A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

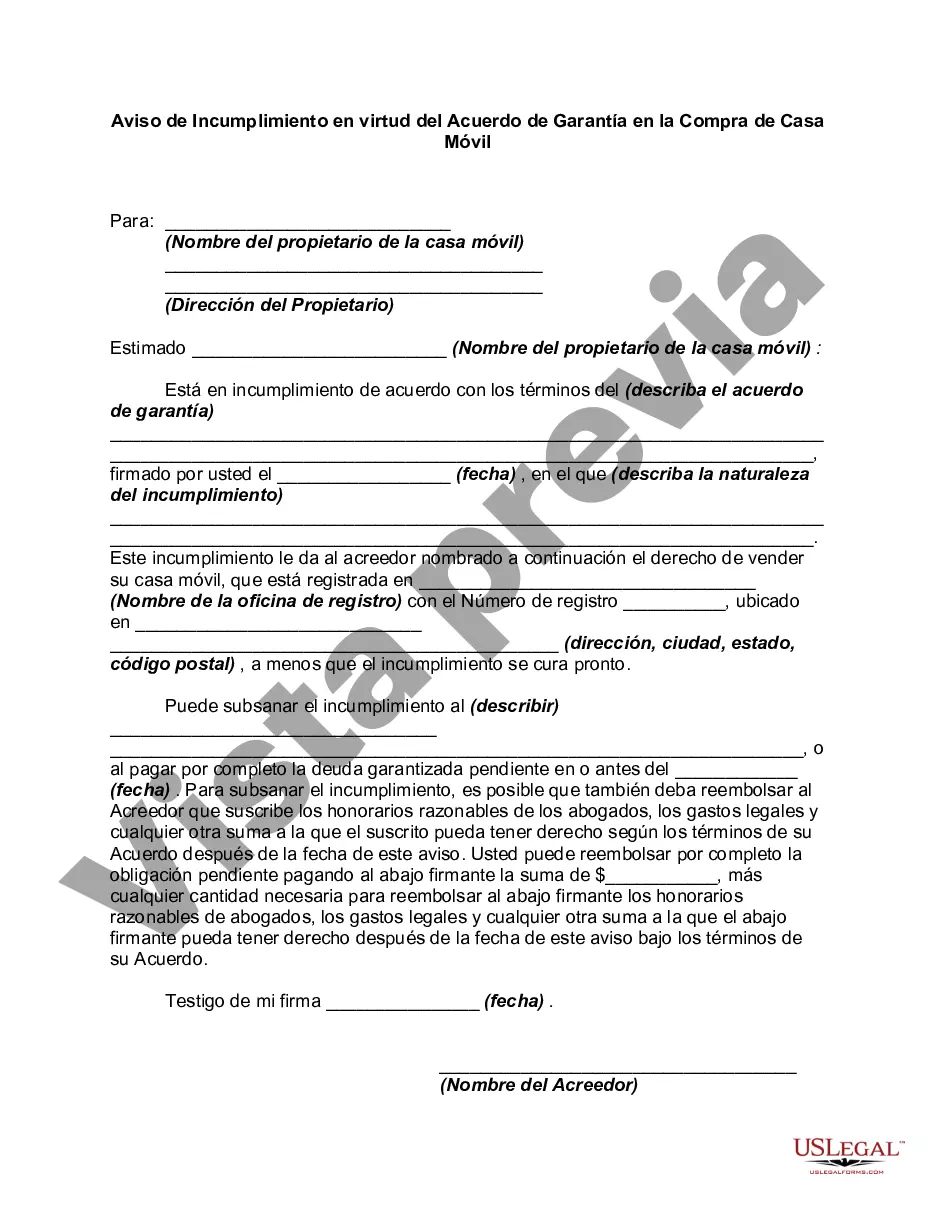

Clark Nevada Notice of Default under Security Agreement in Purchase of Mobile Home A Clark Nevada Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that serves as a formal notification to a mobile homeowner regarding their default on the terms outlined in a security agreement. This notice is typically sent by the lender or the party holding the security interest. The Notice of Default under Security Agreement is designed to inform the homeowner of their breach of contract and the specific violations they have committed. It outlines the remedies available to the lender and the steps that will be taken if the default is not remedied within a specified time frame. There may be different types of Clark Nevada Notice of Default under Security Agreement in Purchase of Mobile Home, depending on the nature of the default: 1. Payment Default: This type of default occurs when the homeowner fails to make the required mortgage payments within the agreed-upon timeframe. The Notice of Default under Security Agreement will detail the overdue amount, including any interest or penalties incurred. 2. Insurance Default: If the homeowner fails to maintain adequate insurance coverage on their mobile home, they may be in default. The notice will state the specific insurance requirements and the consequences of not meeting them. 3. Maintenance Default: In some cases, the security agreement may include provisions regarding the maintenance and condition of the mobile home. If the homeowner neglects to fulfill these obligations, they may receive a Notice of Default under Security Agreement outlining the required maintenance and repairs. 4. Unauthorized Alterations Default: Altering the mobile home without prior consent from the lender can result in a default. The notice will specify the unauthorized alterations that were made and the necessary corrective actions. Upon receiving the Notice of Default under Security Agreement, the homeowner is granted a certain period known as the "cure period" to rectify the default. This period allows the homeowner to pay the outstanding amount, provide proof of insurance coverage, perform required maintenance, or correct unauthorized alterations. Failure to cure the default within the given timeframe can lead to further legal actions, including foreclosure or repossession of the mobile home by the lender. In conclusion, a Clark Nevada Notice of Default under Security Agreement in Purchase of Mobile Home is a crucial legal document that protects the rights of lenders and outlines the breach of contract by the homeowner. It is essential for homeowners to promptly address the default to avoid potential adverse consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.