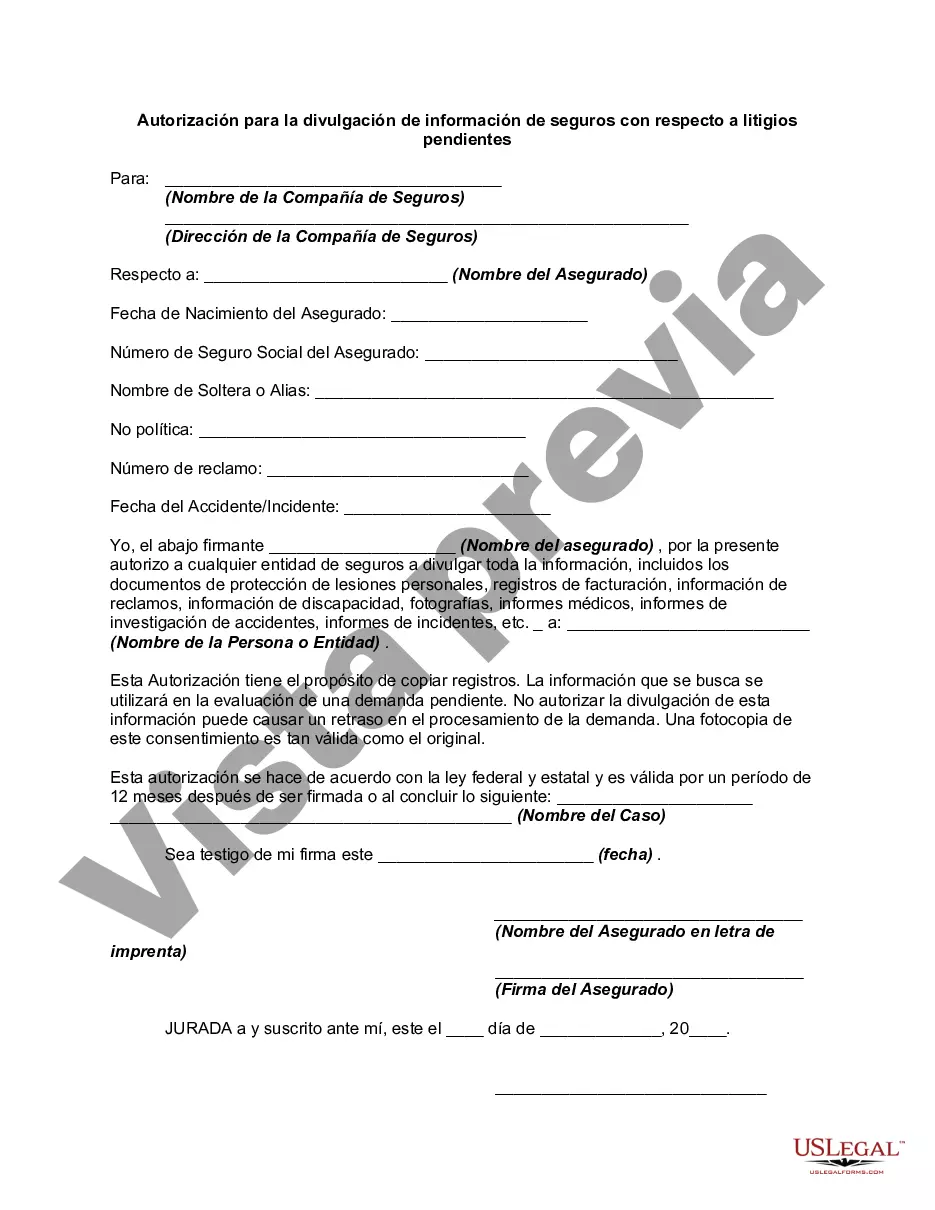

This form grants permission to an insurance company to release insurance information with regard to pending litigation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fairfax Virginia Authorization for Release of Insurance Information with Regard to Pending Litigation is a legal document that enables individuals involved in pending litigation in Fairfax, Virginia, to grant authorization for the release of their insurance information. This document is necessary for parties to gain access to insurance-related details that may be relevant to their case. The Authorization for Release of Insurance Information is crucial for plaintiffs and defendants involved in litigation as it empowers them to request and obtain key insurance details from the relevant parties. This information includes the policy limits, policy coverage, and other relevant policy provisions, which can greatly influence the resolution of the pending litigation. There are several types of Fairfax Virginia Authorization for Release of Insurance Information with Regard to Pending Litigation, each designed to cater to specific circumstances related to the pending legal case. These may include: 1. Personal Injury Insurance Information Release: This type of authorization primarily focuses on obtaining insurance information relevant to personal injury cases. It allows the release of insurance details related to any bodily injuries sustained by the claimant. 2. Property Damage Insurance Information Release: This authorization form is specifically used in cases where property damage is involved. It enables parties to access insurance information pertaining to damages caused to property, such as vehicles, homes, or other possessions. 3. Professional Liability Insurance Information Release: This type of authorization is relevant in cases where professional negligence or malpractice is alleged. It allows parties to obtain insurance information related to errors or omissions committed by professionals in their respective fields. 4. Employment Related Insurance Information Release: In employment-related disputes, this authorization form grants access to insurance information pertaining to incidents occurring within the scope of employment. It may involve issues such as workers' compensation claims or employer liability coverage. 5. Product Liability Insurance Information Release: In cases involving defective products causing harm, this type of authorization allows parties to obtain insurance information related to product liability coverage that may be applicable. It is crucial for individuals involved in pending litigation to consult with their legal representatives to determine the specific type of Fairfax Virginia Authorization for Release of Insurance Information required for their case. By utilizing the appropriate form, parties can ensure they have the necessary authorization to access crucial insurance details that can significantly impact the outcome of their litigation process.Fairfax Virginia Authorization for Release of Insurance Information with Regard to Pending Litigation is a legal document that enables individuals involved in pending litigation in Fairfax, Virginia, to grant authorization for the release of their insurance information. This document is necessary for parties to gain access to insurance-related details that may be relevant to their case. The Authorization for Release of Insurance Information is crucial for plaintiffs and defendants involved in litigation as it empowers them to request and obtain key insurance details from the relevant parties. This information includes the policy limits, policy coverage, and other relevant policy provisions, which can greatly influence the resolution of the pending litigation. There are several types of Fairfax Virginia Authorization for Release of Insurance Information with Regard to Pending Litigation, each designed to cater to specific circumstances related to the pending legal case. These may include: 1. Personal Injury Insurance Information Release: This type of authorization primarily focuses on obtaining insurance information relevant to personal injury cases. It allows the release of insurance details related to any bodily injuries sustained by the claimant. 2. Property Damage Insurance Information Release: This authorization form is specifically used in cases where property damage is involved. It enables parties to access insurance information pertaining to damages caused to property, such as vehicles, homes, or other possessions. 3. Professional Liability Insurance Information Release: This type of authorization is relevant in cases where professional negligence or malpractice is alleged. It allows parties to obtain insurance information related to errors or omissions committed by professionals in their respective fields. 4. Employment Related Insurance Information Release: In employment-related disputes, this authorization form grants access to insurance information pertaining to incidents occurring within the scope of employment. It may involve issues such as workers' compensation claims or employer liability coverage. 5. Product Liability Insurance Information Release: In cases involving defective products causing harm, this type of authorization allows parties to obtain insurance information related to product liability coverage that may be applicable. It is crucial for individuals involved in pending litigation to consult with their legal representatives to determine the specific type of Fairfax Virginia Authorization for Release of Insurance Information required for their case. By utilizing the appropriate form, parties can ensure they have the necessary authorization to access crucial insurance details that can significantly impact the outcome of their litigation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.