Suffolk New York Investment Letter is a comprehensive and informative publication that focuses on providing detailed insight into Intrastate Offering opportunities for investors in Suffolk County, New York. This letter aims to educate readers about the various investment options available within the county and offer valuable advice on how to make the most of these opportunities. Intrastate Offering refers to the process of raising capital from investors residing within the same state where the issuer is located. It presents a unique avenue for businesses and entrepreneurs within Suffolk County to obtain funding without having to comply with certain federal securities regulations. By adhering to specific state-level guidelines, companies can issue securities to local investors, thereby enhancing economic growth, promoting job creation, and supporting local businesses. The Suffolk New York Investment Letter covers different types of Intrastate Offering in detail, providing in-depth analysis on each. Some specific types or categories of Intrastate Offerings that may be discussed include: 1. Equity-based Intrastate Offering: This type of offering involves companies issuing shares or equity stakes to local investors in exchange for their investment. The letter explores the benefits of equity investments, potential risks, and strategies for evaluating and selecting companies with strong growth potential. 2. Debt-based Intrastate Offering: This category focuses on businesses issuing debt securities, such as bonds or promissory notes, to local investors. The letter delves into the advantages of debt investments, including fixed income potential and risk mitigation strategies. 3. Real Estate Intrastate Offering: Real estate projects within Suffolk County often rely on Intrastate Offerings to secure funding. This section of the letter discusses the intricacies of investing in real estate through Intrastate Offerings, covering topics such as property types, potential returns, and associated risks. 4. Start-up Intrastate Offering: Start-up companies in Suffolk County can benefit greatly from Intrastate Offerings to obtain the necessary capital for growth. The letter provides guidance on evaluating start-up investment opportunities, understanding the unique challenges these ventures face, and assessing their potential for success. Each edition of the Suffolk New York Investment Letter provides readers with valuable insights, expert opinions, and the latest updates on Intrastate Offering regulations and trends within Suffolk County. It aims to equip investors with the knowledge and tools required to make informed decisions and capitalize on the investment opportunities available in their local community.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Carta de inversión con respecto a la oferta intraestatal - Investment Letter regarding Intrastate Offering

Description

How to fill out Suffolk New York Carta De Inversión Con Respecto A La Oferta Intraestatal?

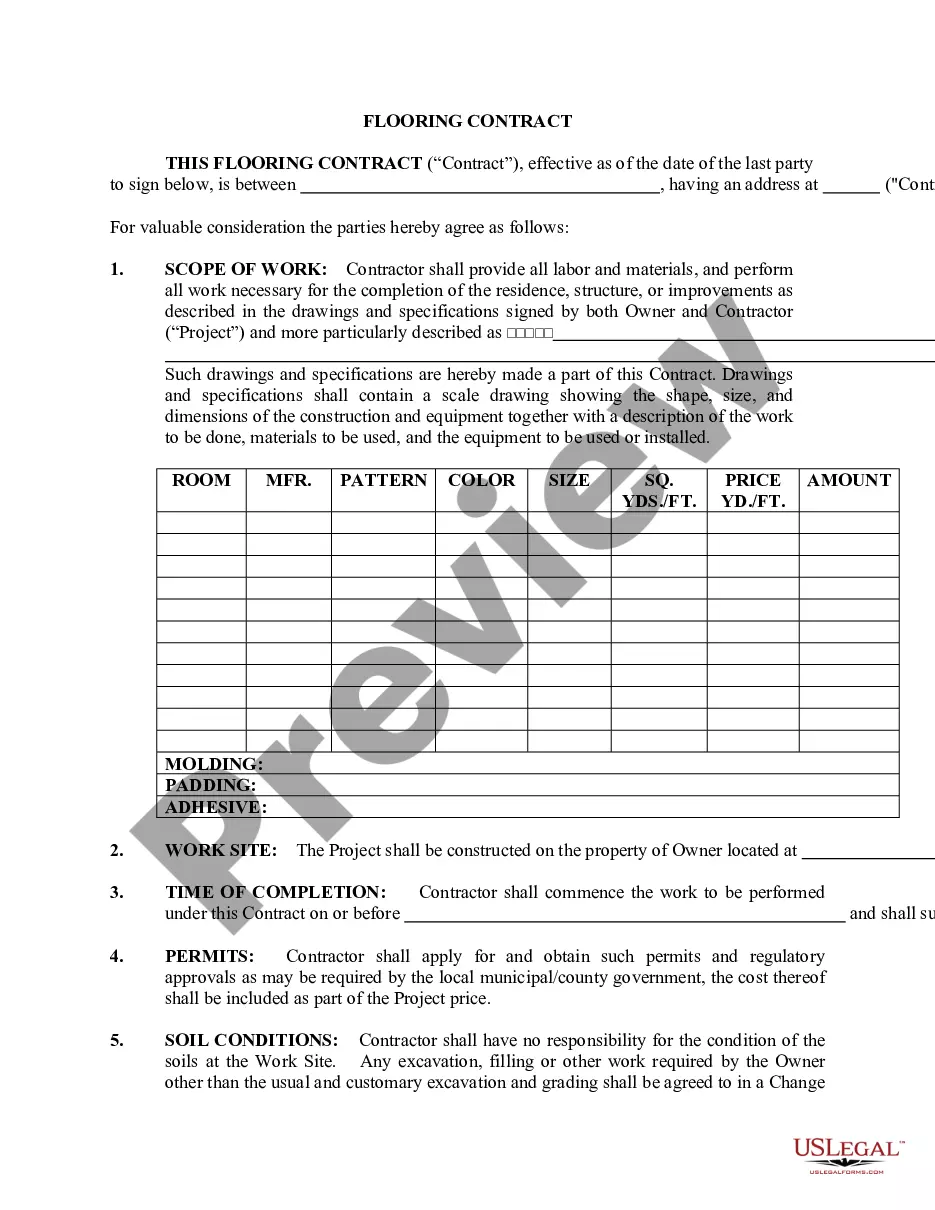

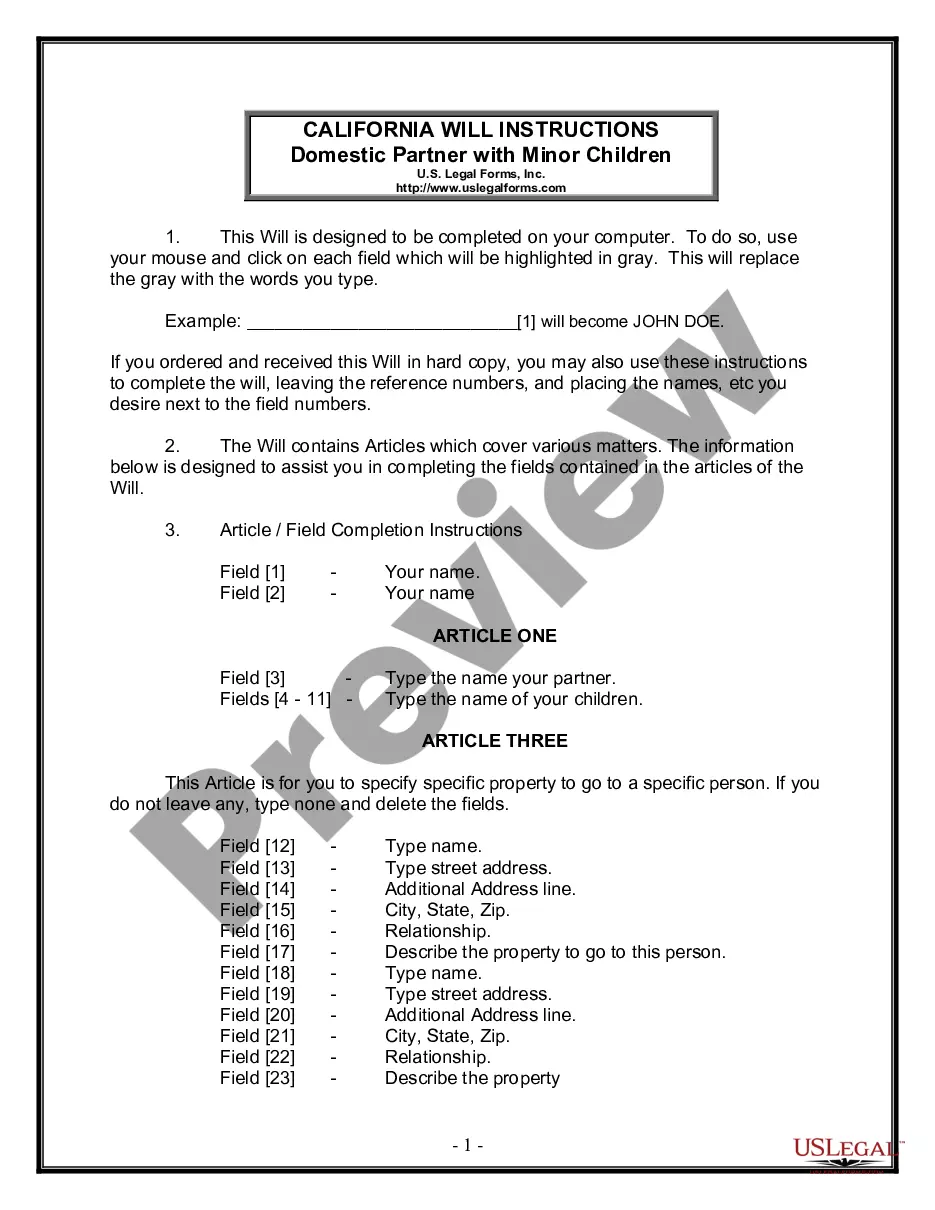

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Suffolk Investment Letter regarding Intrastate Offering is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Suffolk Investment Letter regarding Intrastate Offering. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Investment Letter regarding Intrastate Offering in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!