Contra Costa California Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal document that outlines the terms and conditions of leasing equipment in Contra Costa County, California. It encompasses provisions related to the investment tax credit, which allow businesses to deduct a percentage of their qualified equipment costs from their federal taxes. When entering into a Comprehensive Equipment Lease with Provision Regarding Investment Tax in Contra Costa California, both the lessor (the equipment owner) and the lessee (the party leasing the equipment) must agree on various aspects. These include the type and description of the leased equipment, the lease term, the monthly payment amount, and any additional fees or penalties. The purpose of including a provision regarding investment tax is to clarify the eligibility criteria for claiming an investment tax credit. This credit encourages businesses to invest in new equipment by offsetting a portion of the acquisition costs against their tax liability. The provision outlines the conditions under which the lessee can qualify for this credit and how it will be calculated. Different types of Contra Costa California Comprehensive Equipment Lease with Provision Regarding Investment Tax may exist depending on the specific industry or equipment involved. For example, there could be leases tailored to office equipment, manufacturing machinery, or medical devices. Each lease may have its own distinct set of terms and conditions, as well as varying provisions regarding investment tax depending on the nature of the leased equipment. In summary, a Contra Costa California Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legally binding agreement that governs the leasing of equipment in the county. It includes provisions related to the investment tax credit, which incentivizes businesses to invest in new equipment. Different types of leases may exist based on the industry and type of equipment involved.

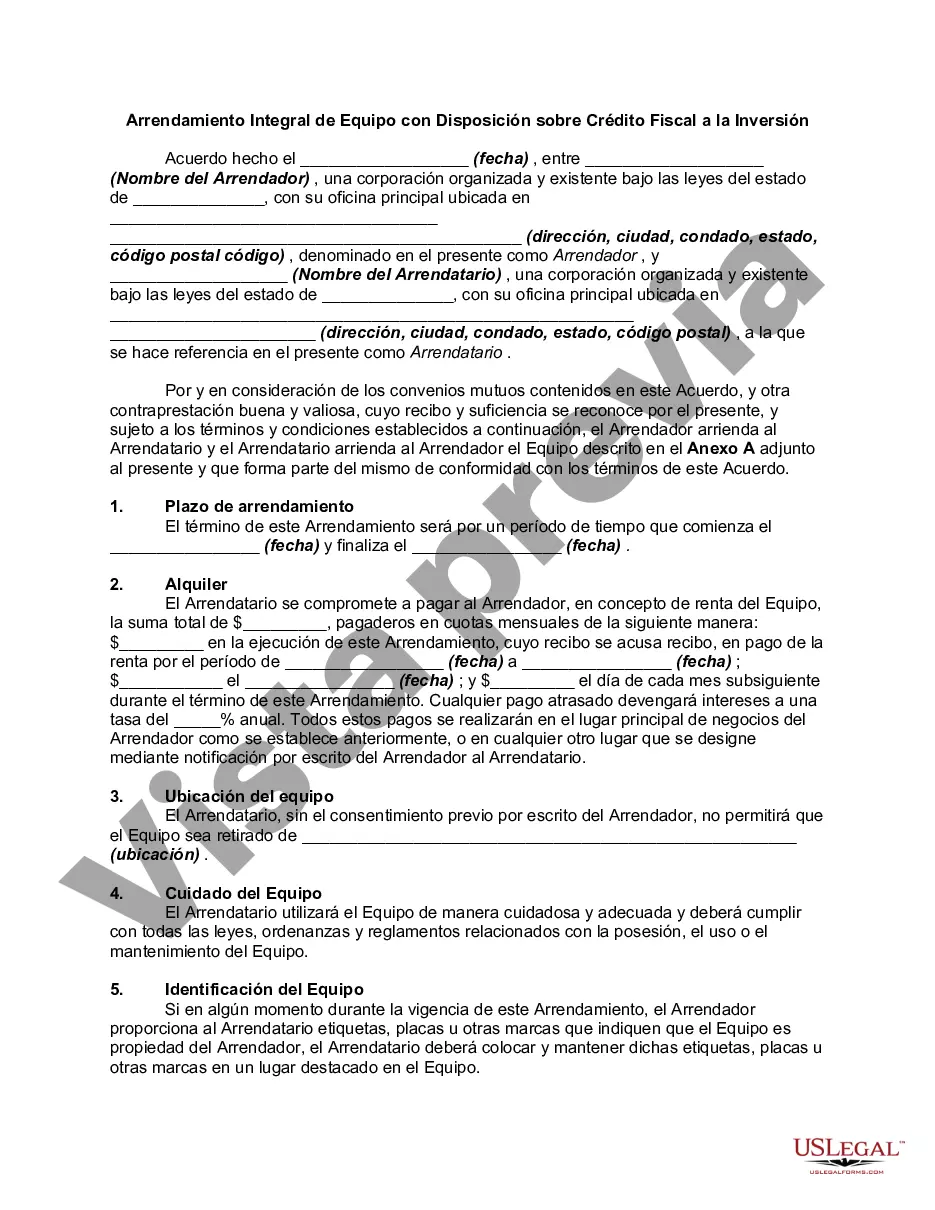

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Contra Costa California Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Contra Costa Comprehensive Equipment Lease with Provision Regarding Investment Tax, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Consequently, if you need the recent version of the Contra Costa Comprehensive Equipment Lease with Provision Regarding Investment Tax, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Comprehensive Equipment Lease with Provision Regarding Investment Tax:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Contra Costa Comprehensive Equipment Lease with Provision Regarding Investment Tax and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!