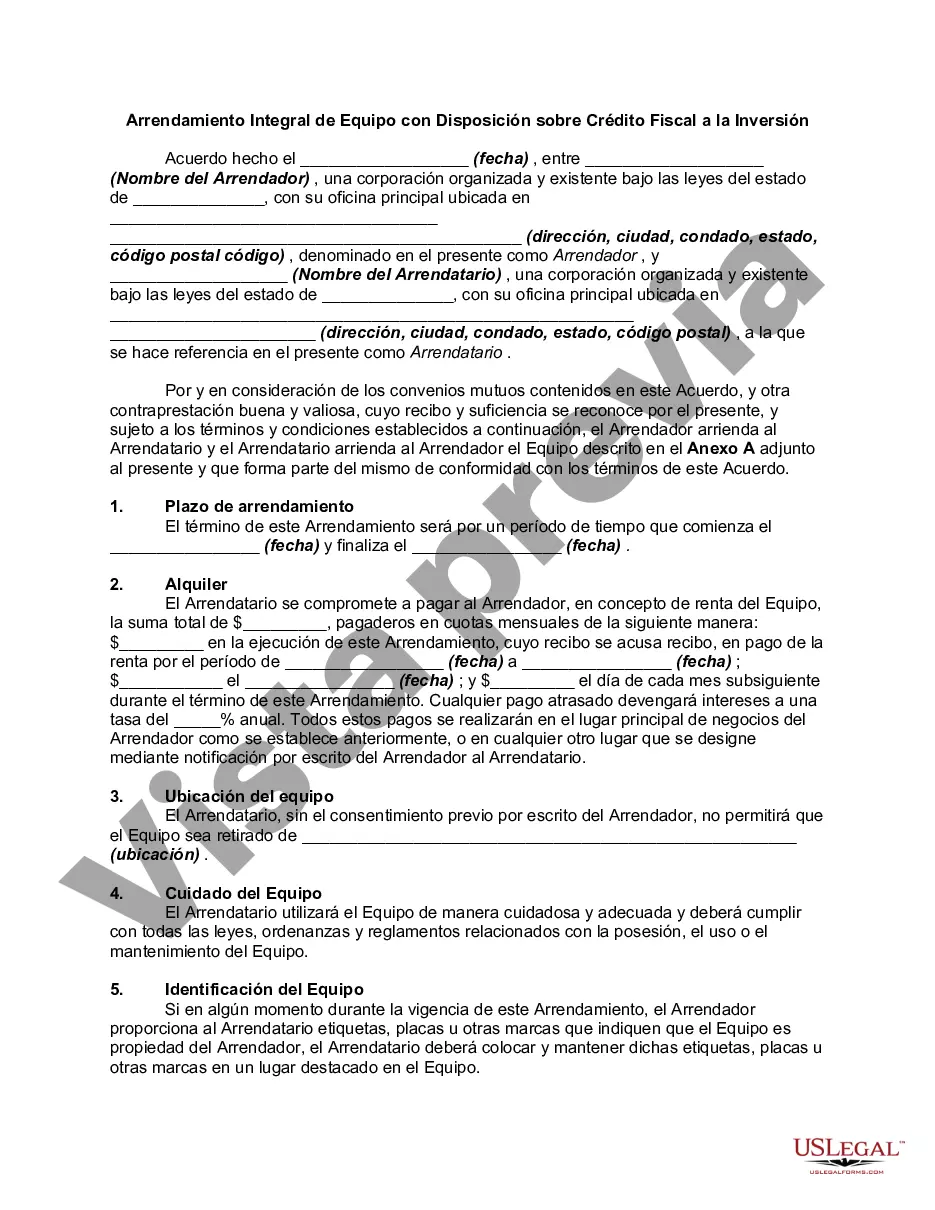

The King Washington Comprehensive Equipment Lease with Provision Regarding Investment Tax is a specialized leasing agreement that is specifically designed for businesses or individuals seeking to lease equipment while taking advantage of certain tax benefits related to investments. This lease agreement includes a provision that addresses investment tax credits or deductions that the lessee may be eligible for when leasing the equipment. With the King Washington Comprehensive Equipment Lease, lessees have the opportunity to secure the necessary equipment for their operations while potentially enjoying tax benefits associated with their investment. This lease agreement covers a wide range of equipment types, including but not limited to machinery, vehicles, computers, office equipment, and manufacturing tools. One of the key features of this lease is the provision that takes into consideration investment tax benefits. Depending on the jurisdiction and specific tax laws, lessees may be able to claim tax credits or deductions related to the equipment lease payments. This provision allows lessees to explore potential tax savings and optimize their investment. Moreover, the King Washington Comprehensive Equipment Lease offers flexibility with different payment options, such as monthly, quarterly, or annual installments, allowing lessees to manage their finances effectively. The agreement also outlines the responsibilities of both the lessor and lessee regarding maintenance, repairs, insurance, and eventual return or purchase of the equipment. While there might not be different types of the King Washington Comprehensive Equipment Lease specifically with a provision regarding investment tax, variations of this lease are available based on the industry, equipment type, and lease duration. These variations ensure that businesses from various sectors can benefit from the leasing agreement while potentially maximizing their investment tax benefits. In conclusion, the King Washington Comprehensive Equipment Lease with Provision Regarding Investment Tax is a customizable lease agreement designed to provide lessees with the necessary equipment for their operations while keeping investment tax benefits in mind. By utilizing this lease, businesses or individuals have the opportunity to streamline operations, conserve capital, and potentially reduce taxes through strategic investment in equipment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out King Washington Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life sphere, finding a King Comprehensive Equipment Lease with Provision Regarding Investment Tax meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the King Comprehensive Equipment Lease with Provision Regarding Investment Tax, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your King Comprehensive Equipment Lease with Provision Regarding Investment Tax:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the King Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!