Bexar Texas Debt Agreement is a legally binding arrangement between a debtor and creditor, typically for the purpose of settling outstanding debts. This agreement helps individuals or businesses in Bexar County, Texas, to negotiate and resolve debts by creating a structured repayment plan that satisfies both parties involved. The primary goal of a Bexar Texas Debt Agreement is to provide debtors with an opportunity to repay their debts while also avoiding bankruptcy. By entering into a debt agreement, the debtor agrees to make regular payments towards their outstanding balance over a fixed period of time. This allows them to manage their finances and gradually reduce their debt burden. There are various types of Bexar Texas Debt Agreements depending on the specific circumstances and the entities involved. Some common types include: 1. Personal Debt Agreement: This agreement is applicable to individuals who are overwhelmed with personal debts, including credit card debts, medical bills, or personal loans. It allows them to negotiate with their creditors to establish an affordable repayment plan, considering their income and financial situation. 2. Small Business Debt Agreement: Designed for small businesses struggling with mounting debts, this agreement enables business owners to negotiate with their creditors to restructure their debts and establish a repayment plan that accommodates the business's cash flow. 3. Medical Debt Agreement: Unpaid medical bills can quickly accumulate and become a financial burden. This type of debt agreement allows individuals to negotiate with medical providers to reduce or consolidate their debts, making it more manageable and affordable. 4. Credit Card Debt Agreement: Credit card debt can be one of the most challenging financial obligations to overcome due to high-interest rates. A credit card debt agreement helps individuals negotiate with credit card companies to potentially reduce the interest rates or establish a more suitable repayment plan. 5. Student Loan Debt Agreement: As student loans often have long repayment periods and high-interest rates, individuals who struggle with student loan debts can enter into a debt agreement to negotiate more affordable repayment terms with their lenders. In conclusion, Bexar Texas Debt Agreement is a flexible solution that allows debtors in Bexar County, Texas, to negotiate with their creditors and establish manageable repayment plans for various types of debts. By entering into this agreement, individuals and businesses can work towards resolving their financial burdens while avoiding more severe measures like bankruptcy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Acuerdo de deuda - Debt Agreement

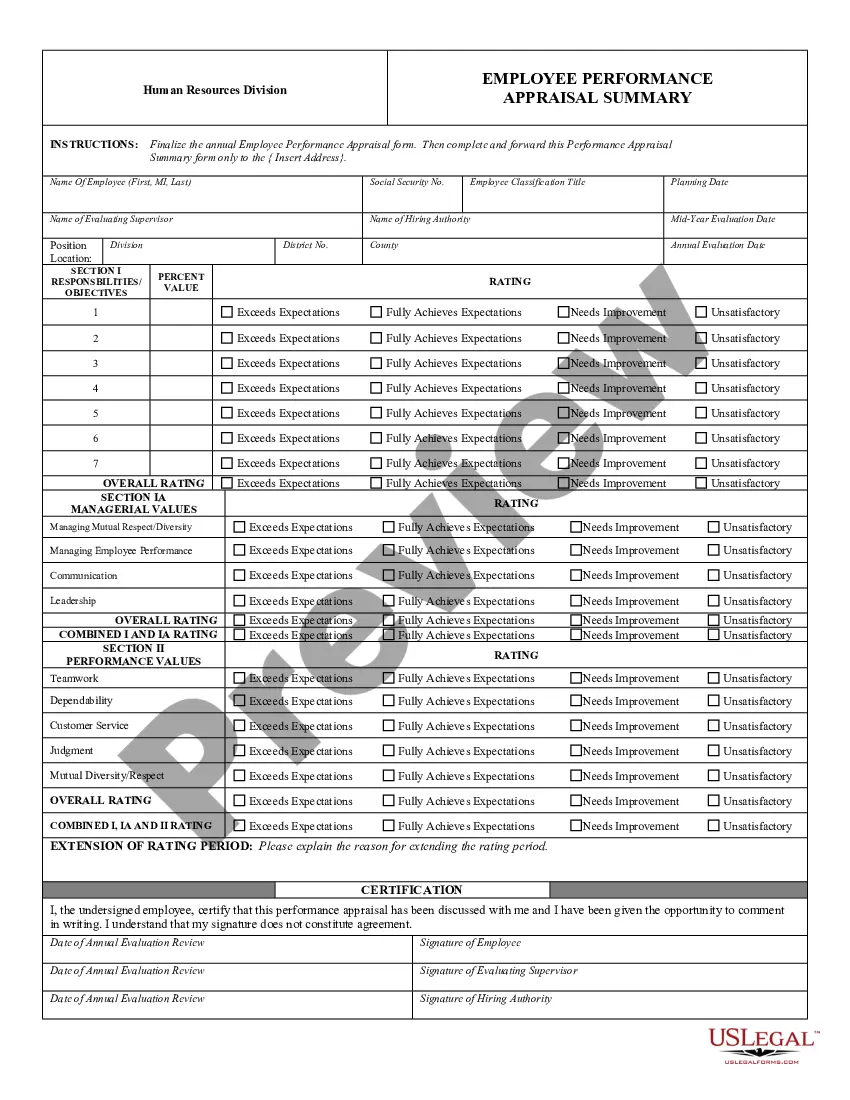

Description

How to fill out Bexar Texas Acuerdo De Deuda?

Creating forms, like Bexar Debt Agreement, to manage your legal affairs is a tough and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents created for various cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Bexar Debt Agreement template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before downloading Bexar Debt Agreement:

- Make sure that your document is specific to your state/county since the regulations for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Bexar Debt Agreement isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our service and get the document.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!