provides a level of commitment and dedication from the finder to the venture capital firm. Keywords: Exclusive Finder's Fee Agreement, exclusivity, terms of engagement, commission structure, commitment, dedication. 2. Non-Exclusive Finder's Fee Agreement: Unlike an exclusive agreement, the non-exclusive Finder's Fee Agreement allows the finder to work with multiple venture capital firms simultaneously. This agreement specifies the finder's responsibilities, compensation structure, and conditions for sharing potential investment opportunities with other firms. The non-exclusive agreement provides flexibility to the finder while remaining aligned with multiple venture capital firms. Keywords: Non-Exclusive Finder's Fee Agreement, multiple firms, responsibilities, compensation structure, flexibility, alignment. In both types of agreements, some common elements are often included: 1. Fee Structure: The agreement clearly defines the amount or percentage of the finder's fee to be paid upon successful investment. This fee can be a flat rate or a percentage of the investment amount. Keywords: Fee Structure, finder's fee, successful investment, flat rate, percentage. 2. Conflicts of Interest: The agreement addresses any potential conflicts of interest that might arise during the engagement. It outlines the finder's obligation to disclose any conflicts and ensures transparency in the relationship. Keywords: Conflicts of Interest, disclosure, transparency, relationship. 3. Termination Clause: This section outlines the conditions under which either party can terminate the agreement. It specifies the notice period and any financial obligations that remain in effect even after termination. Keywords: Termination Clause, conditions, notice period, financial obligations. 4. Representations and Warranties: Both the venture capital firm and the finder make certain representations and warranties to each other. These ensure that both parties have the legal capacity to enter into the agreement and that they are not in violation of any laws or regulations. Keywords: Representations and Warranties, legal capacity, violation, laws, regulations. In conclusion, the Riverside California Venture Capital Finder's Fee Agreement is a comprehensive and binding contract that solidifies the relationship between a venture capital firm and a finder. It outlines the terms, compensation, obligations, and termination conditions to create a mutually beneficial partnership in sourcing investment opportunities in Riverside, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Acuerdo de honorarios del buscador de capital de riesgo - Venture Capital Finder's Fee Agreement

Description

How to fill out Riverside California Acuerdo De Honorarios Del Buscador De Capital De Riesgo?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Riverside Venture Capital Finder's Fee Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any tasks related to document execution simple.

Here's how to locate and download Riverside Venture Capital Finder's Fee Agreement.

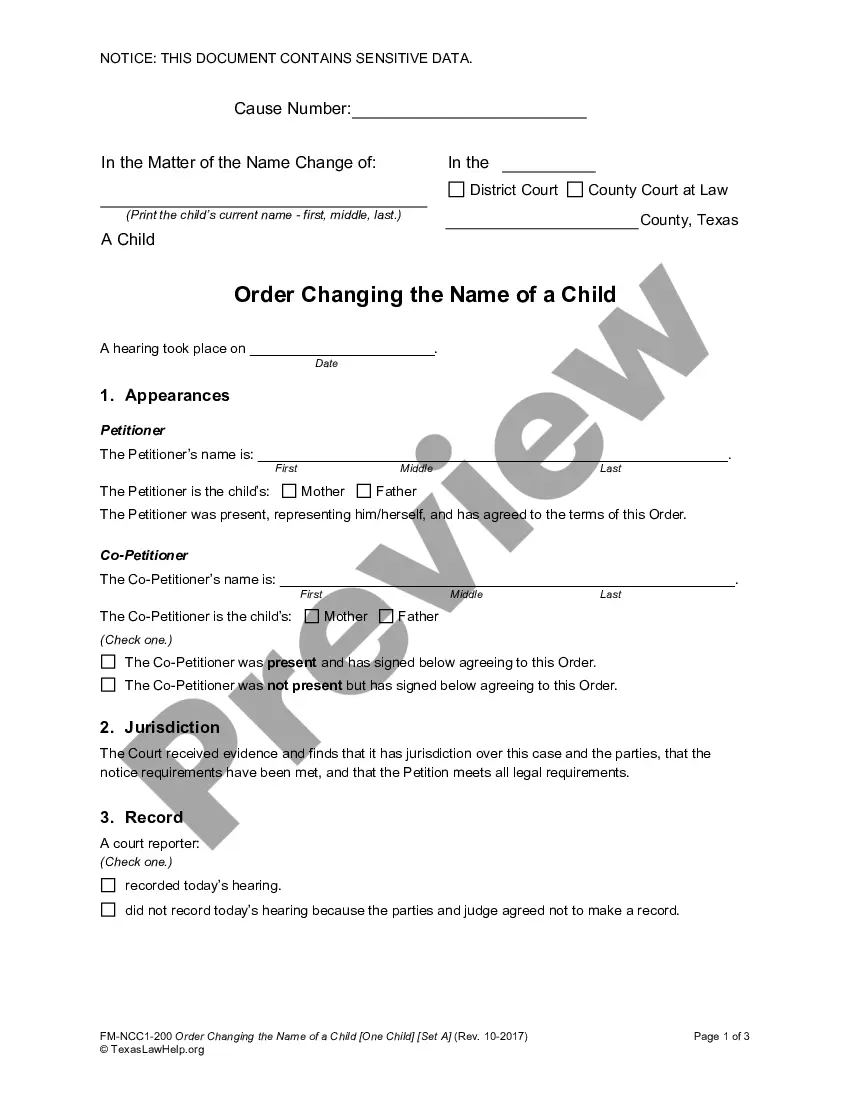

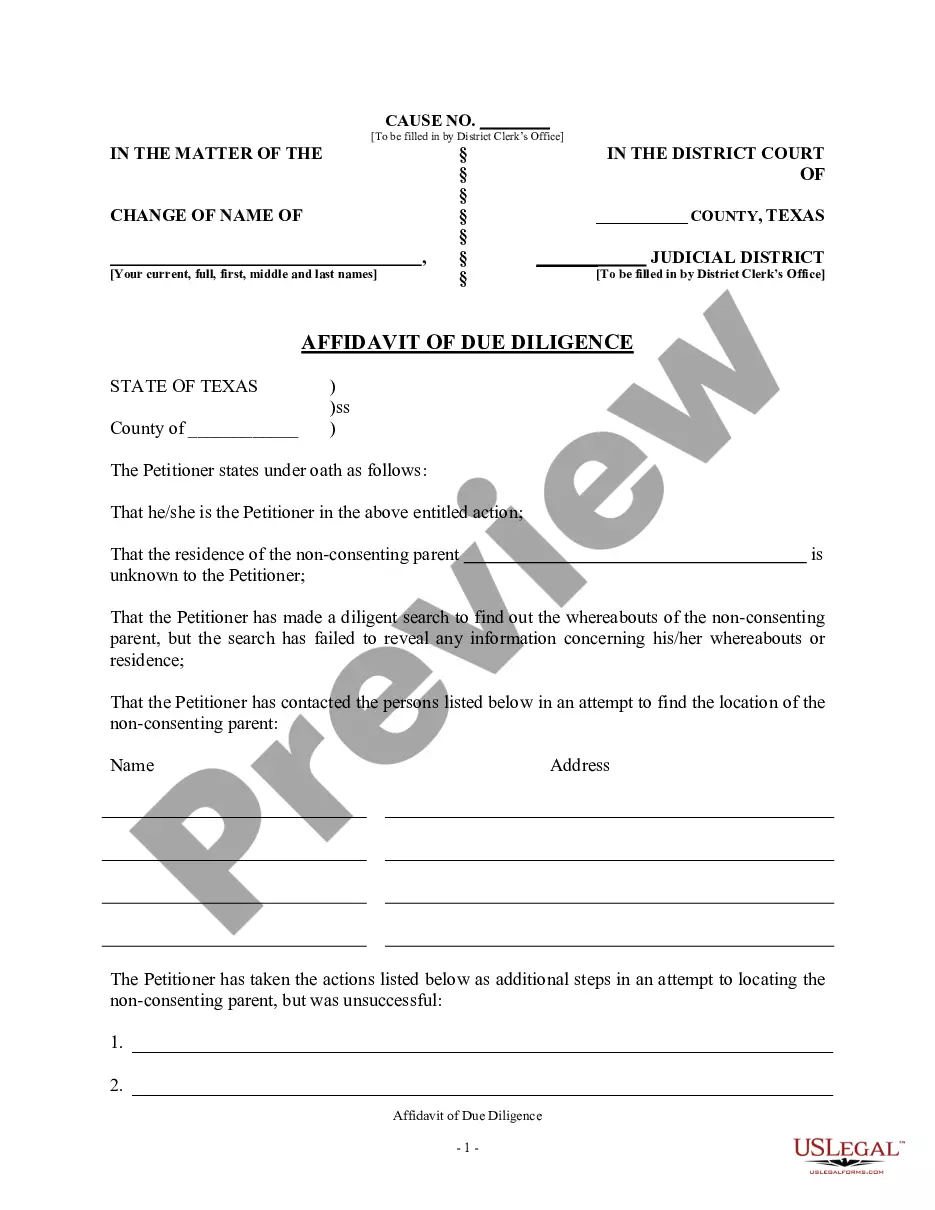

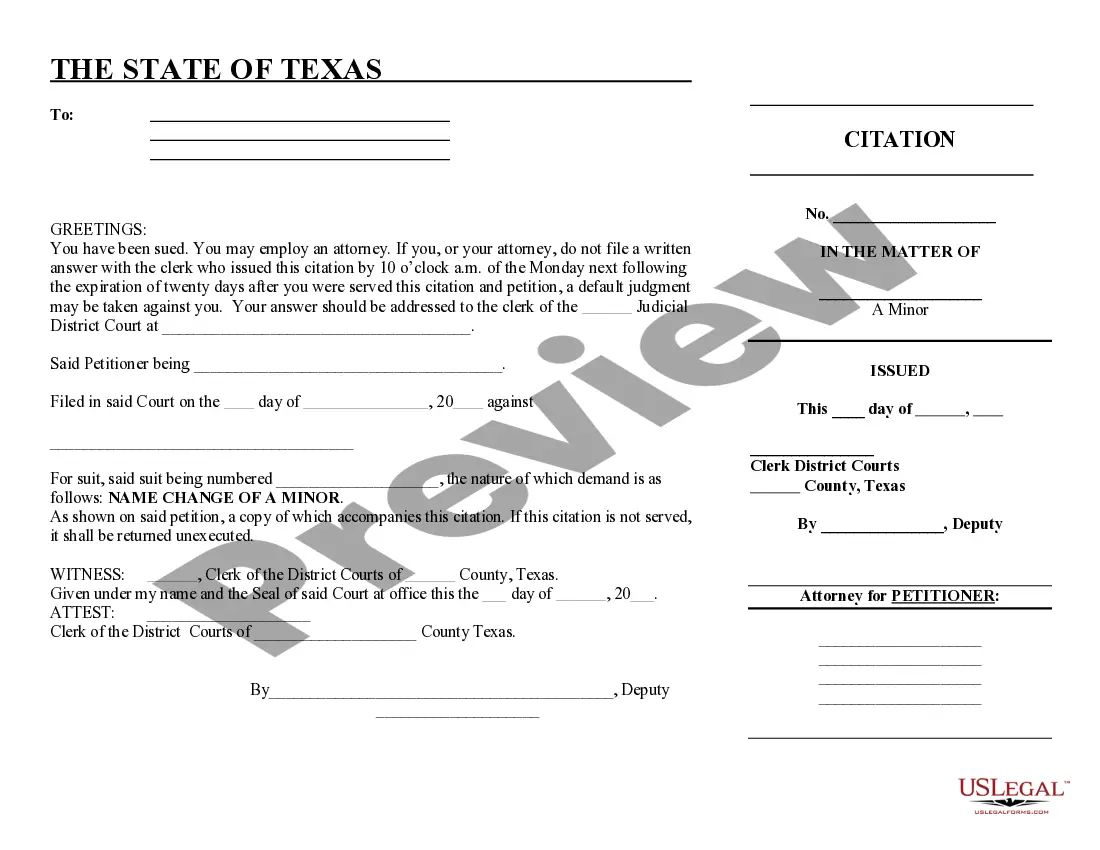

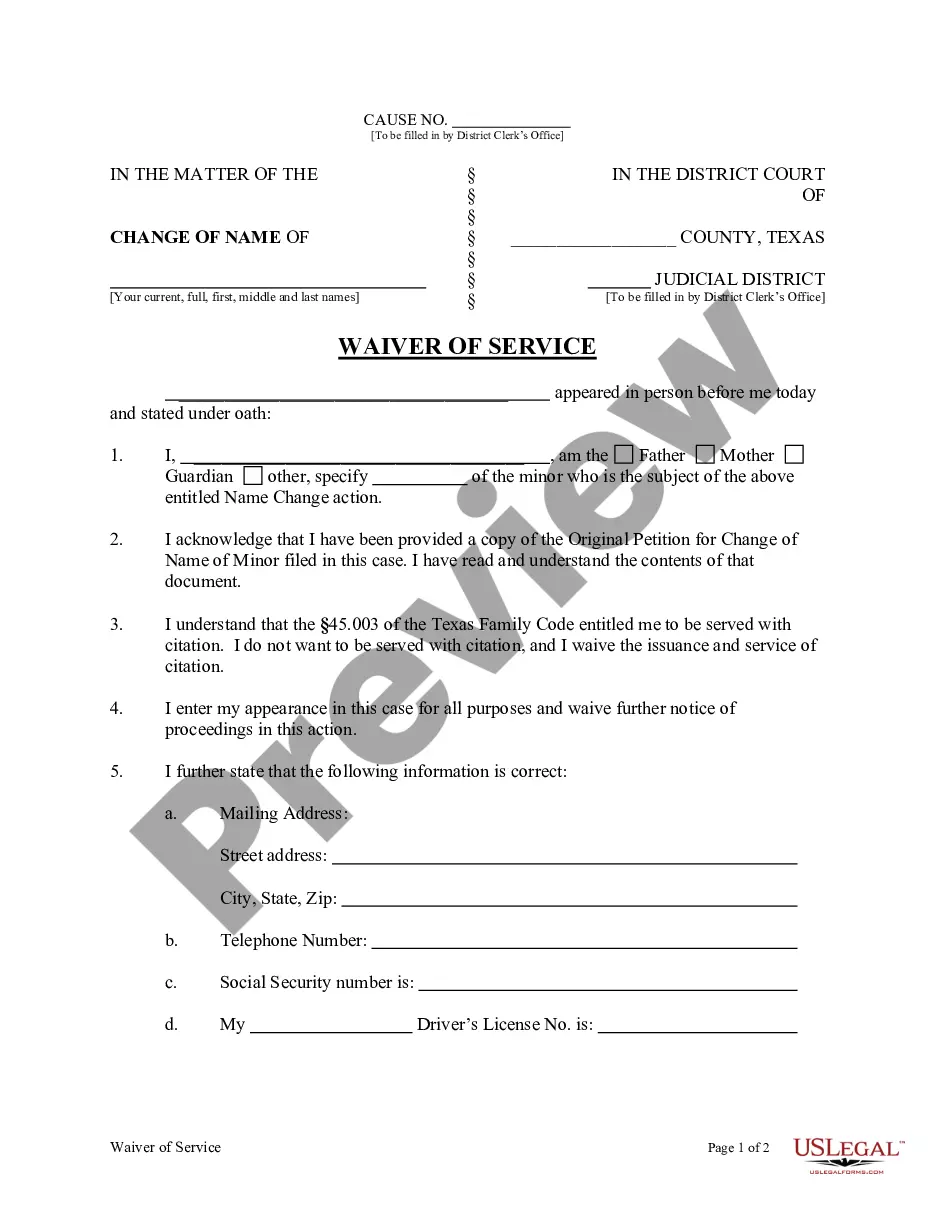

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the related document templates or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Riverside Venture Capital Finder's Fee Agreement.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Riverside Venture Capital Finder's Fee Agreement, log in to your account, and download it. Needless to say, our website can’t replace an attorney completely. If you need to deal with an extremely difficult case, we advise getting a lawyer to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!