Broward Florida Comprehensive Equipment Lease with Provision Regarding Investment Tax: A Comprehensive Guide Introduction: Broward, Florida offers a range of comprehensive equipment lease options to businesses and individuals looking to obtain the essential tools and machinery necessary for their operations. These leases come with a unique provision regarding investment tax, aligned with the local tax regulations. In this article, we will explore the key features and benefits of Broward Florida Comprehensive Equipment Lease with Provision Regarding Investment Tax, along with different types that cater to various needs. 1. Key Features: — Equipment Options: Broward, Florida, provides a wide range of equipment leasing options tailored to diverse industries, including construction, manufacturing, healthcare, transportation, and more. From heavy machinery to specialized medical equipment, businesses can find solutions that align with their operational requirements. — Lease Terms: The comprehensive equipment lease terms are designed to offer flexibility and convenience to lessees. Terms can be customized to accommodate specific business needs, including lease duration, monthly/annual payments, and options for buyouts or upgrades. — Tax Benefits: The provision regarding investment tax is a significant advantage of the Broward Florida comprehensive equipment lease. Lessees can potentially benefit from tax deductions on their lease payments, helping to reduce their overall tax liability. — Maintenance and Support: The lessor often provides equipment maintenance, repairs, and replacement services, ensuring lessees experience minimal disruptions to their operations. This comprehensive support is crucial for smooth business functioning. 2. Types of Broward Florida Comprehensive Equipment Lease: a) Construction Equipment Lease: Specifically designed for construction companies, this lease includes equipment such as excavators, loaders, bulldozers, and cranes. With investment tax provisions, lessees can enjoy tax benefits on their lease payments. b) Manufacturing Equipment Lease: Businesses in the manufacturing sector can access a wide array of machinery, such as CNC machines, robotic systems, assembly lines, and more. The investment tax provision ensures potential tax deductions for lease payments. c) Medical Equipment Lease: Healthcare providers, clinics, and hospitals can lease advanced medical equipment like MRI machines, ultrasound systems, sterilizers, and laboratory equipment. The investment tax provision offers cost savings through tax benefits. d) Transportation Equipment Lease: Companies involved in transportation, logistics, or delivery services can opt for this lease, including commercial vehicles, trailers, forklifts, and other essential transportation equipment. The investment tax provision aids in reducing tax burdens. e) Technology Equipment Lease: Aimed at businesses requiring the latest technology solutions, this lease covers IT hardware, software, servers, and networking equipment. The investment tax provision encourages businesses to invest in cutting-edge technologies. In conclusion, the Broward Florida Comprehensive Equipment Lease with Provision Regarding Investment Tax is a valuable tool for businesses and individuals looking to acquire equipment without significant upfront costs. With various lease types targeting different industries, lessees can find tailored solutions to meet their specific requirements. Moreover, the investment tax provision provides tax benefits, making these leases an attractive option for businesses in Broward, Florida.

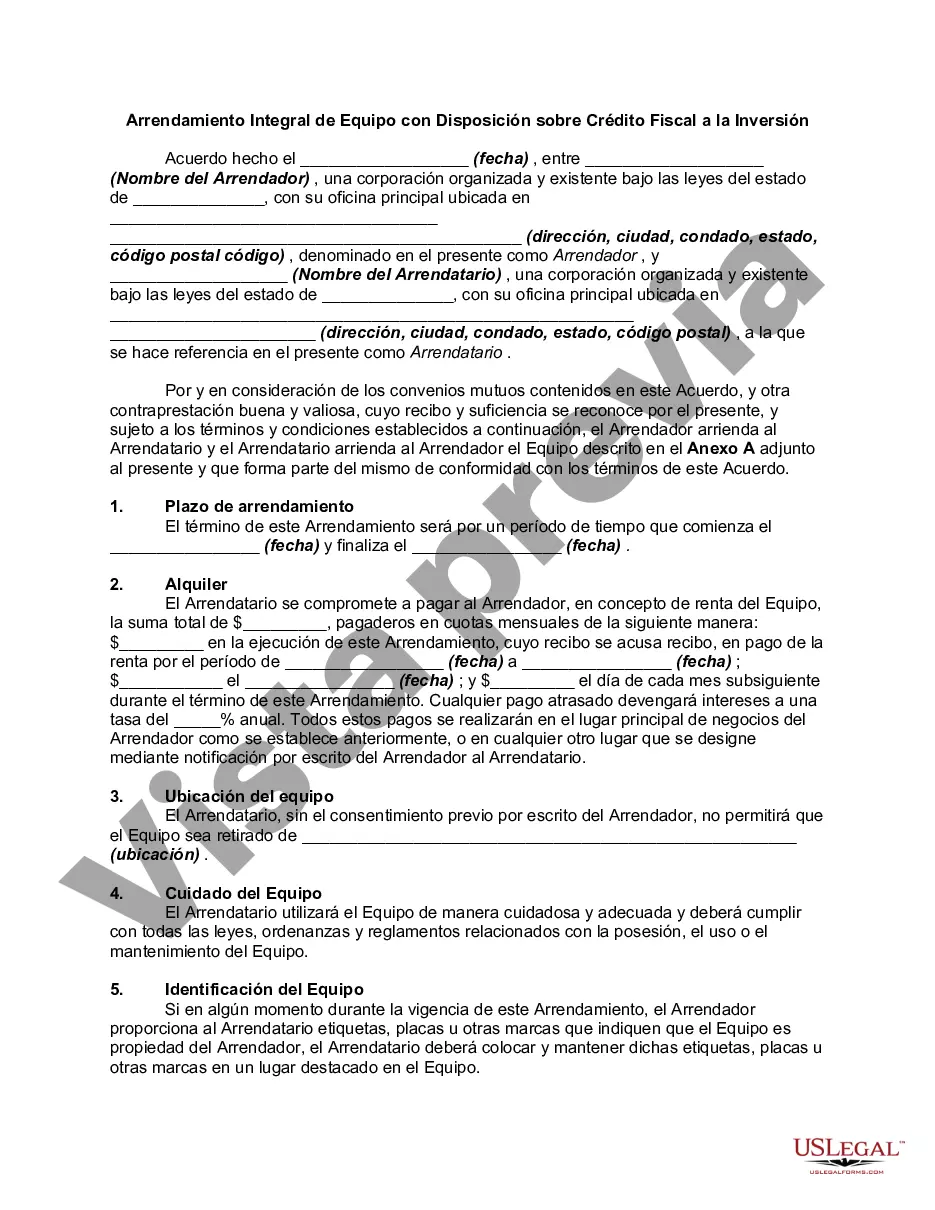

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Broward Florida Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Broward Comprehensive Equipment Lease with Provision Regarding Investment Tax, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the recent version of the Broward Comprehensive Equipment Lease with Provision Regarding Investment Tax, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Broward Comprehensive Equipment Lease with Provision Regarding Investment Tax:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Broward Comprehensive Equipment Lease with Provision Regarding Investment Tax and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!