Tarrant Texas Investment Letter is an informative publication that provides detailed insights on Intrastate Offering opportunities in the investment market. This publication aims to educate potential investors about the various aspects of intrastate offerings, including their benefits, regulations, and risks involved. Intrastate offerings refer to investment opportunities that are limited to a specific state, allowing local businesses to raise funds from residents within that state. These offerings are governed by specific securities regulations imposed by state authorities, such as the Texas State Securities Board in the case of Tarrant Texas. Tarrant Texas Investment Letter offers in-depth analysis and research on different types of intrastate offerings available to investors. Some key types covered by this letter may include: 1. Equity-based intrastate offerings: These offerings involve buying shares or equity stakes in local businesses. Tarrant Texas Investment Letter provides comprehensive information on the potential returns, risks, and market trends related to such investments. 2. Debt-based intrastate offerings: This category includes investment opportunities in which local businesses borrow funds from investors and offer interest payments over a specific period. Tarrant Texas Investment Letter offers insights into the lending dynamics, creditworthiness of borrowers, and potential risks associated with these investments. 3. Real estate intrastate offerings: These offerings focus on investment opportunities in local real estate projects, such as residential or commercial properties. Tarrant Texas Investment Letter provides detailed analysis on the local real estate market, project viability, and potential returns for investors. 4. Renewable energy intrastate offerings: With the growing interest in green investments, Tarrant Texas Investment Letter may also cover intrastate offerings related to renewable energy projects, such as solar farms or wind energy installations. Investors can learn about the prospects of these projects and their contribution to sustainable development. By subscribing to Tarrant Texas Investment Letter, potential investors gain access to up-to-date information, research reports, expert opinions, and legal insights on intrastate offering opportunities specific to Texas. This publication helps investors make informed decisions by providing them with the necessary knowledge and understanding of the local investment landscape, enabling them to navigate the complexities associated with intrastate offerings effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Carta de inversión con respecto a la oferta intraestatal - Investment Letter regarding Intrastate Offering

Description

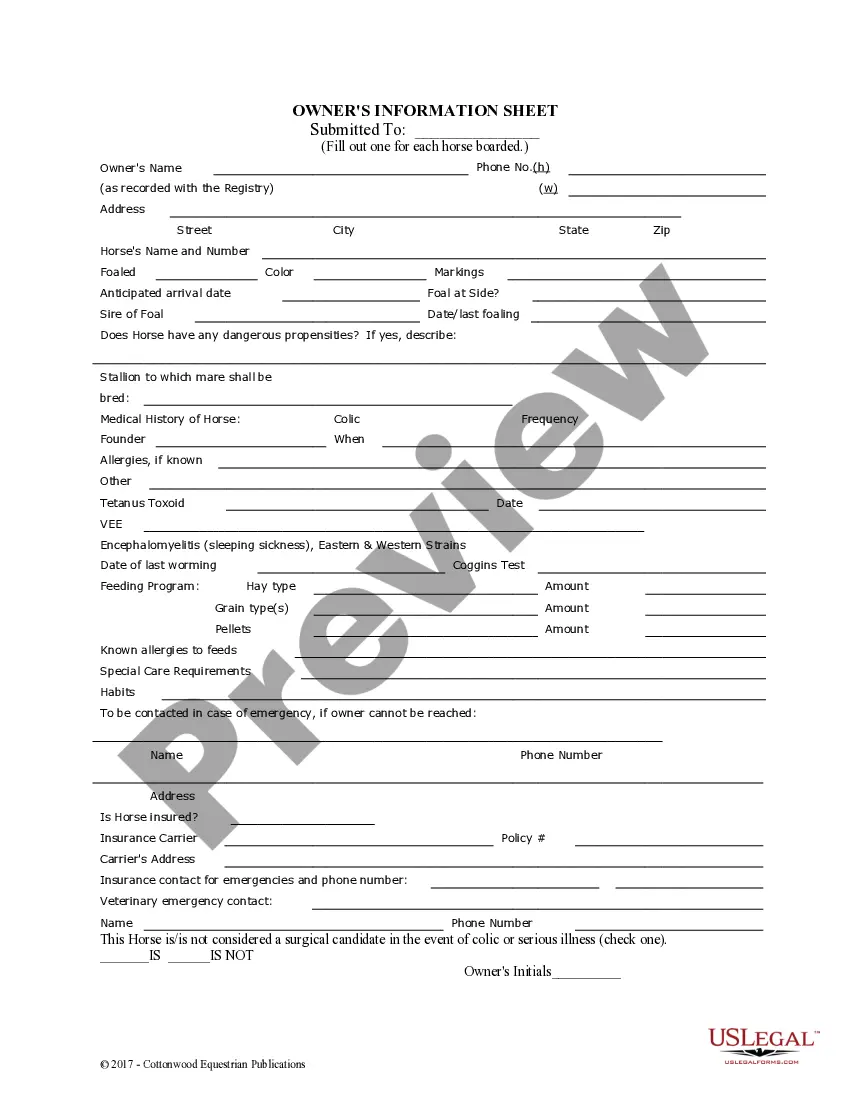

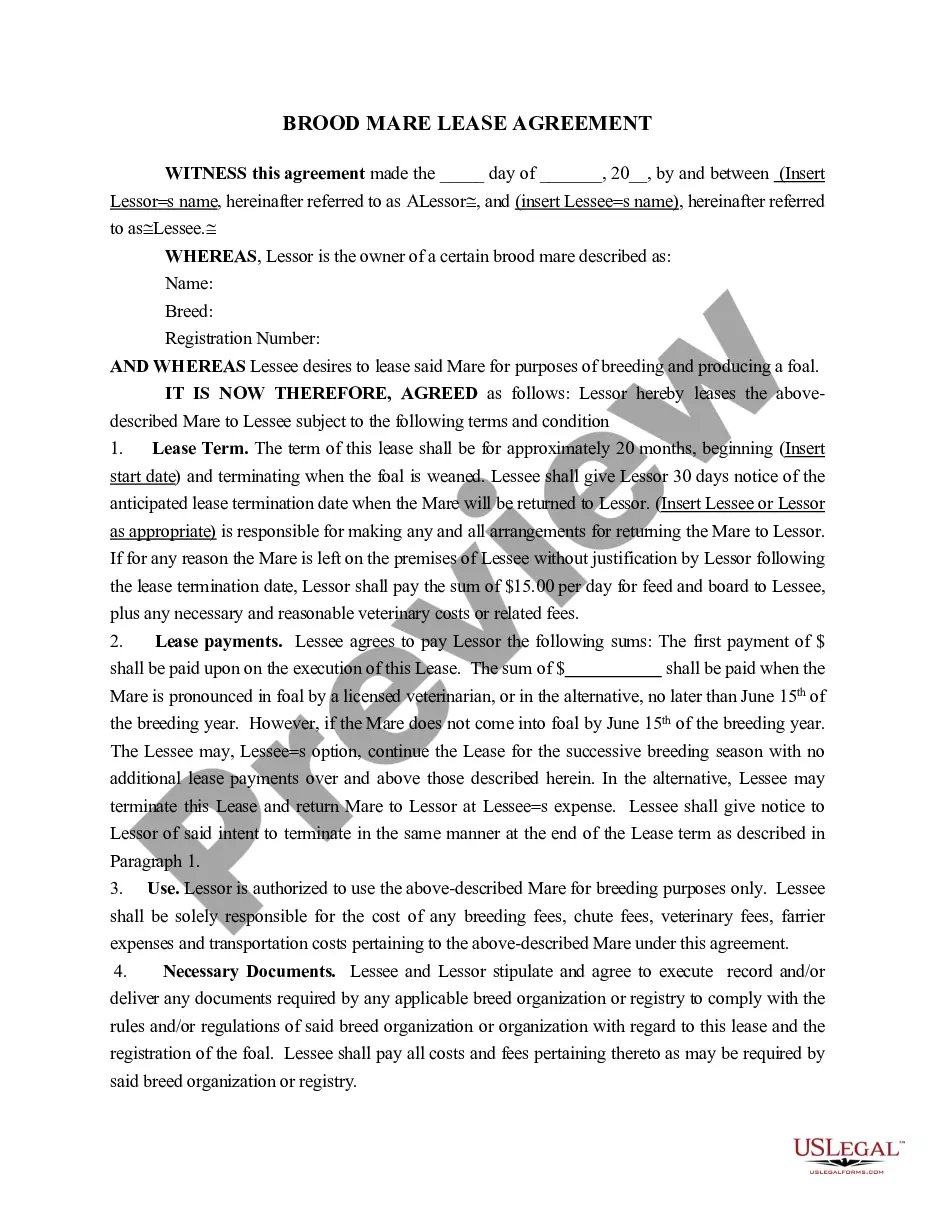

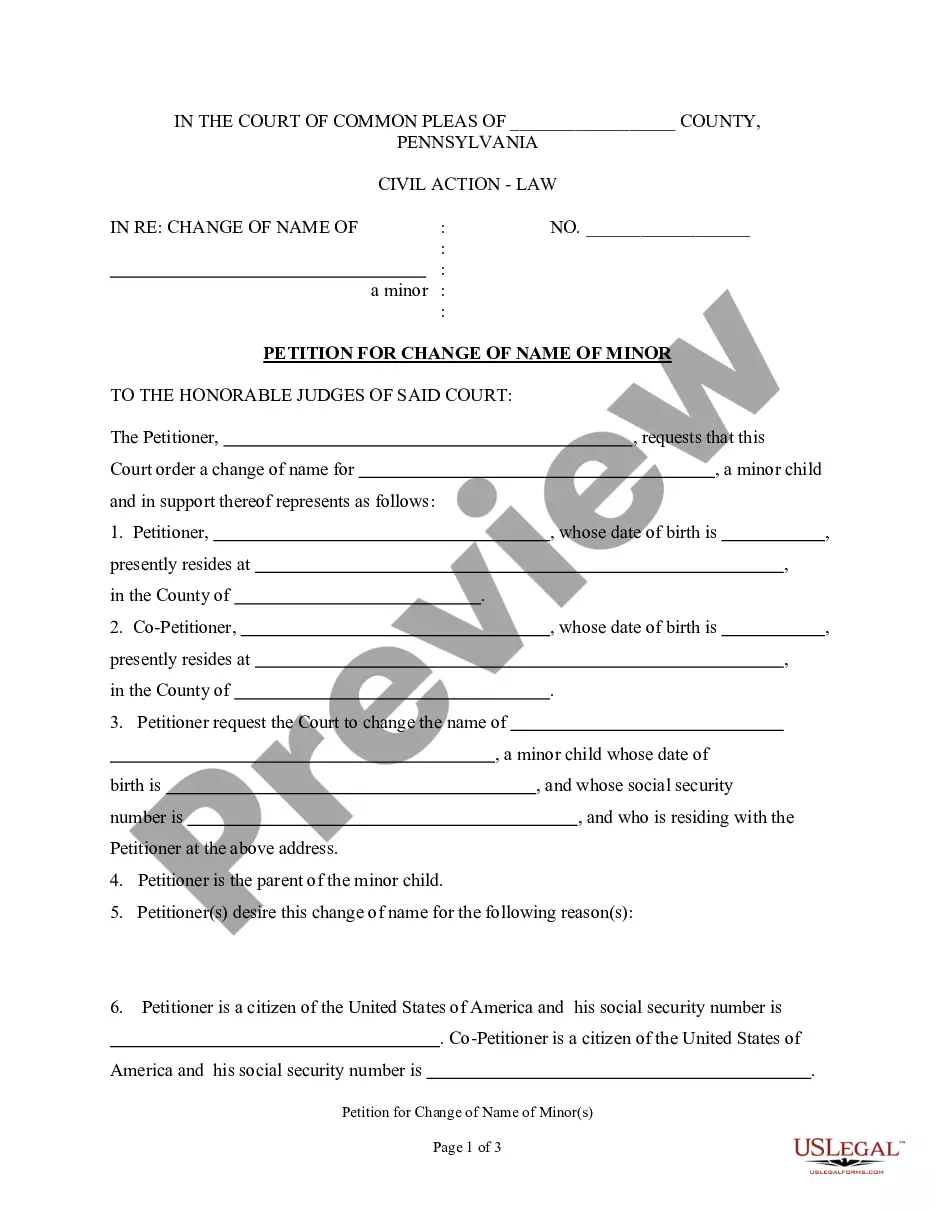

How to fill out Tarrant Texas Carta De Inversión Con Respecto A La Oferta Intraestatal?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Tarrant Investment Letter regarding Intrastate Offering is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Tarrant Investment Letter regarding Intrastate Offering. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Investment Letter regarding Intrastate Offering in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!