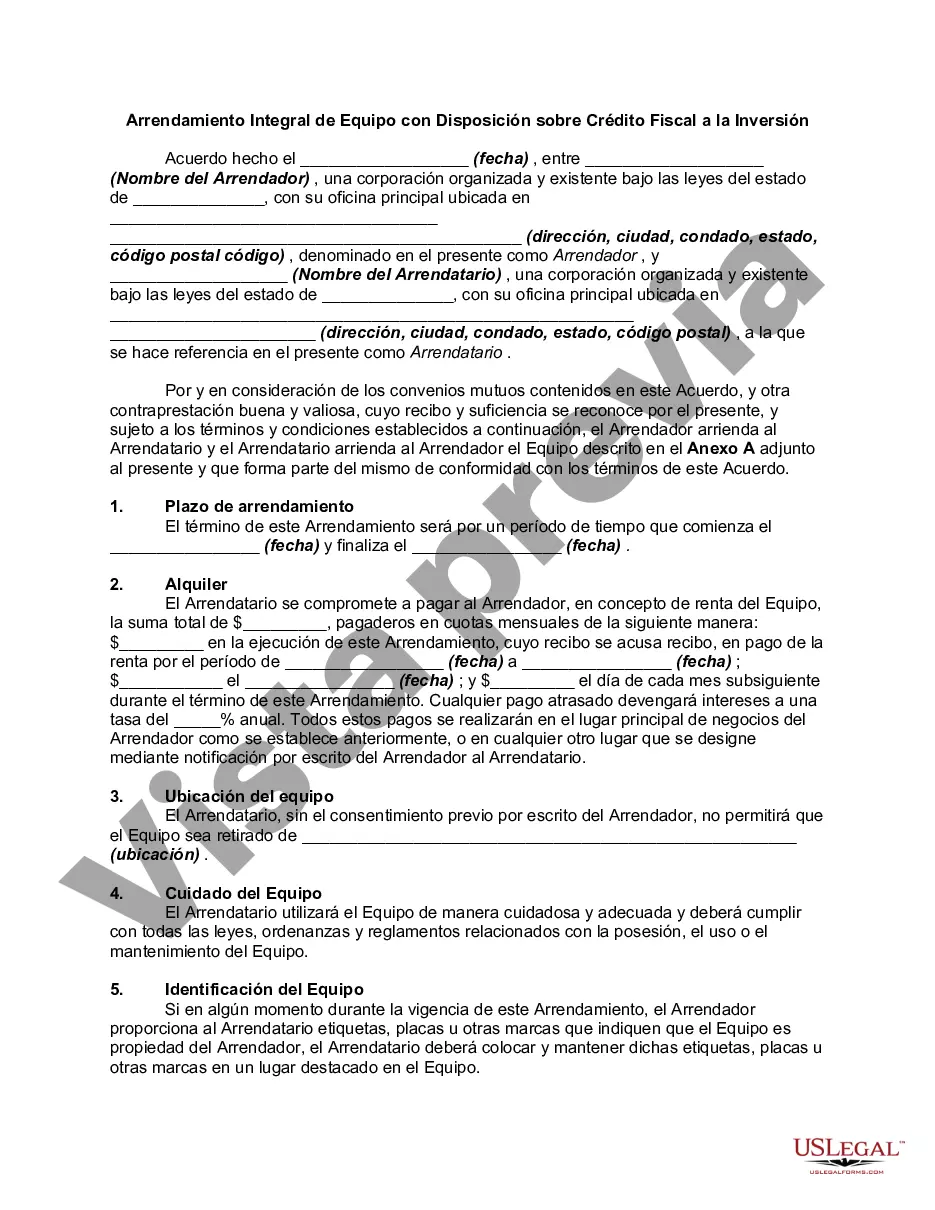

Bronx, New York, Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legally binding agreement between a lessor and lessee, outlining the terms and conditions for leasing various equipment assets within the Bronx, New York area. This type of lease includes a specific provision relating to investment tax, which is crucial for businesses seeking tax benefits and deductions. The Bronx, being one of the five boroughs of New York City, is home to a diverse range of businesses and industries. To cater to these varying needs, there are several types of Comprehensive Equipment Leases available with specific provisions regarding investment tax: 1. Manufacturing Equipment Lease: This lease specifically caters to manufacturing businesses in the Bronx, providing them with the necessary machinery and equipment required for their production processes. The provision regarding investment tax helps these businesses in claiming tax benefits on the leased equipment, potentially reducing their overall tax liability. 2. Medical Equipment Lease: Healthcare providers, hospitals, clinics, and medical facilities in the Bronx often require state-of-the-art medical equipment. This type of lease allows them to acquire advanced medical devices, such as MRI machines, X-ray equipment, ultrasound machines, etc. The investment tax provision ensures that these entities can benefit from tax deductions related to the leased medical equipment. 3. Construction Equipment Lease: Construction companies operating in the Bronx often require heavy machinery and construction equipment, including excavators, loaders, bulldozers, and cranes. The Comprehensive Equipment Lease with an investment tax provision enables these businesses to claim tax benefits applicable to the leased construction equipment, reducing their tax burden and increasing their cash flow for other essential activities. 4. Information Technology (IT) Equipment Lease: Bronx-based businesses heavily reliant on IT infrastructure can lease various IT equipment like servers, computers, networking devices, and software. This lease type offers the investment tax provision, allowing businesses to depreciate the leased IT assets and write off the investment against their taxable income. By entering into a Bronx, New York, Comprehensive Equipment Lease with Provision Regarding Investment Tax, businesses gain access to necessary equipment without the financial burden of outright purchasing. Additionally, they can take advantage of the investment tax provision to optimize their tax position and preserve capital for other business needs. Note: It is essential to consult legal and tax professionals when considering leasing equipment and its potential tax implications, as tax regulations may vary and change over time.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Bronx New York Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Bronx Comprehensive Equipment Lease with Provision Regarding Investment Tax, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any tasks associated with paperwork completion straightforward.

Here's how you can find and download Bronx Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the related forms or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and purchase Bronx Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Bronx Comprehensive Equipment Lease with Provision Regarding Investment Tax, log in to your account, and download it. Of course, our platform can’t replace a legal professional entirely. If you have to deal with an exceptionally difficult case, we advise using the services of a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-compliant documents with ease!