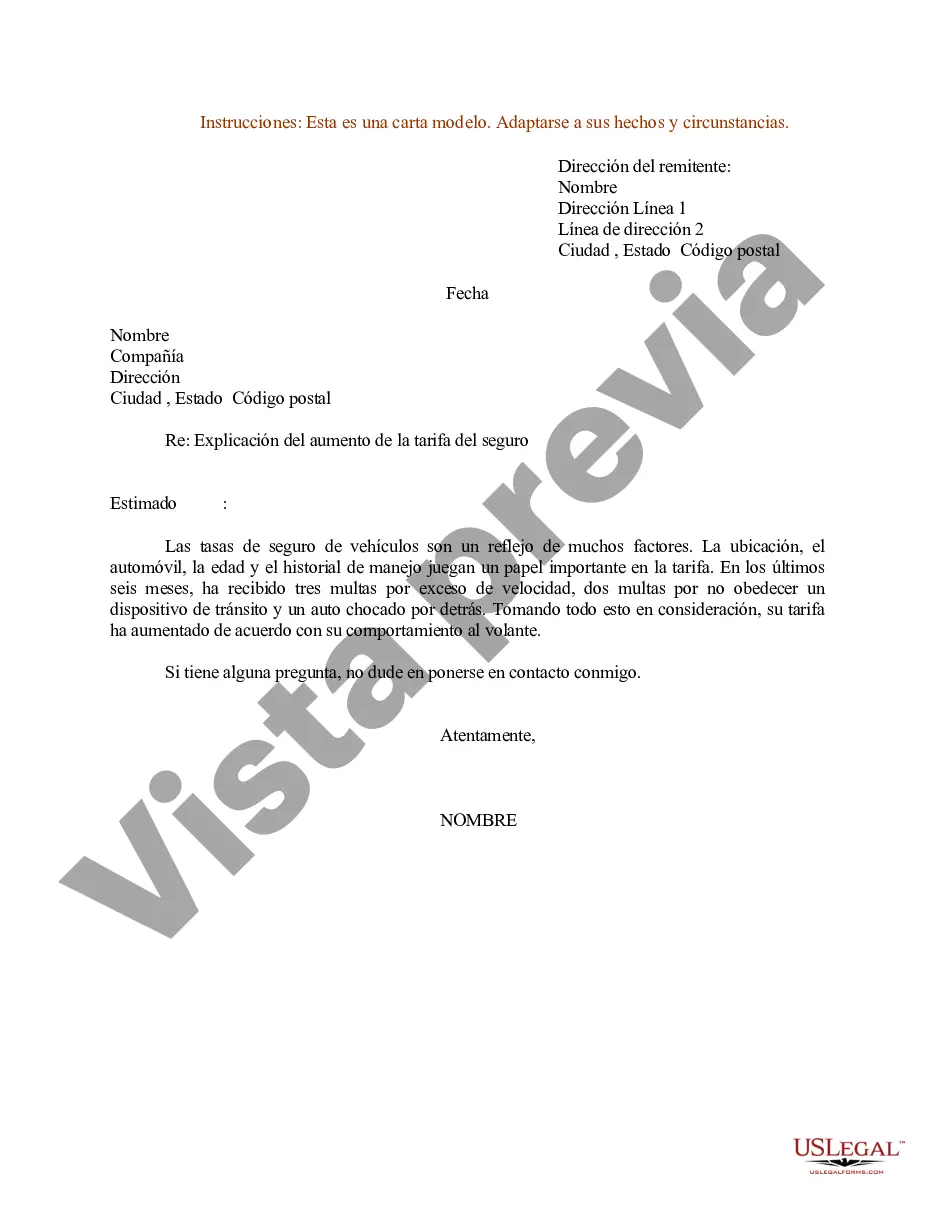

Dear [Insurance Policyholder], We hope this letter finds you well. We are writing to inform you about a recent change that affects your insurance policy. Effective [date], there will be an increase in your insurance premium rates. We understand that this news might cause concerns, and we want to provide a detailed explanation regarding this adjustment. At [Insurance Company], we strive to offer the best coverage to our valued policyholders while ensuring the financial stability of our organization. The decision to adjust premiums is always carefully considered and based on several factors. Firstly, San Diego, California, where you are residing, plays a significant role in determining insurance rates. The unique geographical location of San Diego, the coastal climate, and regional risks contribute to the overall insurance market conditions. Since insurance is designed to protect against potential risks and uncertainties, it is crucial for us to analyze all relevant factors when setting premium rates for this specific area. Moreover, the cost of materials and services has been consistently rising, and this directly impacts the repair and replacement costs associated with claims. San Diego's construction costs continue to increase due to market demands, labor expenses, and inflation rates. As a result, we need to adjust the premium rates to adequately cover these higher costs to ensure your policy offers the comprehensive coverage you deserve. Additionally, insurance premiums are influenced by various external factors, such as changes in state regulations, laws, and market competition. These factors can affect our ability to provide affordable coverage without jeopardizing our financial stability. Regulatory requirements, evolving underwriting guidelines, and industry-wide adjustments contribute to the need for rate increases in certain instances. We want to assure you that even with this rate increase, your insurance coverage remains comprehensive and tailored to meet your specific needs. Our team of dedicated professionals continues to monitor market conditions and strives to offer competitive rates while maintaining the highest level of service for our policyholders. If you have any questions or concerns regarding this rate increase, we encourage you to contact our customer service representatives. We are here to address any queries you may have and discuss potential alternatives to help manage the impact of this adjustment on your budget. We truly value your continued trust and loyalty as our esteemed policyholder. Rest assured, we remain committed to providing you with the best insurance coverage possible. We appreciate your understanding regarding this necessary adjustment and look forward to serving you in the future. Sincerely, [Your Name] [Your Title/Position] [Insurance Company] Keywords: San Diego, California, insurance rate increase, premium rate adjustment, geographical location, coastal climate, regional risks, market conditions, cost of materials and services, repair and replacement costs, claims, construction costs, market demands, labor expenses, inflation rates, comprehensive coverage, state regulations, industry-wide adjustments, competitive rates, customer service representatives, trust and loyalty

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Modelo de carta para explicación del aumento de la tarifa del seguro - Sample Letter for Explanation of Insurance Rate Increase

Description

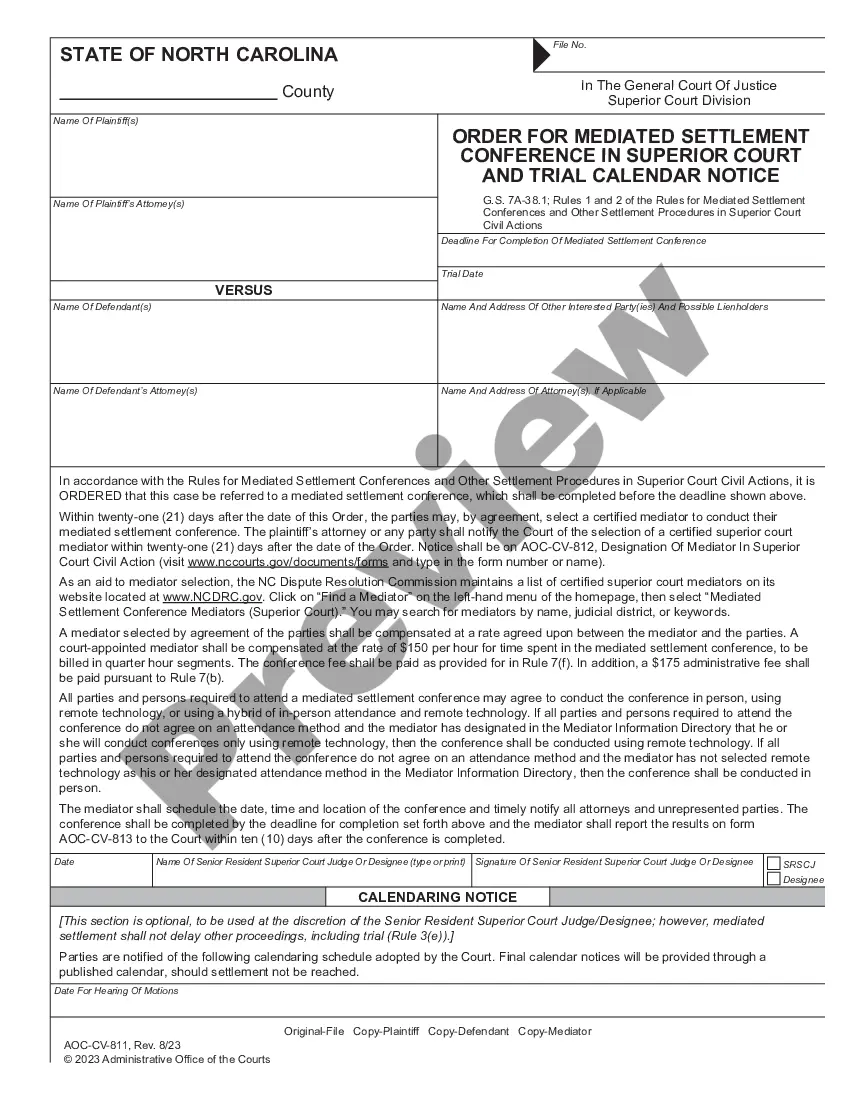

How to fill out San Diego California Modelo De Carta Para Explicación Del Aumento De La Tarifa Del Seguro?

If you need to get a trustworthy legal paperwork supplier to obtain the San Diego Sample Letter for Explanation of Insurance Rate Increase, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to get and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to search or browse San Diego Sample Letter for Explanation of Insurance Rate Increase, either by a keyword or by the state/county the document is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the San Diego Sample Letter for Explanation of Insurance Rate Increase template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less pricey and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the San Diego Sample Letter for Explanation of Insurance Rate Increase - all from the comfort of your home.

Join US Legal Forms now!