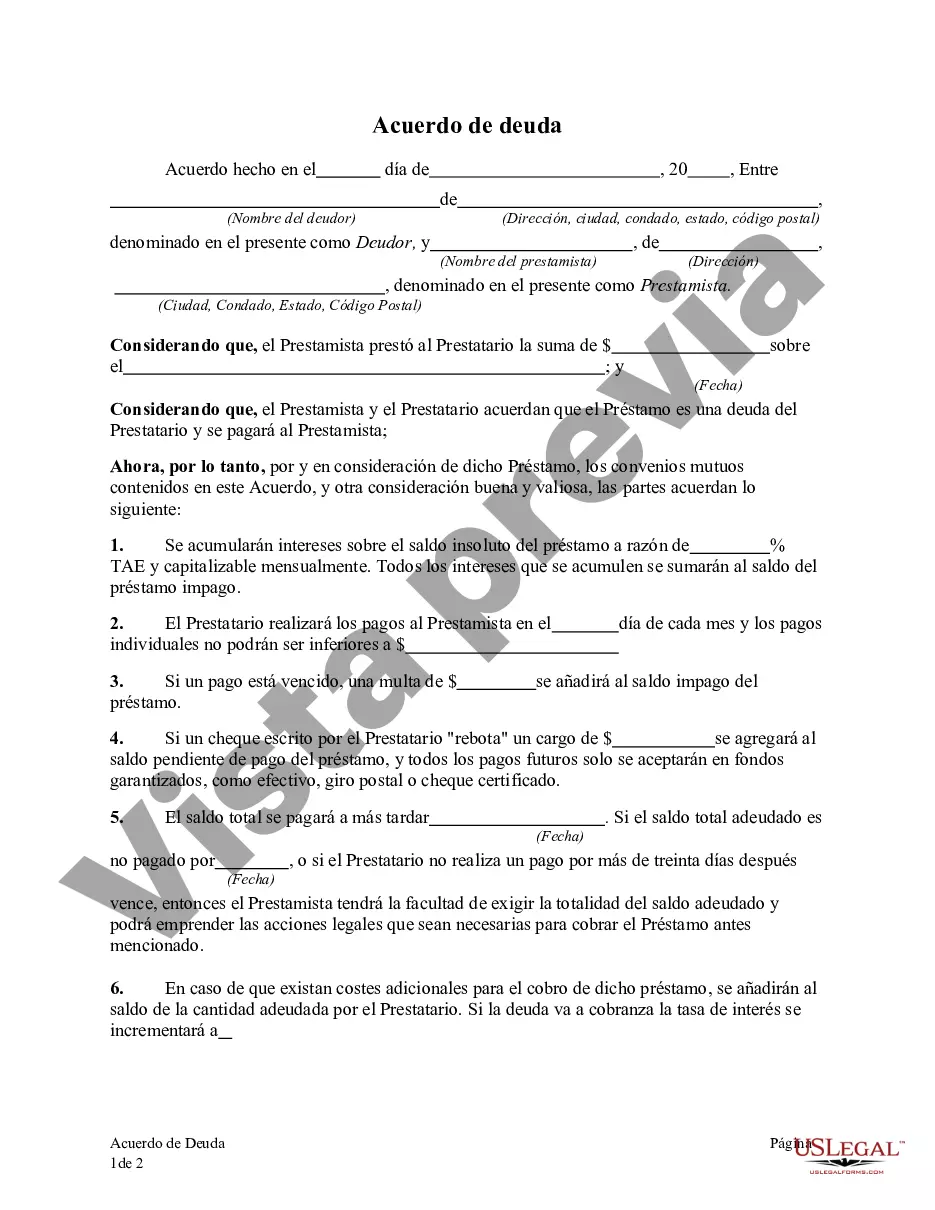

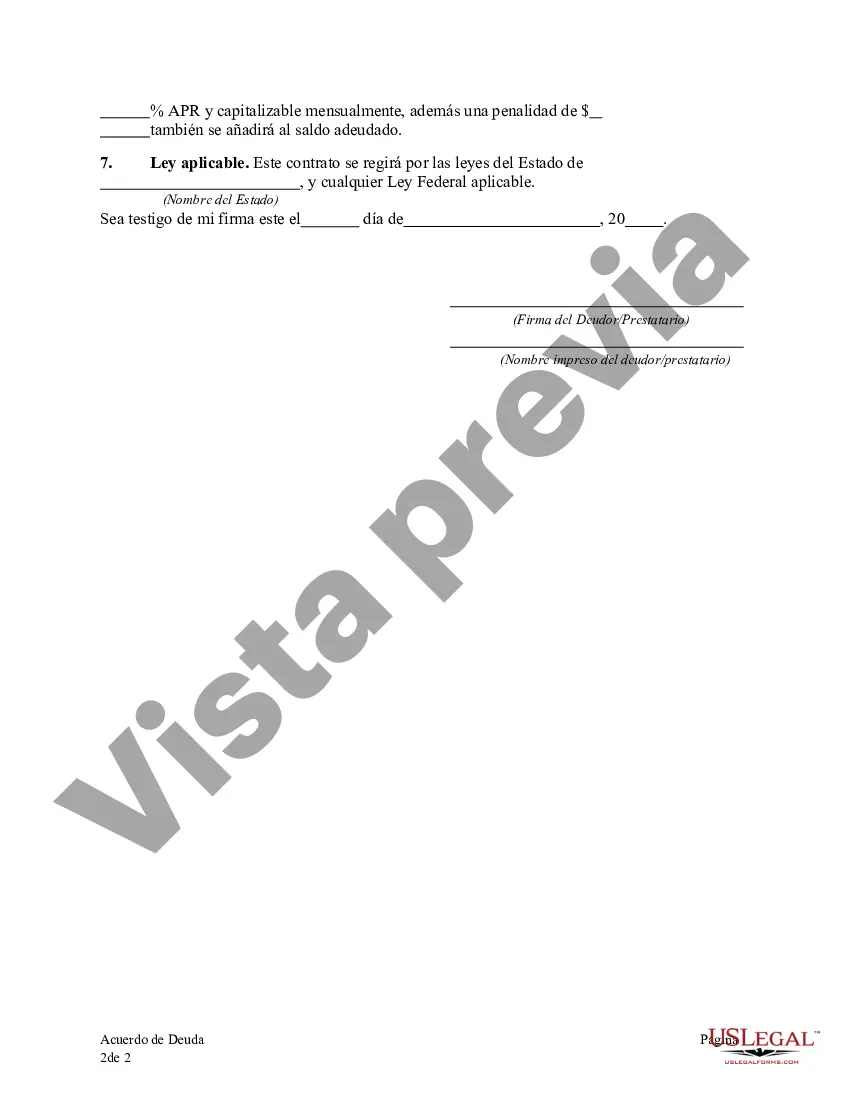

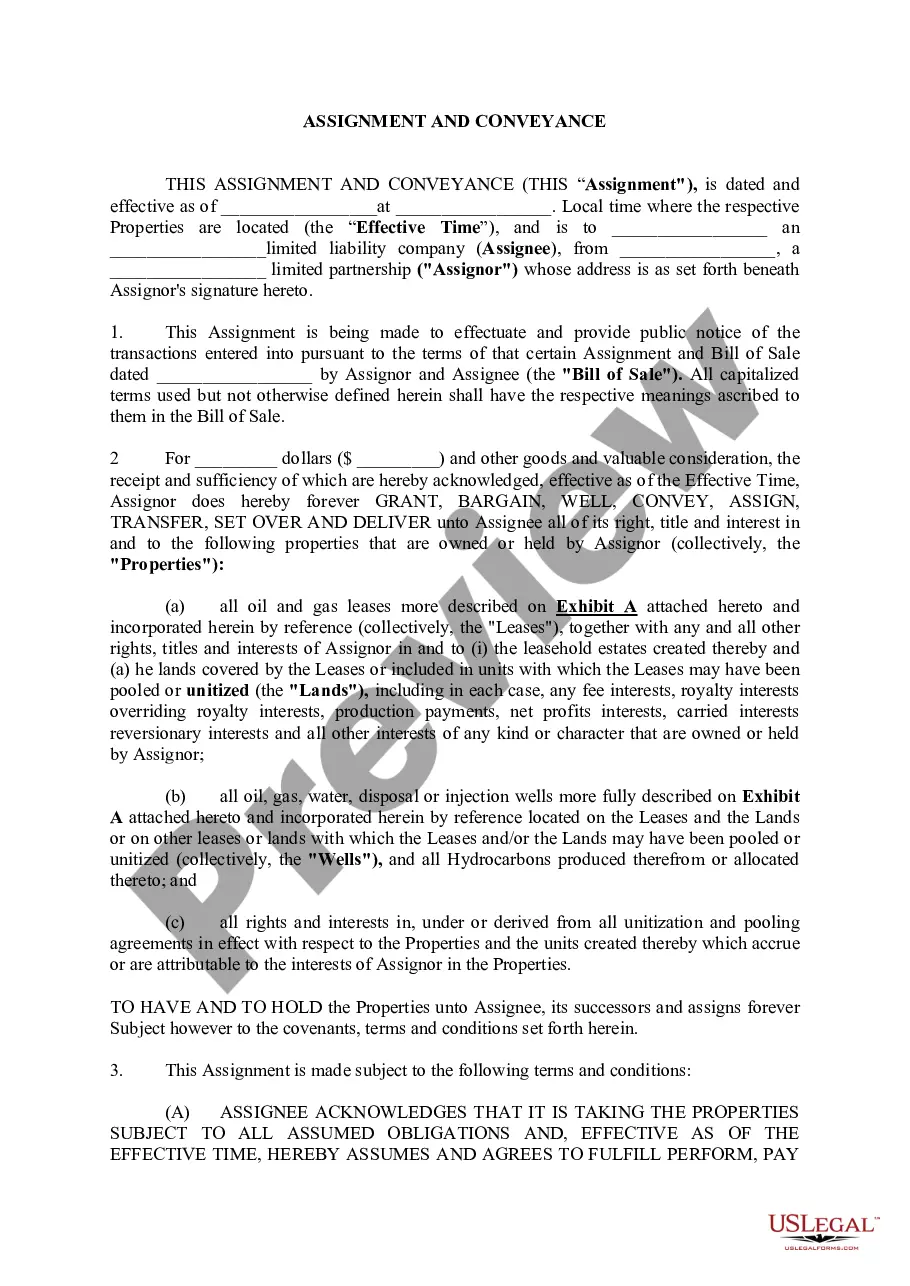

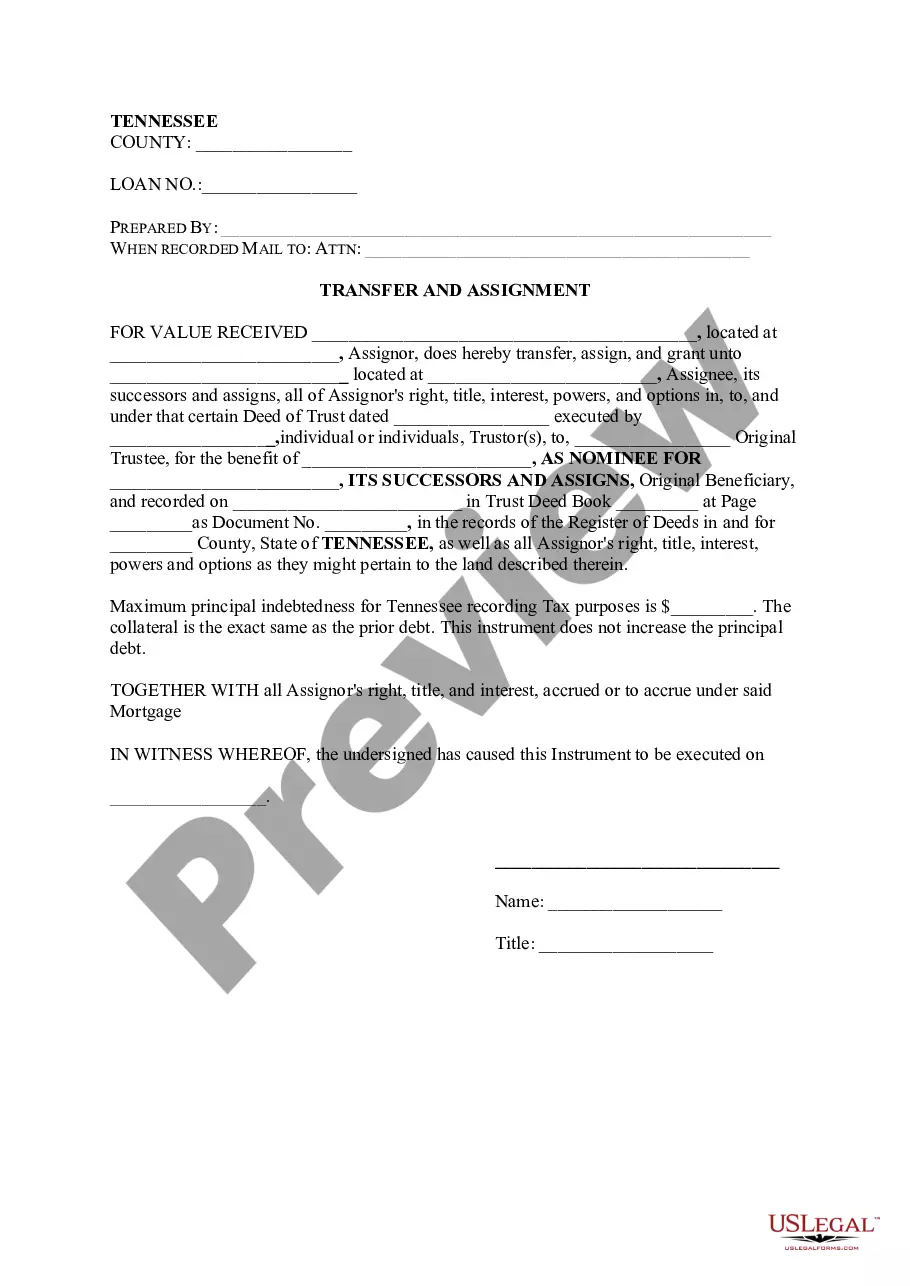

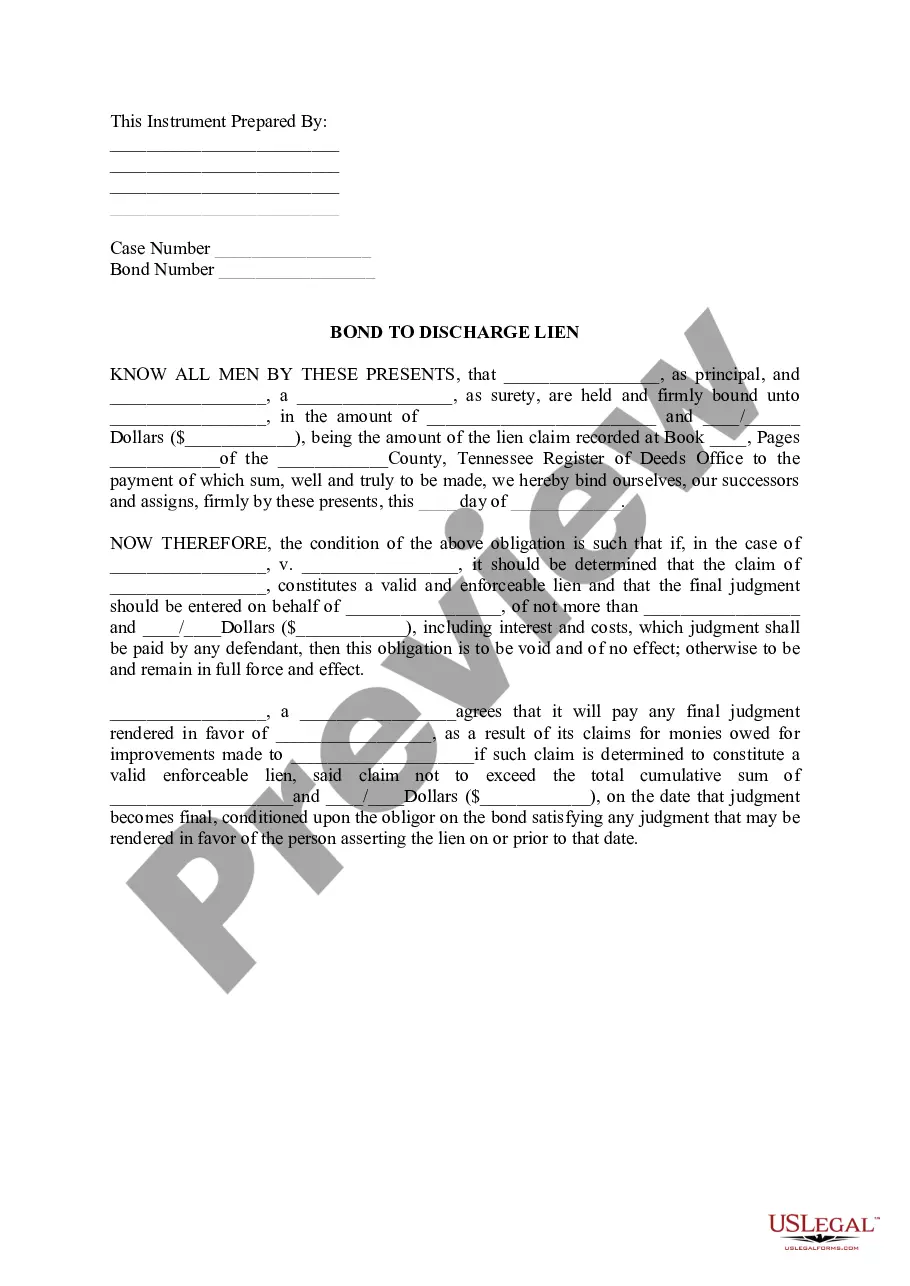

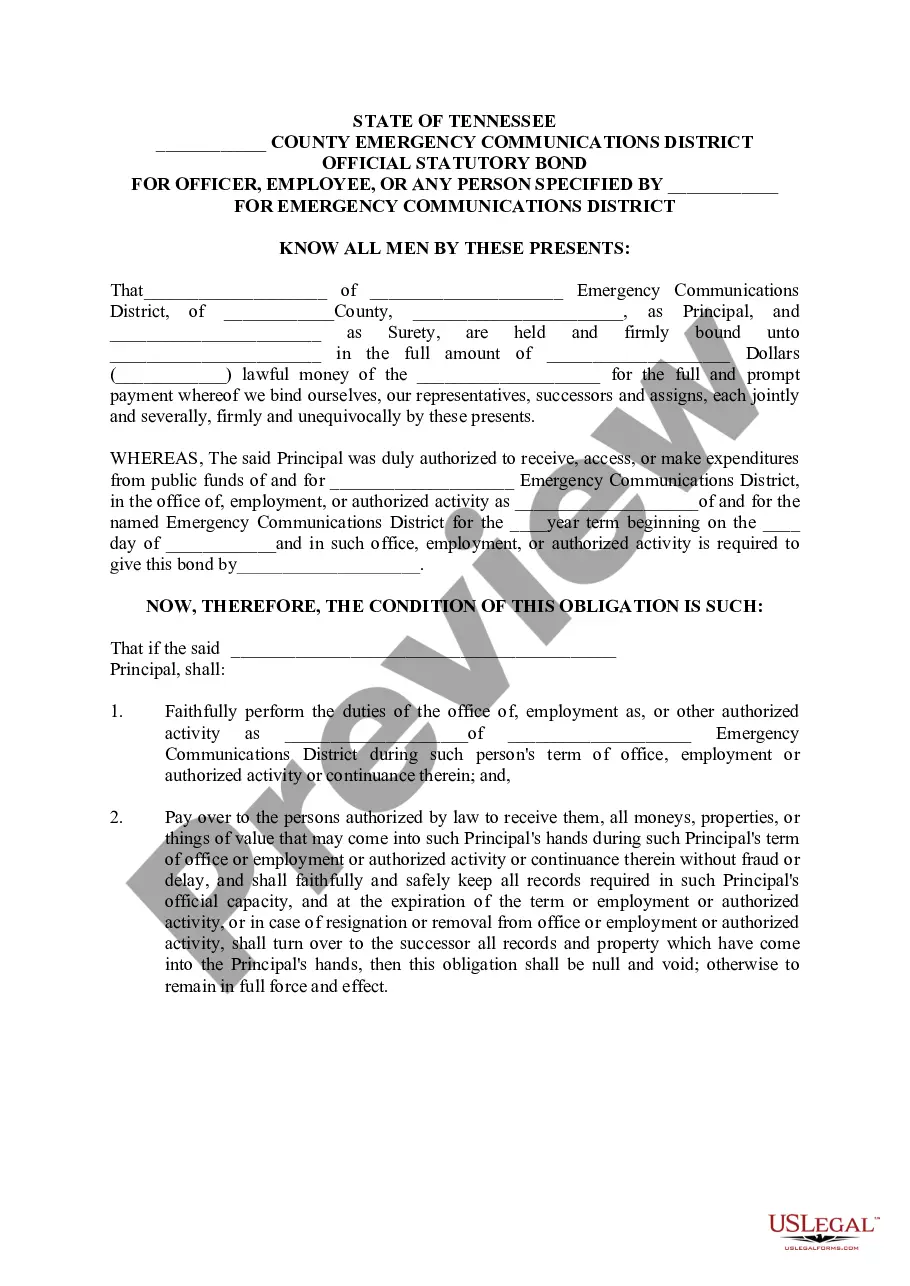

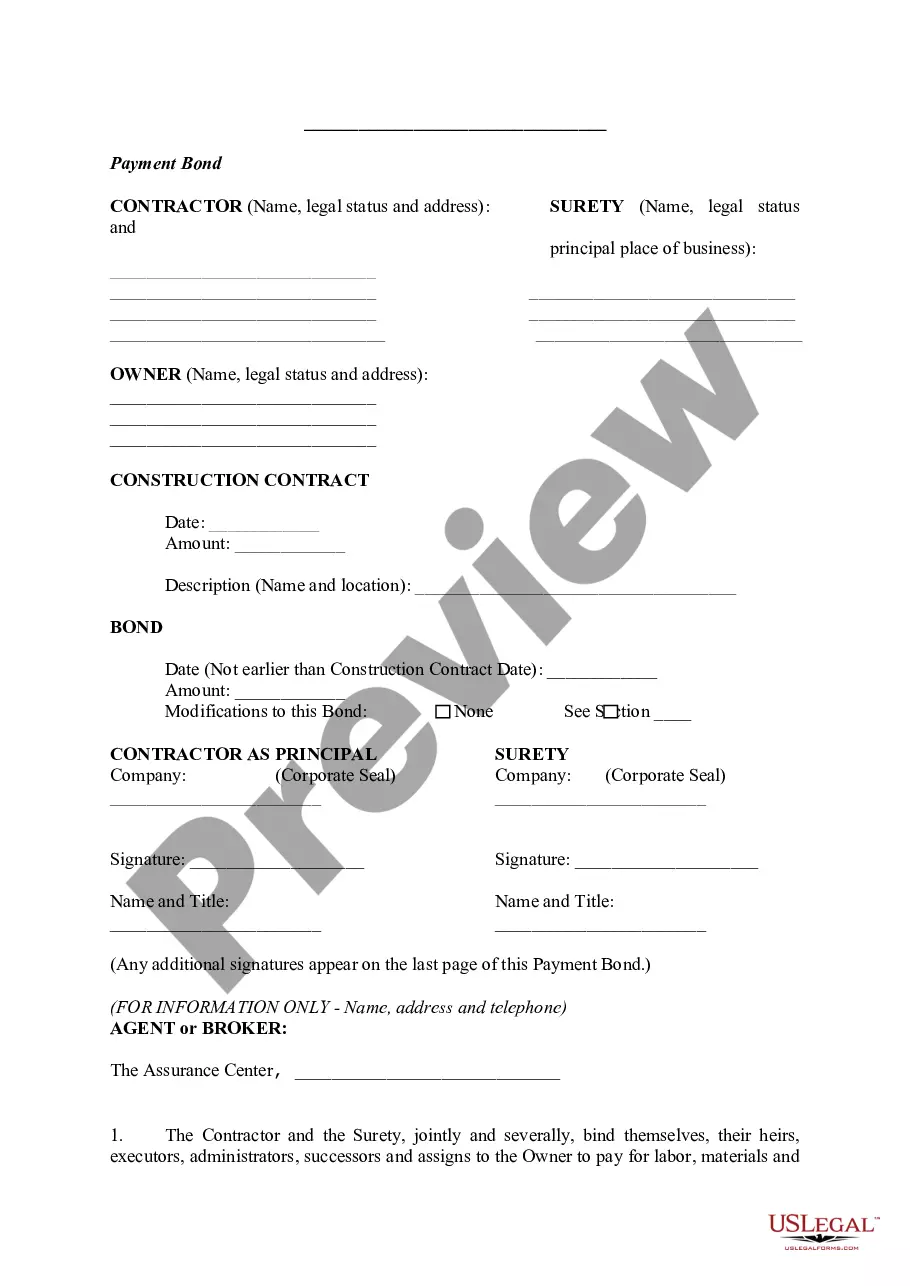

Maricopa Arizona Debt Agreement is a legal contract entered into between a debtor and creditor to resolve outstanding debts. It allows individuals or businesses in Maricopa, Arizona, to negotiate a repayment plan that suits their financial situation, providing a pathway to pay off their debts over a specified period. The Maricopa Arizona Debt Agreement is designed for individuals or businesses who are struggling to meet their financial obligations and wish to avoid bankruptcy. It offers an alternative solution by allowing debtors to consolidate their debts and create a structured repayment plan. This can help debtors regain their financial stability while ensuring creditors receive at least a portion of the owed amount. As for different types of Maricopa Arizona Debt Agreement, there are primarily two common options: 1. Debt Settlement Agreement: This type of agreement involves negotiating with creditors to reduce the overall debt amount. Debtors can work with a debt settlement company or negotiate directly with their creditors to settle the debt for less than the full amount owed. By agreeing to a lump-sum payment, creditors may forgive a portion of the debt. This option is suitable for individuals or businesses with a significant amount of debt and financial hardship. 2. Debt Management Plan: A debt management plan involves creating a budget and repayment schedule in collaboration with a credit counseling agency. The agency negotiates lower interest rates and fees with creditors, allowing the debtor to make affordable monthly payments. Debt management plans are ideal for individuals or businesses who can still make regular payments but need assistance with organizing their finances and reducing interest rates. In both types of agreements, debtors must adhere to the agreed-upon terms and make timely payments. Failure to comply with the terms may result in the agreement being terminated and legal actions may resume. It is important to note that Maricopa Arizona Debt Agreement may not be suitable for everyone, and the decision to enter into such an agreement should be made after careful consideration of individual financial circumstances. Seeking advice from a qualified attorney or credit counseling agency is recommended to ensure a comprehensive understanding of the options available and the potential consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de deuda - Debt Agreement

Description

How to fill out Maricopa Arizona Acuerdo De Deuda?

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occurrence. All files are grouped by state and area of use, so picking a copy like Maricopa Debt Agreement is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Maricopa Debt Agreement. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Debt Agreement in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!