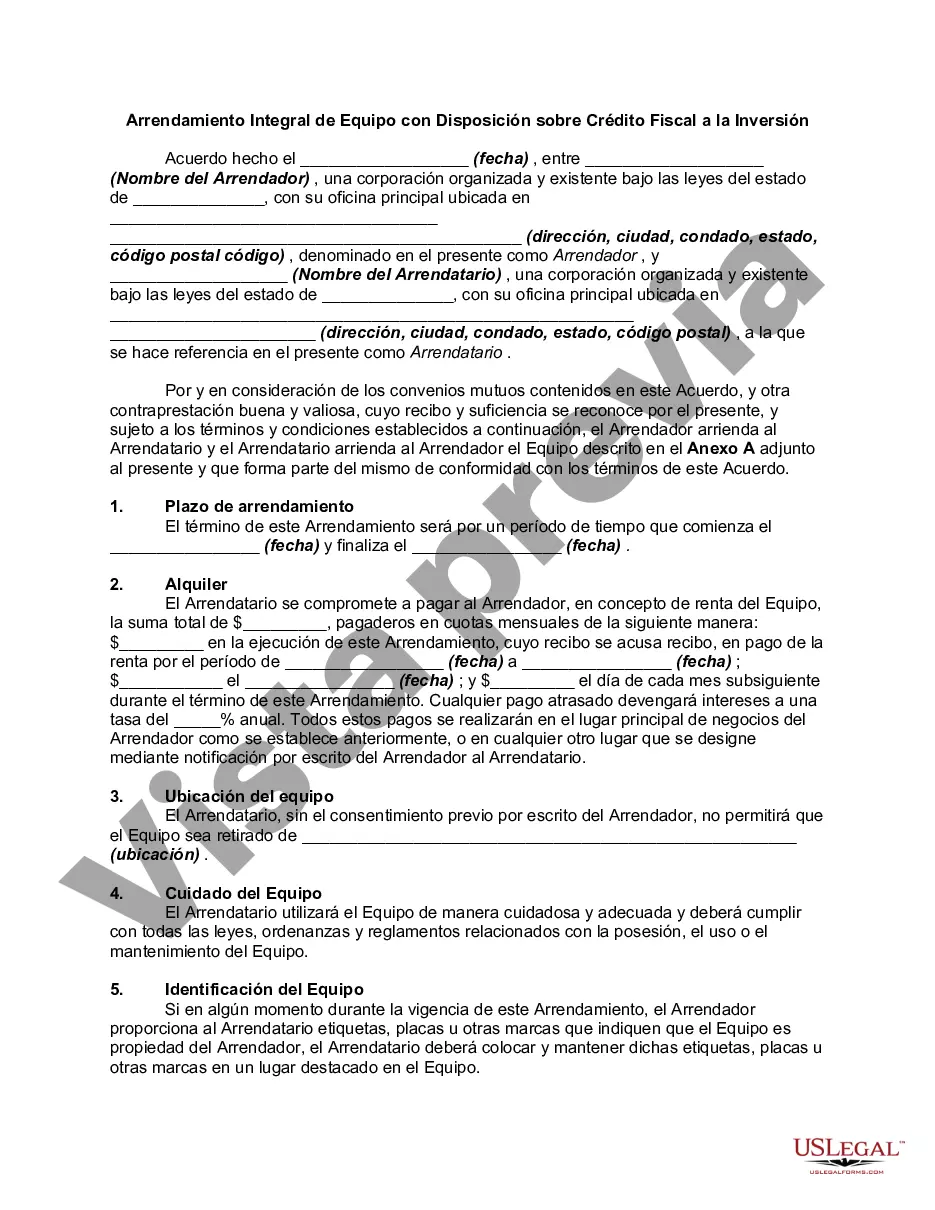

San Diego California Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal document that outlines the terms and conditions for leasing equipment in San Diego, California, while also providing provisions related to investment tax. This lease is specifically designed for businesses and individuals who wish to lease equipment while taking advantage of investment tax benefits. Key Features: 1. Property Description: The lease includes a detailed description of the equipment being leased, including the make, model, and serial number, to ensure clarity and accuracy. 2. Term of Lease: It specifies the duration of the lease agreement, outlining the start and end date, giving lessees the flexibility to determine the length of the lease that best suits their needs. 3. Lease Payments: The lease agreement clearly explains the financial aspect, detailing the monthly or periodic payment amounts required by the lessee. It may also include provisions for additional costs, such as maintenance or insurance fees. 4. Investment Tax Provision: This type of lease includes a provision that allows the lessee to benefit from investment tax advantages. It outlines the specific tax benefits associated with the equipment leased under this agreement, providing details on how to qualify and claim tax deductions. 5. Conditions and Restrictions: The lease agreement may impose certain conditions and restrictions on the lessee, such as limitations on equipment use, maintenance responsibilities, or requirements for insuring the equipment. Types of San Diego California Comprehensive Equipment Lease with Provision Regarding Investment Tax: 1. Short-Term Equipment Lease: This type of lease agreement typically spans a shorter period, such as a few months or a year. It suits businesses or individuals with temporary equipment needs. 2. Long-Term Equipment Lease: A long-term lease extends over several years, catering to businesses or individuals requiring equipment for an extended period. It offers stability and long-term planning for equipment use. 3. Fair Market Value (FMV) Lease: In an FMV lease, the lessee has the option to purchase the leased equipment at the fair market value at the end of the lease term. This allows for potential ownership and flexibility for businesses that may want to acquire the equipment eventually. 4. Dollar Buy-out Lease: A dollar buy-out lease grants the lessee the option to purchase the equipment for a predetermined amount, typically for a dollar, at the end of the lease term. This provides certainty for businesses intending to own the equipment outright. In summary, the San Diego California Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal agreement that allows businesses and individuals in San Diego to lease equipment while benefiting from investment tax advantages. Different types of this lease include short-term, long-term, fair market value, and dollar-buyout options, providing flexibility and customization to suit various equipment leasing needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out San Diego California Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Do you need to quickly draft a legally-binding San Diego Comprehensive Equipment Lease with Provision Regarding Investment Tax or maybe any other form to take control of your personal or corporate affairs? You can select one of the two options: contact a legal advisor to draft a legal paper for you or create it entirely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant form templates, including San Diego Comprehensive Equipment Lease with Provision Regarding Investment Tax and form packages. We offer documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the San Diego Comprehensive Equipment Lease with Provision Regarding Investment Tax is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's intended for.

- Start the searching process over if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the San Diego Comprehensive Equipment Lease with Provision Regarding Investment Tax template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the paperwork we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!