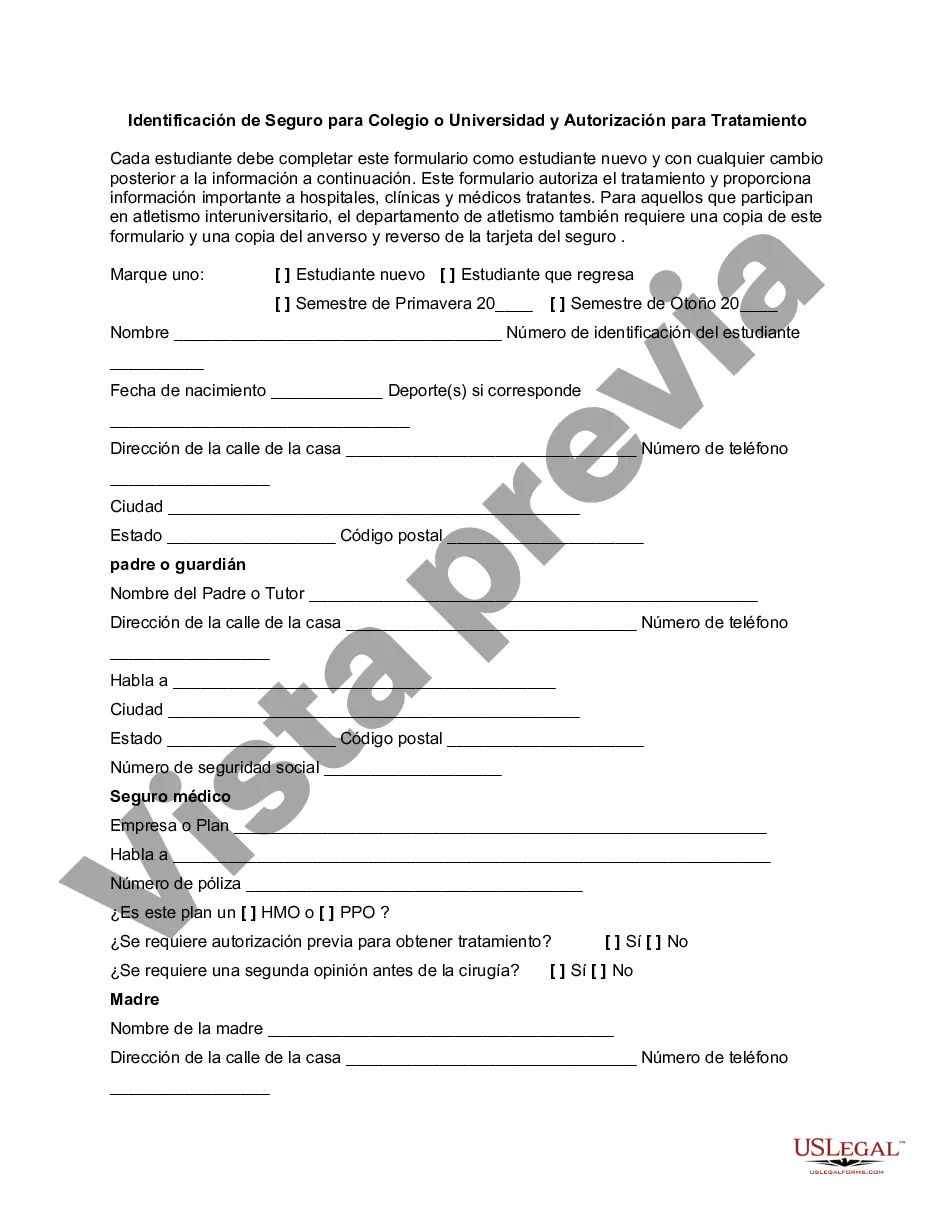

This form authorizes treatment for athletes and students of a college and university and provides important information to hospitals, clinics and attending physicians. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin Texas Identification of Insurance for College or University and Authorization is a crucial requirement for educational institutions located in Collin County, Texas. This identification of insurance ensures that colleges and universities have the necessary coverage to protect their students, faculty, staff, and property from potential risks and liabilities. In Collin County, there are different types of Identification of Insurance for College or University and Authorization that institutions must secure: 1. General Liability Insurance: This coverage protects the college or university against claims of bodily injury or property damage that may occur on their premises. It provides financial protection in case of accidents, slips and falls, or other incidents that could lead to lawsuits. 2. Property Insurance: Property insurance is essential for colleges and universities to protect their buildings, equipment, and contents from damage or loss due to various risks such as fire, theft, vandalism, or natural disasters. This coverage ensures that educational institutions can quickly replace or repair damaged property without incurring a significant financial burden. 3. Workers' Compensation Insurance: This type of insurance is necessary to cover employee injuries or illnesses that occur on the job. It ensures that colleges or universities can provide medical benefits, rehabilitation services, and wage replacement to their employees if they are injured or become ill due to work-related activities. 4. Professional Liability Insurance: Also known as errors and omissions insurance, professional liability insurance safeguards educational institutions and their employees (e.g., professors, instructors, advisors) from claims related to negligence or errors in their professional services. It provides financial protection in case students or other parties suffer damages due to the institution's educational, counseling, or consulting services. 5. Cyber Liability Insurance: With the reliance on technology and data storage, colleges and universities face the risk of cyber-attacks, data breaches, or identity theft. Cyber liability insurance helps cover the costs associated with data recovery, legal expenses, notification to affected parties, and potential financial losses resulting from these incidents. 6. Student Health Insurance: Many colleges and universities require students to have health insurance to ensure they have access to medical care while pursuing their studies. Institutions may offer health insurance plans specifically tailored for their students or require them to provide proof of alternative coverage. In order to obtain Collin Texas Identification of Insurance for College or University and Authorization, educational institutions must assess their specific needs and work with insurance providers who specialize in serving colleges and universities. It is crucial to review policy terms, and coverage limits, as well as comply with any regulations set forth by Collin County or the State of Texas regarding insurance requirements for educational institutions. Securing comprehensive and well-rounded insurance coverage not only protects the colleges or universities from potential financial losses but also provides peace of mind to students, employees, and stakeholders, ensuring a safe and secure educational environment.Collin Texas Identification of Insurance for College or University and Authorization is a crucial requirement for educational institutions located in Collin County, Texas. This identification of insurance ensures that colleges and universities have the necessary coverage to protect their students, faculty, staff, and property from potential risks and liabilities. In Collin County, there are different types of Identification of Insurance for College or University and Authorization that institutions must secure: 1. General Liability Insurance: This coverage protects the college or university against claims of bodily injury or property damage that may occur on their premises. It provides financial protection in case of accidents, slips and falls, or other incidents that could lead to lawsuits. 2. Property Insurance: Property insurance is essential for colleges and universities to protect their buildings, equipment, and contents from damage or loss due to various risks such as fire, theft, vandalism, or natural disasters. This coverage ensures that educational institutions can quickly replace or repair damaged property without incurring a significant financial burden. 3. Workers' Compensation Insurance: This type of insurance is necessary to cover employee injuries or illnesses that occur on the job. It ensures that colleges or universities can provide medical benefits, rehabilitation services, and wage replacement to their employees if they are injured or become ill due to work-related activities. 4. Professional Liability Insurance: Also known as errors and omissions insurance, professional liability insurance safeguards educational institutions and their employees (e.g., professors, instructors, advisors) from claims related to negligence or errors in their professional services. It provides financial protection in case students or other parties suffer damages due to the institution's educational, counseling, or consulting services. 5. Cyber Liability Insurance: With the reliance on technology and data storage, colleges and universities face the risk of cyber-attacks, data breaches, or identity theft. Cyber liability insurance helps cover the costs associated with data recovery, legal expenses, notification to affected parties, and potential financial losses resulting from these incidents. 6. Student Health Insurance: Many colleges and universities require students to have health insurance to ensure they have access to medical care while pursuing their studies. Institutions may offer health insurance plans specifically tailored for their students or require them to provide proof of alternative coverage. In order to obtain Collin Texas Identification of Insurance for College or University and Authorization, educational institutions must assess their specific needs and work with insurance providers who specialize in serving colleges and universities. It is crucial to review policy terms, and coverage limits, as well as comply with any regulations set forth by Collin County or the State of Texas regarding insurance requirements for educational institutions. Securing comprehensive and well-rounded insurance coverage not only protects the colleges or universities from potential financial losses but also provides peace of mind to students, employees, and stakeholders, ensuring a safe and secure educational environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.