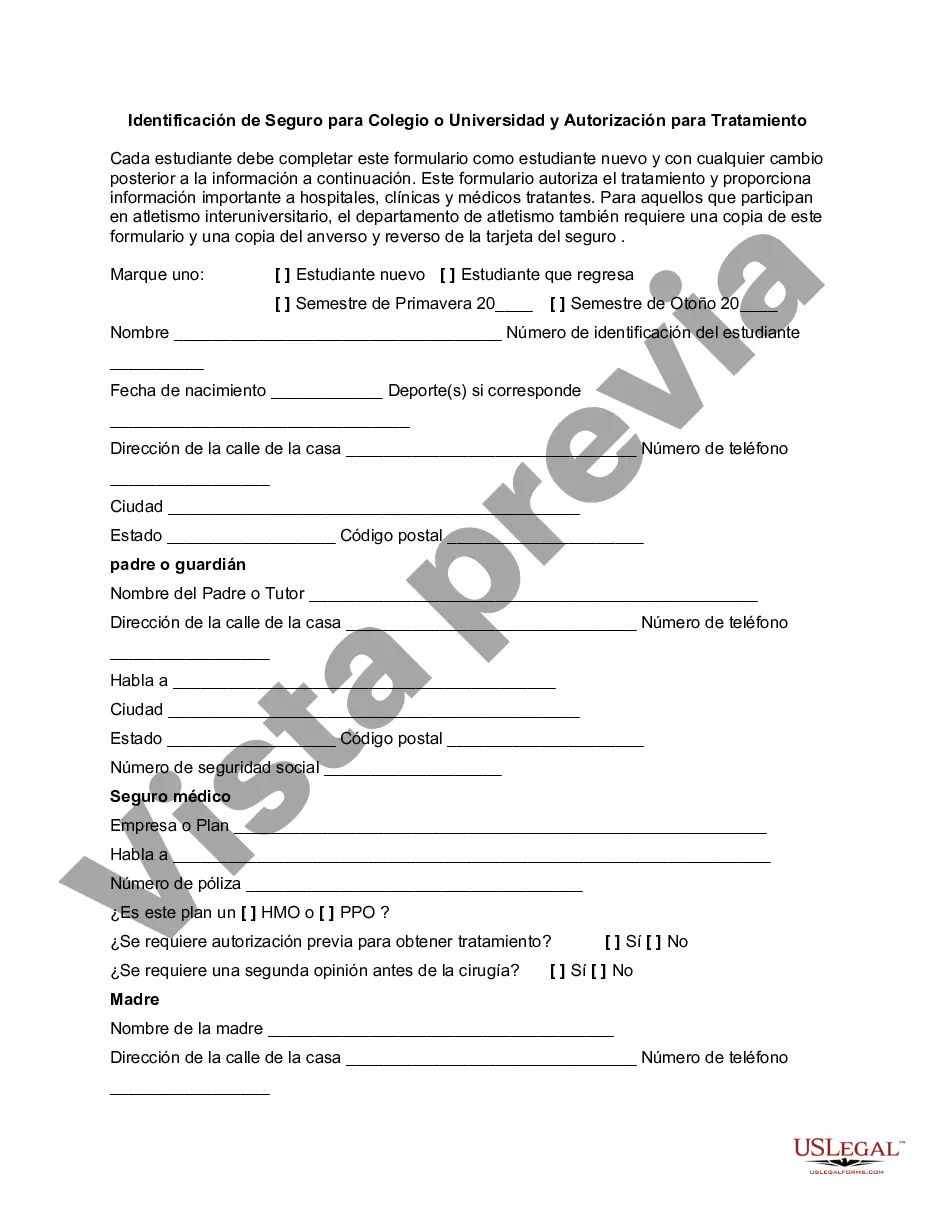

This form authorizes treatment for athletes and students of a college and university and provides important information to hospitals, clinics and attending physicians. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Bexar Texas Identification of Insurance for College or University provides essential coverage and authorization for educational institutions operating in Bexar County, Texas. This identification serves as proof of insurance and authorization for the college or university, ensuring compliance with legal requirements and providing peace of mind to students, staff, and stakeholders. Types of Bexar Texas Identification of Insurance for College or University: 1. General Liability Insurance: This type of insurance protects the college or university from claims arising from bodily injury, property damage, personal injury, or advertising injury. It covers legal defense costs and potential settlements if the institution is found liable. 2. Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects educational professionals against claims of professional negligence, errors, or omissions. It is essential for educators, administrators, and consultants to safeguard against potential lawsuits related to educational services provided. 3. Workers' Compensation Insurance: Required by law, workers' compensation insurance provides financial protection to employees who suffer work-related injuries or illnesses. It covers medical expenses, disability benefits, and lost wages, helping both the affected employee and the college or university. 4. Property Insurance: This insurance covers the physical assets of the educational institution, including buildings, equipment, supplies, and inventory. It protects against losses due to fire, theft, vandalism, natural disasters, and other covered perils. 5. Cyber Liability Insurance: With advancements in technology, educational institutions face increasing threats from cyber-attacks, data breaches, and identity theft. Cyber liability insurance helps cover the costs associated with data recovery, legal expenses, notification requirements, credit monitoring, and other related expenses. 6. Automobile Insurance: If the college or university owns a fleet of vehicles, auto insurance is necessary to protect against potential accidents, property damage, bodily injury, or theft. It covers the institution's vehicles, drivers, passengers, and third-party liabilities. To obtain the Bexar Texas Identification of Insurance for College or University, educational institutions need to select appropriate insurance policies, ensure compliance with state and county regulations, and submit the necessary documentation to the relevant authorities. This identification serves as proof of the institution's commitment to responsible risk management and provides reassurance to all stakeholders involved.Bexar Texas Identification of Insurance for College or University provides essential coverage and authorization for educational institutions operating in Bexar County, Texas. This identification serves as proof of insurance and authorization for the college or university, ensuring compliance with legal requirements and providing peace of mind to students, staff, and stakeholders. Types of Bexar Texas Identification of Insurance for College or University: 1. General Liability Insurance: This type of insurance protects the college or university from claims arising from bodily injury, property damage, personal injury, or advertising injury. It covers legal defense costs and potential settlements if the institution is found liable. 2. Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects educational professionals against claims of professional negligence, errors, or omissions. It is essential for educators, administrators, and consultants to safeguard against potential lawsuits related to educational services provided. 3. Workers' Compensation Insurance: Required by law, workers' compensation insurance provides financial protection to employees who suffer work-related injuries or illnesses. It covers medical expenses, disability benefits, and lost wages, helping both the affected employee and the college or university. 4. Property Insurance: This insurance covers the physical assets of the educational institution, including buildings, equipment, supplies, and inventory. It protects against losses due to fire, theft, vandalism, natural disasters, and other covered perils. 5. Cyber Liability Insurance: With advancements in technology, educational institutions face increasing threats from cyber-attacks, data breaches, and identity theft. Cyber liability insurance helps cover the costs associated with data recovery, legal expenses, notification requirements, credit monitoring, and other related expenses. 6. Automobile Insurance: If the college or university owns a fleet of vehicles, auto insurance is necessary to protect against potential accidents, property damage, bodily injury, or theft. It covers the institution's vehicles, drivers, passengers, and third-party liabilities. To obtain the Bexar Texas Identification of Insurance for College or University, educational institutions need to select appropriate insurance policies, ensure compliance with state and county regulations, and submit the necessary documentation to the relevant authorities. This identification serves as proof of the institution's commitment to responsible risk management and provides reassurance to all stakeholders involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.