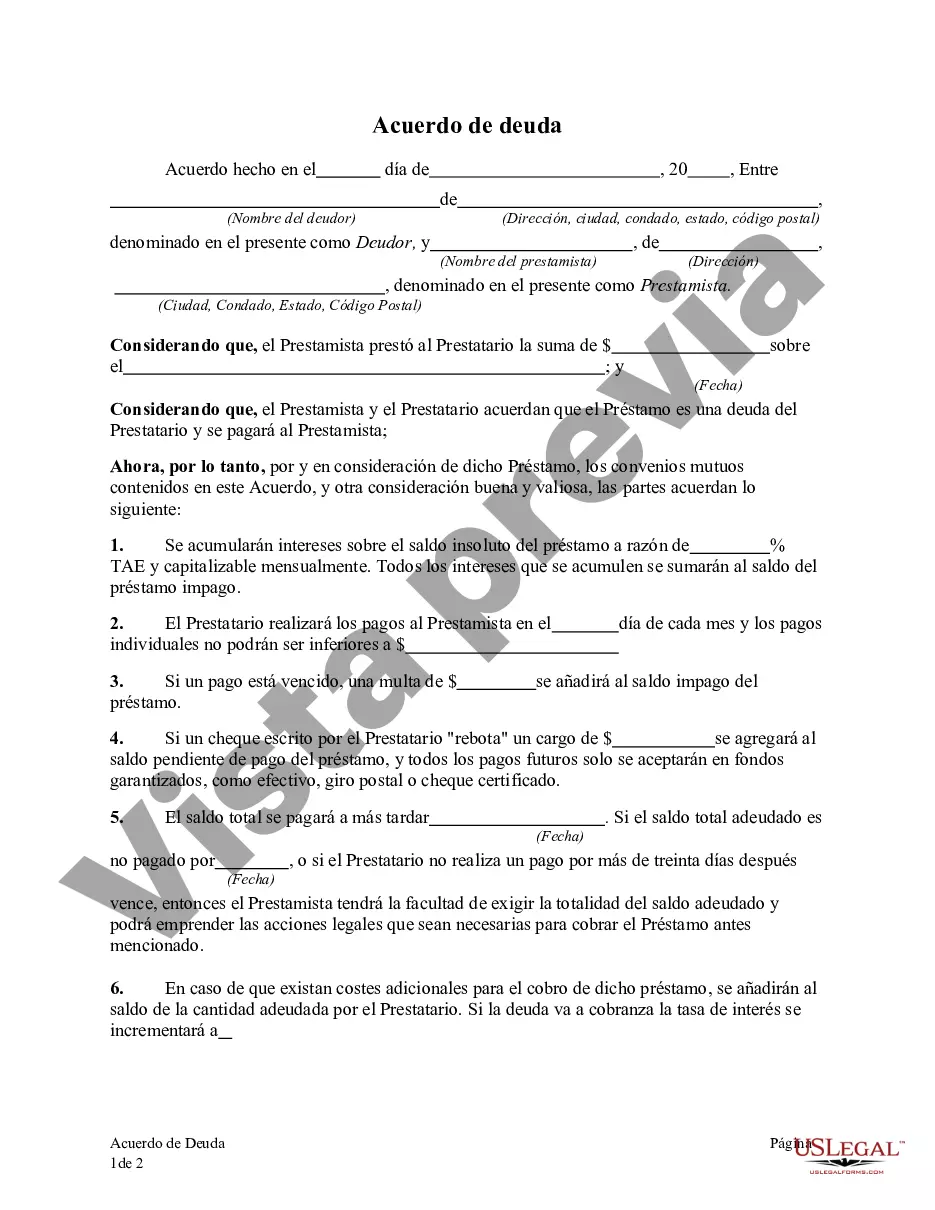

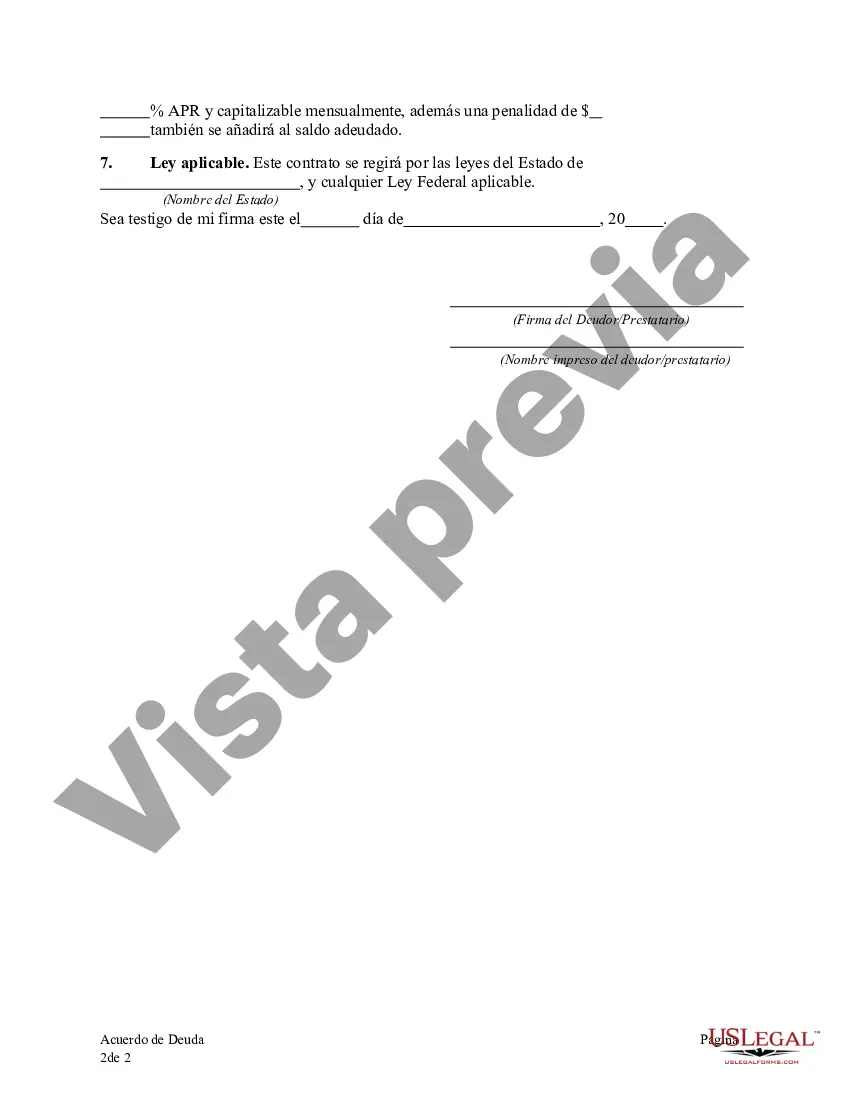

Suffolk New York Debt Agreement is a legally binding agreement made between a debtor and creditor in Suffolk County, New York, to resolve outstanding debts. It is designed to provide a structured repayment plan that allows individuals or businesses to pay off their debts over a specified period of time in a manageable and affordable manner. The Suffolk New York Debt Agreement is often pursued as an alternative to declaring bankruptcy, providing debtors with an opportunity to avoid severe financial consequences such as asset liquidation and credit score damage. Through negotiations between the debtor and creditor, a mutually acceptable agreement is reached, ensuring that both parties benefit from the arrangement. There are various types of Suffolk New York Debt Agreements, depending on the unique circumstances of the debtor and creditor: 1. Debt Settlement Agreement: This type of agreement involves negotiating a reduced lump-sum payment with the creditor, usually for a percentage of the total outstanding debt. In return for this payment, the creditor forgives the remaining balance, releasing the debtor from further obligations. 2. Debt Consolidation Agreement: This agreement allows multiple debts to be consolidated into a single loan or credit facility. By combining various debts, the debtor can simplify their repayment process and potentially secure lower interest rates or favorable repayment terms. 3. Debt Management Plan: Typically facilitated by credit counseling agencies, a debt management plan involves negotiating with creditors to establish a repayment plan that suits the debtor's financial situation. The agency acts as an intermediary, receiving agreed-upon payments from the debtor and distributing them to respective creditors. 4. Debt Restructuring Agreement: In situations where a debtor is facing significant financial hardship, a debt restructuring agreement enables the renegotiation of existing debt terms. This may involve lowering interest rates, extending repayment periods, or modifying other aspects of the original debt agreement to make it more manageable for the debtor. It is important to note that pursuing a Suffolk New York Debt Agreement should be done with careful consideration and evaluation of one's financial circumstances. Seeking professional advice from attorneys or credit counselors is recommended to ensure the most suitable debt resolution strategy is chosen, given the debtor's specific needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Acuerdo de deuda - Debt Agreement

Description

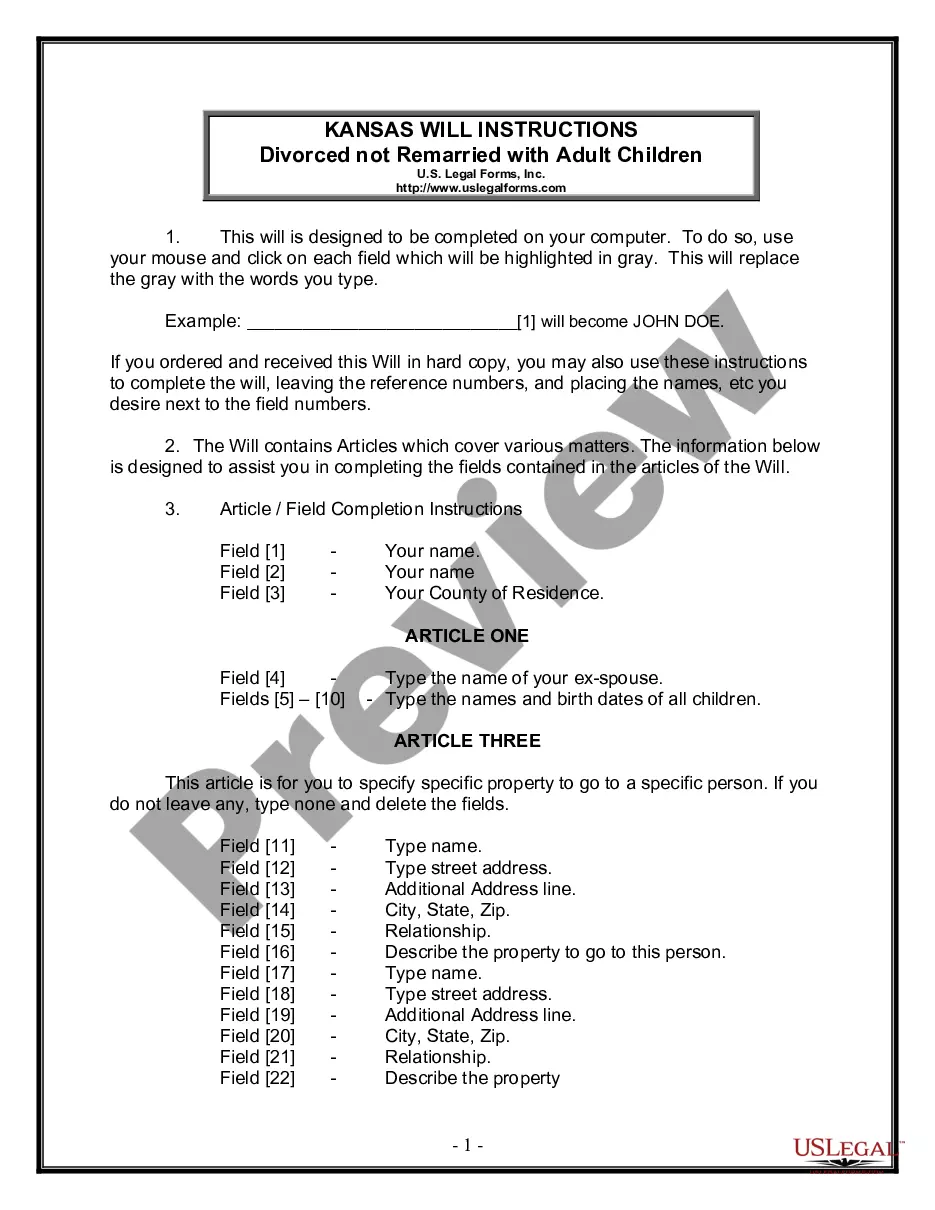

How to fill out Suffolk New York Acuerdo De Deuda?

If you need to get a trustworthy legal document supplier to find the Suffolk Debt Agreement, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of supporting resources, and dedicated support team make it easy to locate and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to search or browse Suffolk Debt Agreement, either by a keyword or by the state/county the document is intended for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Suffolk Debt Agreement template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less costly and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate agreement, or execute the Suffolk Debt Agreement - all from the convenience of your sofa.

Join US Legal Forms now!