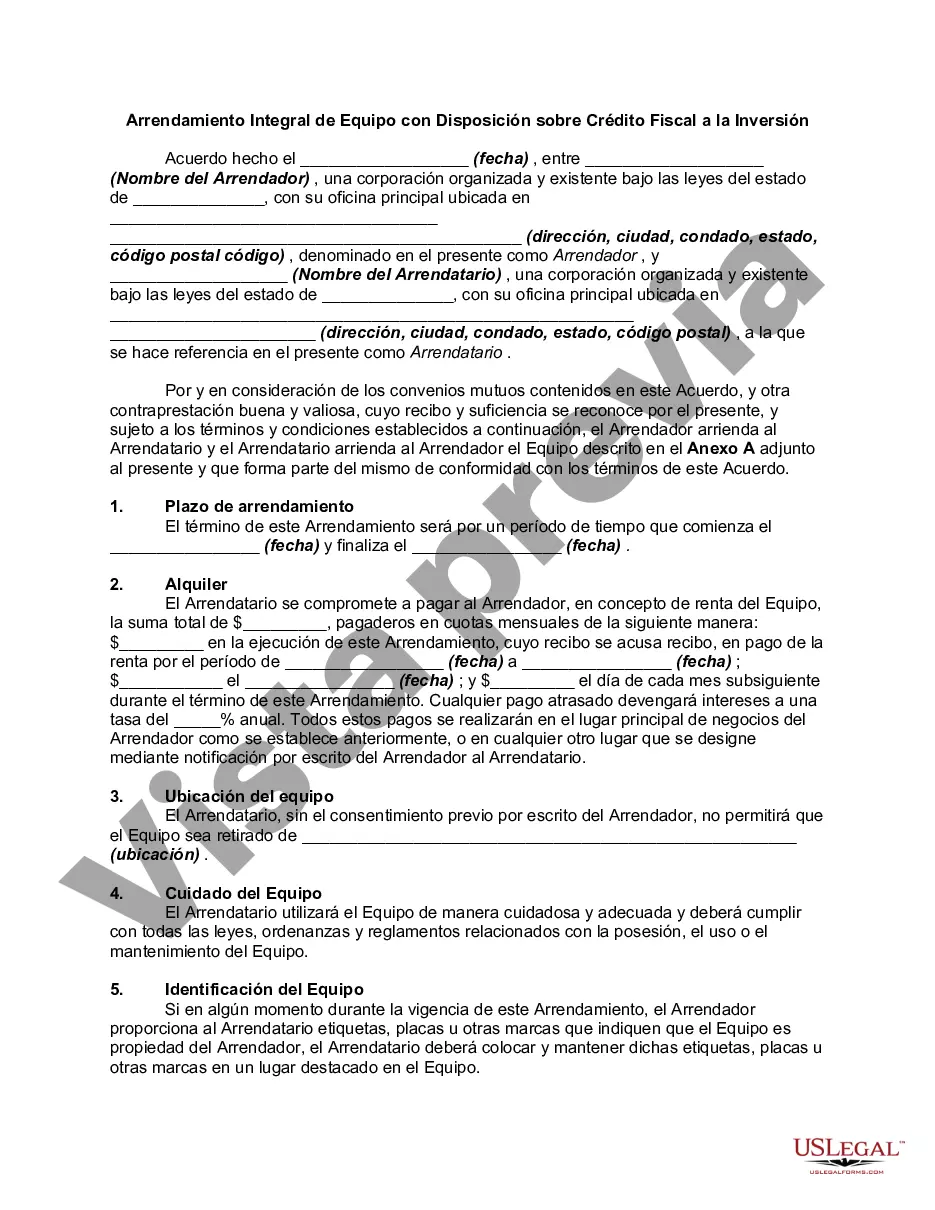

San Antonio Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax A Comprehensive Equipment Lease with Provision Regarding Investment Tax is a type of lease agreement that is specifically designed for businesses in San Antonio, Texas, who are looking to lease equipment while considering tax benefits. Keywords: San Antonio Texas, Comprehensive Equipment Lease, Provision, Investment Tax This lease agreement is tailored to businesses that require various types of equipment, such as machinery, technology, vehicles, or other assets, to operate and grow their operations in the thriving city of San Antonio, Texas. By leasing the equipment instead of purchasing it outright, businesses can conserve capital, streamline cash flow, and take advantage of potential tax incentives. The lease agreement provides a comprehensive framework that includes provisions specifically related to investment tax, allowing businesses to take full advantage of tax deductions and benefits available for leased equipment. This provision is crucial in San Antonio, Texas, as the city offers various tax incentives and exemptions for businesses to encourage economic development and growth. The San Antonio Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax outlines the terms and conditions for acquiring and using the equipment, including lease duration, monthly payments, and any additional fees or charges. It also specifies the responsibilities of both the lessee (business) and the lessor (equipment leasing company). Different types of San Antonio Texas Comprehensive Equipment Leases with Provision Regarding Investment Tax can include variations based on industry-specific requirements or specialized equipment. For example: 1. San Antonio Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax for Construction Companies: This lease agreement is optimized for construction businesses in San Antonio, Texas, and may include provisions related to heavy machinery, tools, and vehicles commonly used in construction projects. 2. San Antonio Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax for Technology Firms: This type of lease agreement caters to technology companies in San Antonio, Texas, and may cover leasing agreements for computers, servers, networking equipment, or other tech-related assets. 3. San Antonio Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax for Manufacturing Enterprises: This lease agreement is specifically designed for manufacturing companies in San Antonio, Texas, and may include provisions related to industrial machinery, assembly line equipment, or specialized tools. 4. San Antonio Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax for Healthcare Providers: This type of lease agreement is tailored for healthcare facilities in San Antonio, Texas, and may cover leasing agreements for medical equipment, imaging machines, or other healthcare-related assets. Overall, a San Antonio Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax offers businesses in San Antonio the opportunity to access essential equipment while enjoying the tax advantages associated with leasing. It is a flexible and cost-effective solution for businesses looking to conserve capital, streamline operations, and take advantage of the economic benefits the city offers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out San Antonio Texas Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Antonio Comprehensive Equipment Lease with Provision Regarding Investment Tax, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the recent version of the San Antonio Comprehensive Equipment Lease with Provision Regarding Investment Tax, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Comprehensive Equipment Lease with Provision Regarding Investment Tax:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your San Antonio Comprehensive Equipment Lease with Provision Regarding Investment Tax and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!