A Wake North Carolina Comprehensive Equipment Lease with Provision Regarding Investment Tax is a type of lease agreement that specifically caters to businesses in the Wake County area, allowing them to lease various types of equipment while taking advantage of investment tax benefits. This lease is designed to provide businesses with a cost-effective solution to acquire necessary equipment for their operations without committing to a significant upfront investment. The comprehensive nature of this lease implies its ability to cover a wide range of equipment, including but not limited to machinery, vehicles, computer systems, office furniture, and other essential assets required for business operations. By leasing equipment through this agreement, businesses can avoid the burdensome upfront costs associated with purchasing equipment outright. One significant aspect of the Wake North Carolina Comprehensive Equipment Lease is the provision regarding investment tax. This provision allows lessees to take advantage of tax benefits related to the leased equipment's cost, ensuring that businesses can maximize their investment returns. The specific details of these investment tax provisions may vary based on the type of equipment being leased and the applicable tax regulations in Wake County. Different types of Wake North Carolina Comprehensive Equipment Leases with Provision Regarding Investment Tax may include: 1. Machinery Lease with Provision Regarding Investment Tax: This lease agreement specifically focuses on leasing machinery and equipment necessary for manufacturing, construction, or industrial purposes. Businesses in these sectors can benefit from the investment tax provision while acquiring the required machinery without incurring large capital expenses. 2. Vehicle Lease with Provision Regarding Investment Tax: This type of lease agreement enables businesses to lease vehicles such as cars, trucks, or vans for their transportation needs. Companies can take advantage of investment tax benefits, making it an attractive option for fleet management. 3. Technology Lease with Provision Regarding Investment Tax: This lease agreement caters to businesses seeking to lease computer systems, software, or other technological equipment. By utilizing the investment tax provision, companies can stay up to date with the latest technology without the need for significant upfront investments. 4. Office Equipment Lease with Provision Regarding Investment Tax: This lease agreement focuses on leasing office furniture, fixtures, and equipment required for day-to-day operations. The investment tax provision allows businesses to improve and upgrade their office infrastructure while minimizing the financial burden. In summary, the Wake North Carolina Comprehensive Equipment Lease with Provision Regarding Investment Tax offers businesses in Wake County the opportunity to lease various types of equipment while benefiting from investment tax provisions. With different types of leases available, businesses can find a tailored solution to meet their specific equipment needs without compromising their financial flexibility.

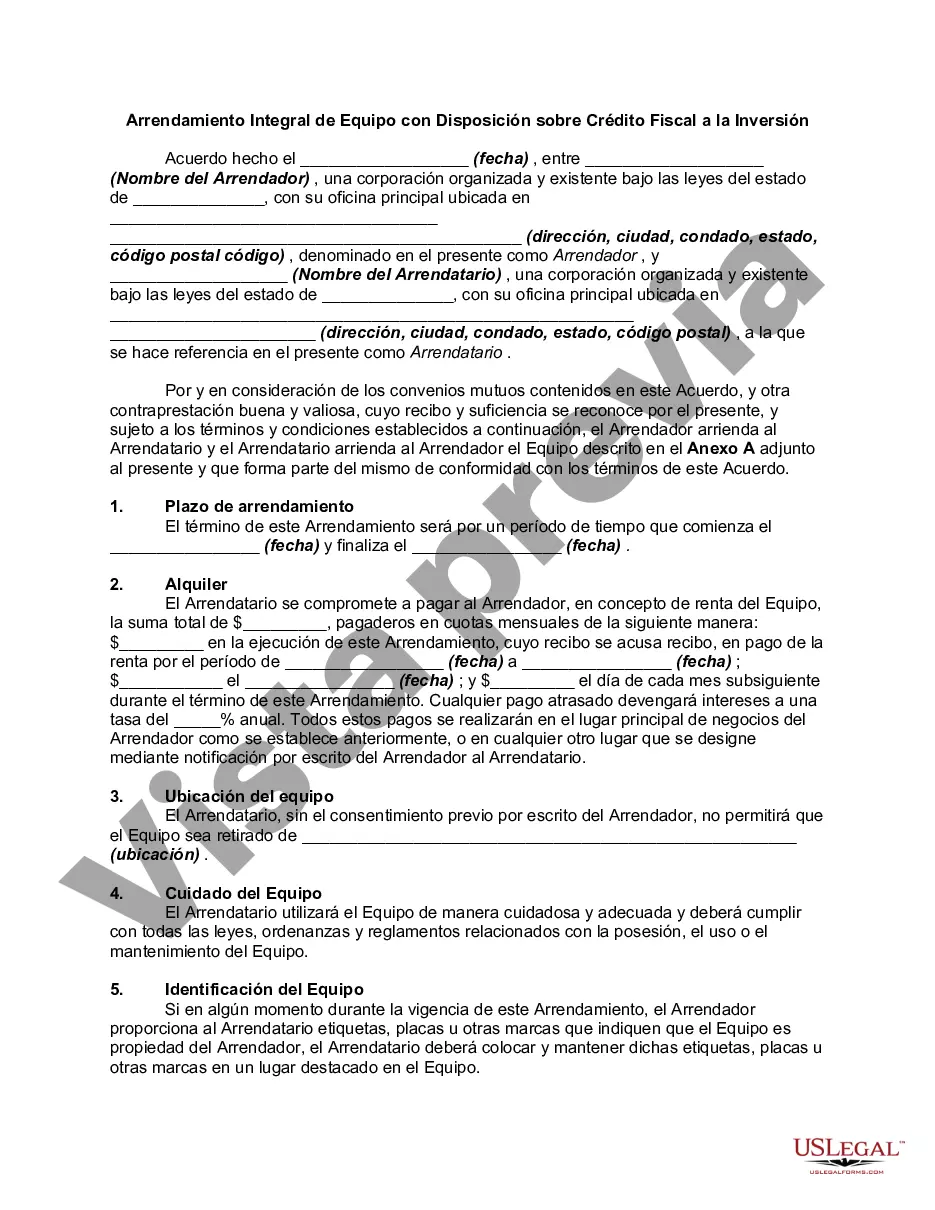

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Arrendamiento Integral de Equipo con Disposición sobre Impuesto a la Inversión - Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Wake North Carolina Arrendamiento Integral De Equipo Con Disposición Sobre Impuesto A La Inversión?

Do you need to quickly draft a legally-binding Wake Comprehensive Equipment Lease with Provision Regarding Investment Tax or probably any other document to handle your own or business affairs? You can go with two options: contact a professional to write a valid paper for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal paperwork without having to pay unreasonable fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant document templates, including Wake Comprehensive Equipment Lease with Provision Regarding Investment Tax and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra hassles.

- To start with, double-check if the Wake Comprehensive Equipment Lease with Provision Regarding Investment Tax is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Wake Comprehensive Equipment Lease with Provision Regarding Investment Tax template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the templates we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!