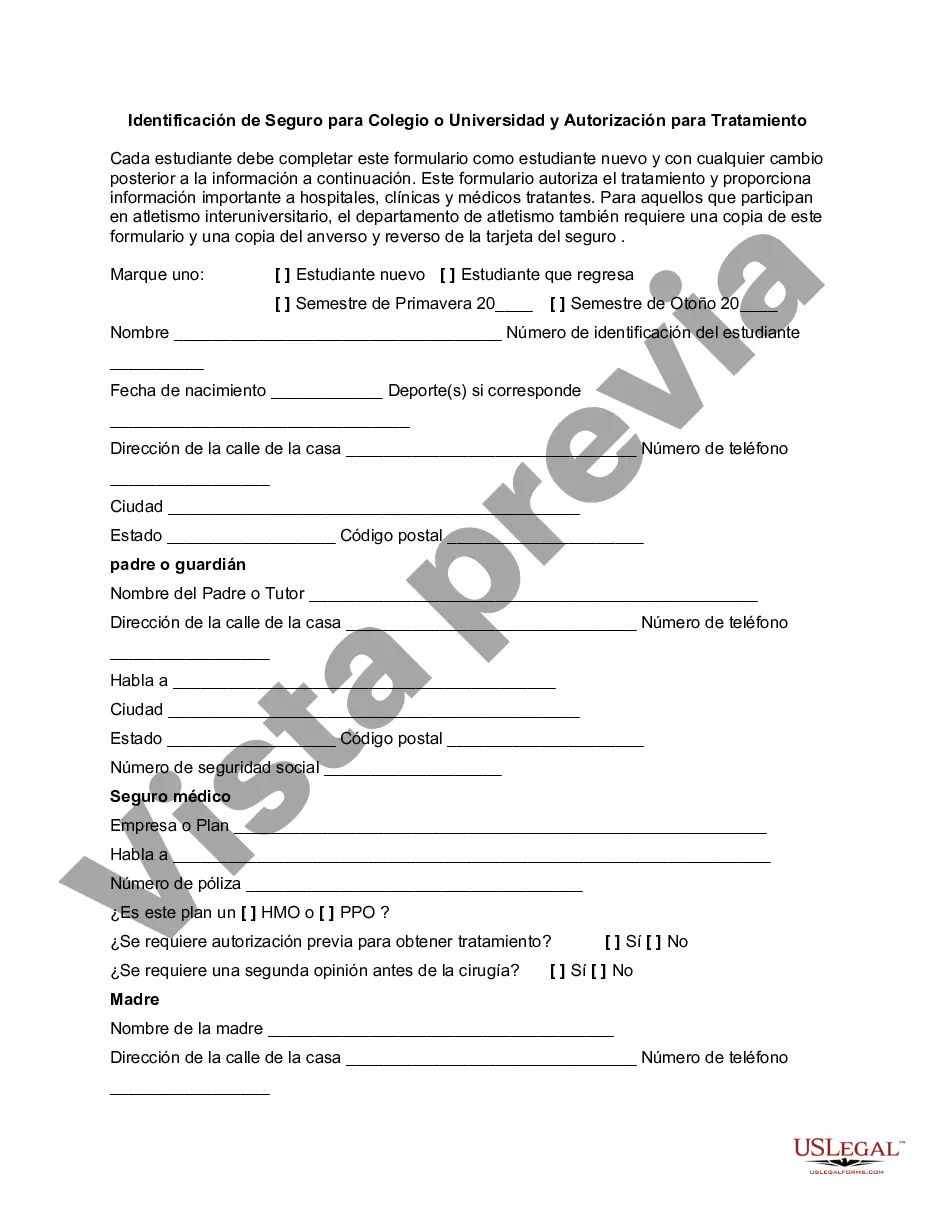

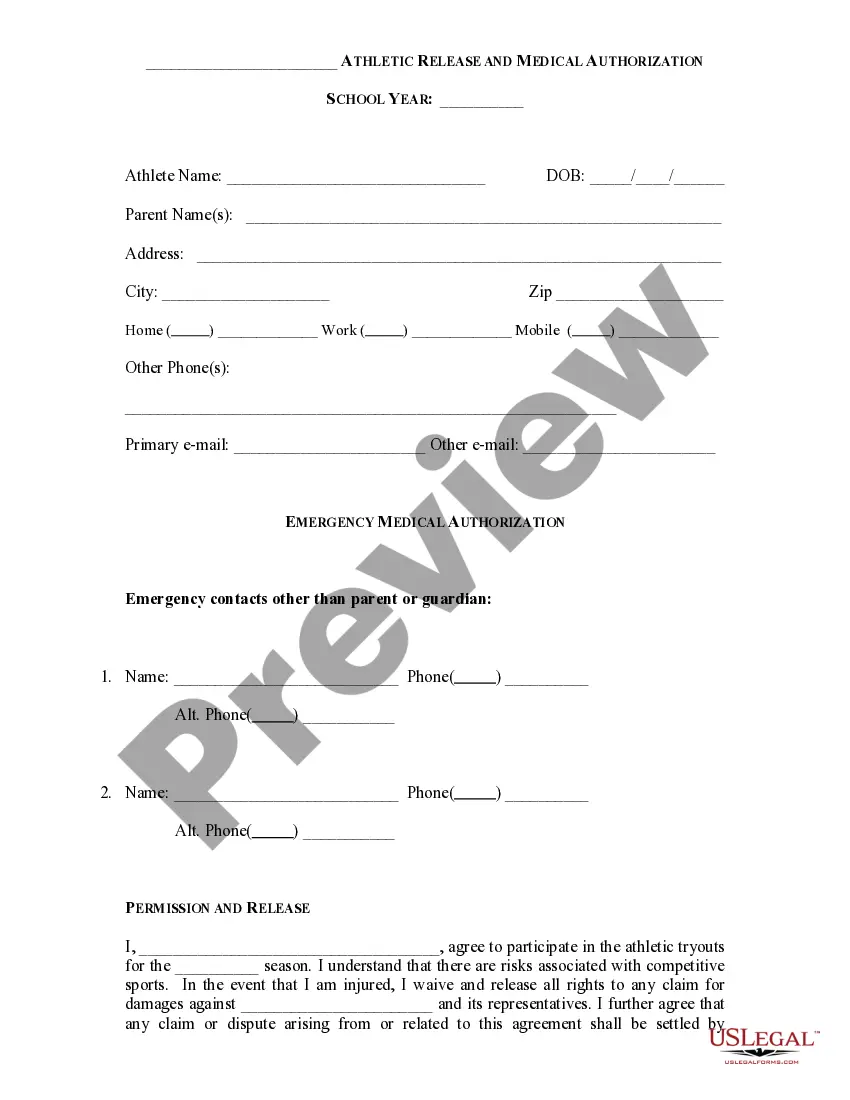

This form authorizes treatment for athletes and students of a college and university and provides important information to hospitals, clinics and attending physicians. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Identificación de Seguro para Colegio o Universidad y Autorización - Identification of Insurance for College or University and Authorization

Description

How to fill out Identificación De Seguro Para Colegio O Universidad Y Autorización?

How long does it usually take you to prepare a legal document.

Considering that each state has its statutes and regulations for various life situations, finding a Queens Identification of Insurance for College or University and Authorization that fulfills all local stipulations can be draining, and procuring it from a practicing attorney is frequently expensive.

Many online platforms provide the most prevalent state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

Choose the subscription plan that fits you best. Register for an account on the platform or Log In to continue to payment options. Pay using PayPal or your credit card. Change the file format if needed. Click Download to save the Queens Identification of Insurance for College or University and Authorization. Print the template or use any preferred online editor to complete it electronically. No matter how often you need to utilize the obtained template, you can find all the samples you’ve ever saved in your profile by opening the My documents tab. Give it a try!

- US Legal Forms is the largest online collection of templates, categorized by states and fields of use.

- Apart from the Queens Identification of Insurance for College or University and Authorization, you can find any particular form to manage your business or personal matters, adhering to your county standards.

- Experts validate all samples for their validity, ensuring you can prepare your documentation correctly.

- Engaging with the service is quite simple.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, choose the necessary sample, and download it.

- You can select the file from your profile at any point in the future.

- If you are unfamiliar with the platform, additional steps will be required before you acquire your Queens Identification of Insurance for College or University and Authorization.

- Examine the content of the page you are on.

- Review the description of the sample or Preview it (if accessible).

- Search for another form using the related option in the header.

- Click Buy Now once you are sure about the selected file.

Form popularity

FAQ

Las citas se pueden concertar llamando al 311 o en linea en . Los solicitantes deben presentar una prueba de identidad y de residencia en la ciudad de Nueva York.

Para pedir una cita visite el sitio en internet nyc.gov/idnyc. Tambien lo puede hacer llamando al 311. La tarjeta es gratuita y esta disponible para todos los neoyorquinos mayores de 14 anos de edad, sin importar su condicion migratoria.

El numero NIE es el numero de identificacion para extranjeros que te permitira trabajar, estudiar o interactuar con la administracion espanola. Este documento solo es valido si tienes tambien tu pasaporte o documento nacional contigo.

Los solicitantes deben completar una solicitud y enviarla a un Centro de inscripcion de IDNYC . Ademas de presentar su solicitud, se debe presentar un comprobante de identidad y residencia de Nueva York en un Centro de inscripcion de IDNYC o en un Centro de inscripcion emergente de IDNYC.

Una DLI son las siglas en ingles de Designated Learning Institution. Estas son instituciones aprobadas por el Gobierno de Canada para recibir estudiantes internacionales. Para aplicar a un permiso de estudios es necesario recibir una carta de aceptacion de una de estas instituciones.

La renovacion de la tarjeta de estudiante debes hacerla en la Oficina de Extranjeria, la que te corresponda por tu lugar de domicilio. La oficina dispone de un plazo de 3 meses contados a partir del dia siguiente a la fecha en que haya tenido entrada en el registro del organo competente en su tramitacion.

Identificacion consular vigente (200b4 puntos, comprobante de edad200b) Licencia de conducir extranjera valida o vencida hasta 24 meses (200b4 puntos, comprobante de edad200b) Boleta de Calificaciones o Expediente Escolar Extranjero 200b(1 pt)200b Con foto 200b(2 pts) Identificacion municipal de EE.

Siempre podra renovar su visado estando dentro del territorio, para ello podra hacerlo con 60 dias de antelacion al vencimiento de dicho visado o 90 dias posteriores. No debera pedir cita previa podra hacerlo directamente en cualquier registro de las Administraciones Publicas del Estado.

Los solicitantes deben completar una solicitud y enviarla a un Centro de inscripcion de IDNYC . Ademas de presentar su solicitud, se debe presentar un comprobante de identidad y residencia de Nueva York en un Centro de inscripcion de IDNYC o en un Centro de inscripcion emergente de IDNYC.

Documentacion necesaria: Tu pasaporte. Impreso de Solicitud EX-17. 3 fotografias de carne (tamano 32 por 26 milimetros) Recibo del abono de tasa 790 (se rellena en linea y la opcion a seleccionar para renovacion es la 4.2 que tiene un coste de 18,92 euros).