Miami-Dade Florida is a vibrant and diverse county located in the southeastern part of the state. With its beautiful beaches, bustling cities, and thriving cultural scene, Miami-Dade is a popular destination for tourists and a home to millions of residents. When it comes to insurance, Miami-Dade residents may sometimes receive a notice of insurance rate increase. This could be due to various factors such as changes in risk assessment, rising costs of claims, or regulatory adjustments. Understanding the reasons behind the rate increase is crucial for policyholders to make informed decisions about their insurance coverage and budgeting. One type of Miami-Dade Florida sample letter for explanation of insurance rate increase is the Personal Auto Insurance Rate Increase letter. This letter is specifically tailored for policyholders who have experienced a rise in their auto insurance premiums. It outlines the factors contributing to the increase, which may include changes in the area's accident rates, increased vehicle repair costs, or adjustments in state insurance regulations. Another type of letter is the Homeowners' Insurance Rate Increase letter. Miami-Dade County is susceptible to natural disasters such as hurricanes, which can impact property insurance rates. A sample letter addressing an increase in homeowners' insurance rates would provide a detailed explanation, taking into account factors like increased risk due to high winds, flood risk, or rising construction and material costs. In both cases, the letter should clearly state the reasons for the increase and provide policyholders with options to address the rate change. This may include suggestions for adjusting coverage levels, exploring alternative insurance providers, or taking steps to mitigate risk factors that contribute to increased premiums. It is important for insurance companies to communicate effectively with their policyholders in these letters, ensuring transparency and clarity in the explanations provided. The letters should also provide contact information for policyholders to seek further clarification or assistance in understanding the rate increase. Overall, a well-written Miami-Dade Florida sample letter for explanation of insurance rate increase should address key concerns of policyholders, offering them insight into the rationale behind the rate adjustment and providing guidance on how to navigate their insurance options. By doing so, insurance companies can foster trust and maintain positive relationships with their policyholders in Miami-Dade County.

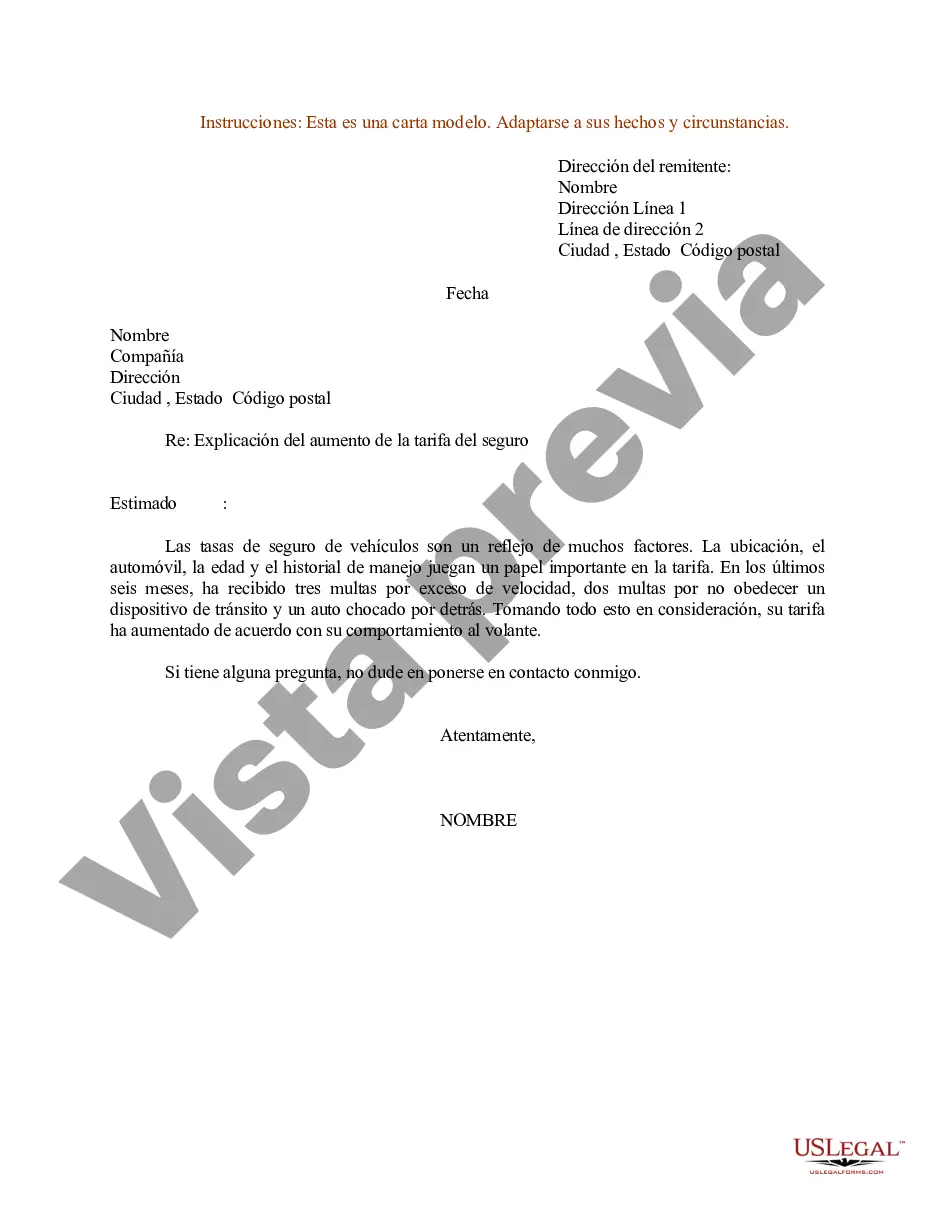

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Modelo de carta para explicación del aumento de la tarifa del seguro - Sample Letter for Explanation of Insurance Rate Increase

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-0238LR

Format:

Word

Instant download

Description

Carta que explica los factores involucrados en el aumento de la tarifa del seguro.

Miami-Dade Florida is a vibrant and diverse county located in the southeastern part of the state. With its beautiful beaches, bustling cities, and thriving cultural scene, Miami-Dade is a popular destination for tourists and a home to millions of residents. When it comes to insurance, Miami-Dade residents may sometimes receive a notice of insurance rate increase. This could be due to various factors such as changes in risk assessment, rising costs of claims, or regulatory adjustments. Understanding the reasons behind the rate increase is crucial for policyholders to make informed decisions about their insurance coverage and budgeting. One type of Miami-Dade Florida sample letter for explanation of insurance rate increase is the Personal Auto Insurance Rate Increase letter. This letter is specifically tailored for policyholders who have experienced a rise in their auto insurance premiums. It outlines the factors contributing to the increase, which may include changes in the area's accident rates, increased vehicle repair costs, or adjustments in state insurance regulations. Another type of letter is the Homeowners' Insurance Rate Increase letter. Miami-Dade County is susceptible to natural disasters such as hurricanes, which can impact property insurance rates. A sample letter addressing an increase in homeowners' insurance rates would provide a detailed explanation, taking into account factors like increased risk due to high winds, flood risk, or rising construction and material costs. In both cases, the letter should clearly state the reasons for the increase and provide policyholders with options to address the rate change. This may include suggestions for adjusting coverage levels, exploring alternative insurance providers, or taking steps to mitigate risk factors that contribute to increased premiums. It is important for insurance companies to communicate effectively with their policyholders in these letters, ensuring transparency and clarity in the explanations provided. The letters should also provide contact information for policyholders to seek further clarification or assistance in understanding the rate increase. Overall, a well-written Miami-Dade Florida sample letter for explanation of insurance rate increase should address key concerns of policyholders, offering them insight into the rationale behind the rate adjustment and providing guidance on how to navigate their insurance options. By doing so, insurance companies can foster trust and maintain positive relationships with their policyholders in Miami-Dade County.