A valid assignment takes effect the moment it is made regardless of whether notice of the assignment is given to the other party to the contract. If the obligor is notified that there has been an assignment and that any money due must be paid to the assignee, the obligor's obligation can only be discharged by making payment to the assignee. In other words, payment to the assignor would not satisfy the contract after notice.

Alameda California Notice of Assignment by Assignee of Right to Payments is a legal document that formally notifies parties involved of a transfer of rights to receive payments. It is commonly used in various financial transactions and legal proceedings. This notice is an essential step in ensuring the smooth transfer of rights between parties, protecting the interests of all parties involved. The Notice of Assignment outlines the key details of the assignment, including the specific rights being transferred, the names and contact information of the assignor (original rights' holder) and assignee (new rights' holder), and the effective date of the assignment. It serves as an official record of the transaction, ensuring transparency and clarity for all parties. This document is typically utilized in scenarios such as: 1. Mortgage Assignments: In the mortgage industry, lenders often transfer the rights to collect mortgage payments to other financial institutions or investors. The Notice of Assignment is crucial in formalizing this transfer and informing the borrower about the updated payment recipient. 2. Factoring Agreements: Companies engaged in factoring, where accounts receivable are sold to third-party financial institutions, require a Notice of Assignment. This document ensures that customers are aware of the change in payment recipient and directs them to remit payment to the assignee. 3. Structured Settlements: When individuals receive structured settlement payments, they might choose to sell their future payments to a third party in exchange for a lump sum. The Notice of Assignment is used to communicate this transfer to the insurance company or annuity issuer, instructing them to send payments to the assignee. 4. Personal Loans: In cases where individuals assign their rights to receive loan repayments to another person or institution, a Notice of Assignment is necessary to inform the borrower of the updated payment instructions. It is essential to mention that there may be variations in the structure and specific requirements of a Notice of Assignment by Assignee of Right to Payments, depending on the jurisdiction and the industry involved. Legal professionals should be consulted to ensure compliance with relevant laws and regulations.Alameda California Notice of Assignment by Assignee of Right to Payments is a legal document that formally notifies parties involved of a transfer of rights to receive payments. It is commonly used in various financial transactions and legal proceedings. This notice is an essential step in ensuring the smooth transfer of rights between parties, protecting the interests of all parties involved. The Notice of Assignment outlines the key details of the assignment, including the specific rights being transferred, the names and contact information of the assignor (original rights' holder) and assignee (new rights' holder), and the effective date of the assignment. It serves as an official record of the transaction, ensuring transparency and clarity for all parties. This document is typically utilized in scenarios such as: 1. Mortgage Assignments: In the mortgage industry, lenders often transfer the rights to collect mortgage payments to other financial institutions or investors. The Notice of Assignment is crucial in formalizing this transfer and informing the borrower about the updated payment recipient. 2. Factoring Agreements: Companies engaged in factoring, where accounts receivable are sold to third-party financial institutions, require a Notice of Assignment. This document ensures that customers are aware of the change in payment recipient and directs them to remit payment to the assignee. 3. Structured Settlements: When individuals receive structured settlement payments, they might choose to sell their future payments to a third party in exchange for a lump sum. The Notice of Assignment is used to communicate this transfer to the insurance company or annuity issuer, instructing them to send payments to the assignee. 4. Personal Loans: In cases where individuals assign their rights to receive loan repayments to another person or institution, a Notice of Assignment is necessary to inform the borrower of the updated payment instructions. It is essential to mention that there may be variations in the structure and specific requirements of a Notice of Assignment by Assignee of Right to Payments, depending on the jurisdiction and the industry involved. Legal professionals should be consulted to ensure compliance with relevant laws and regulations.

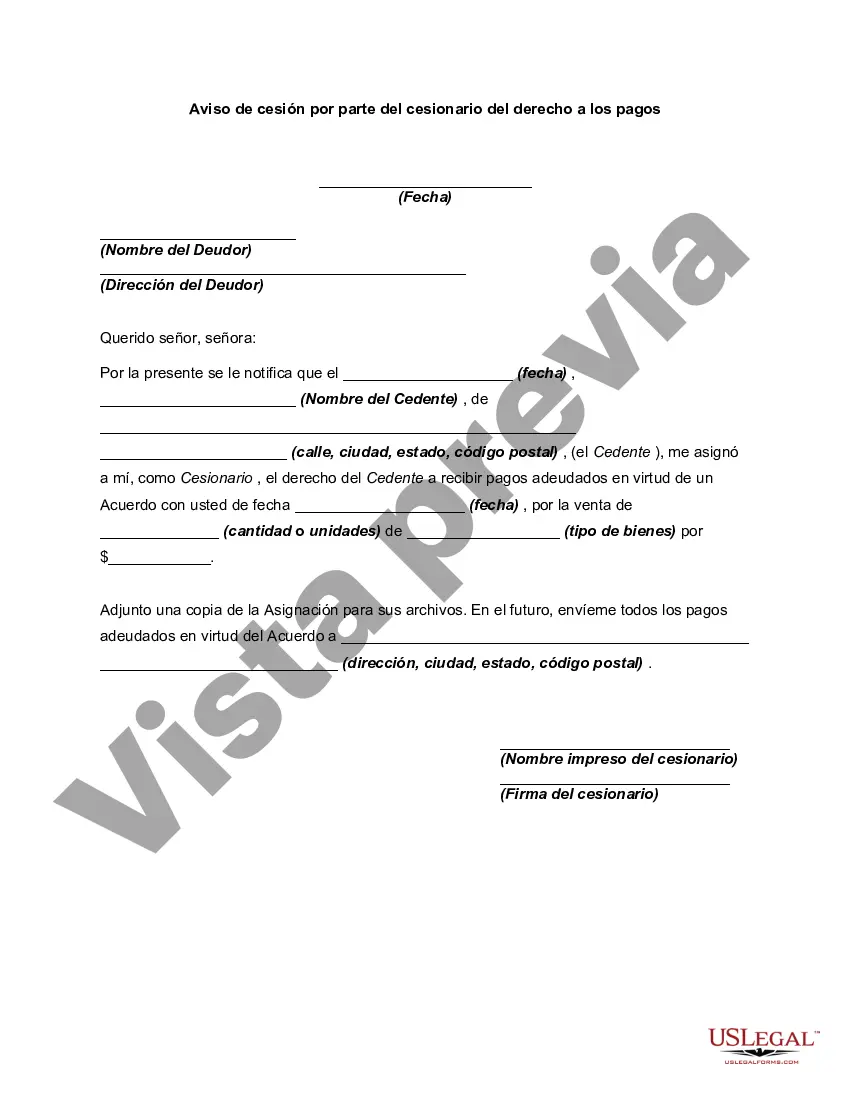

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.