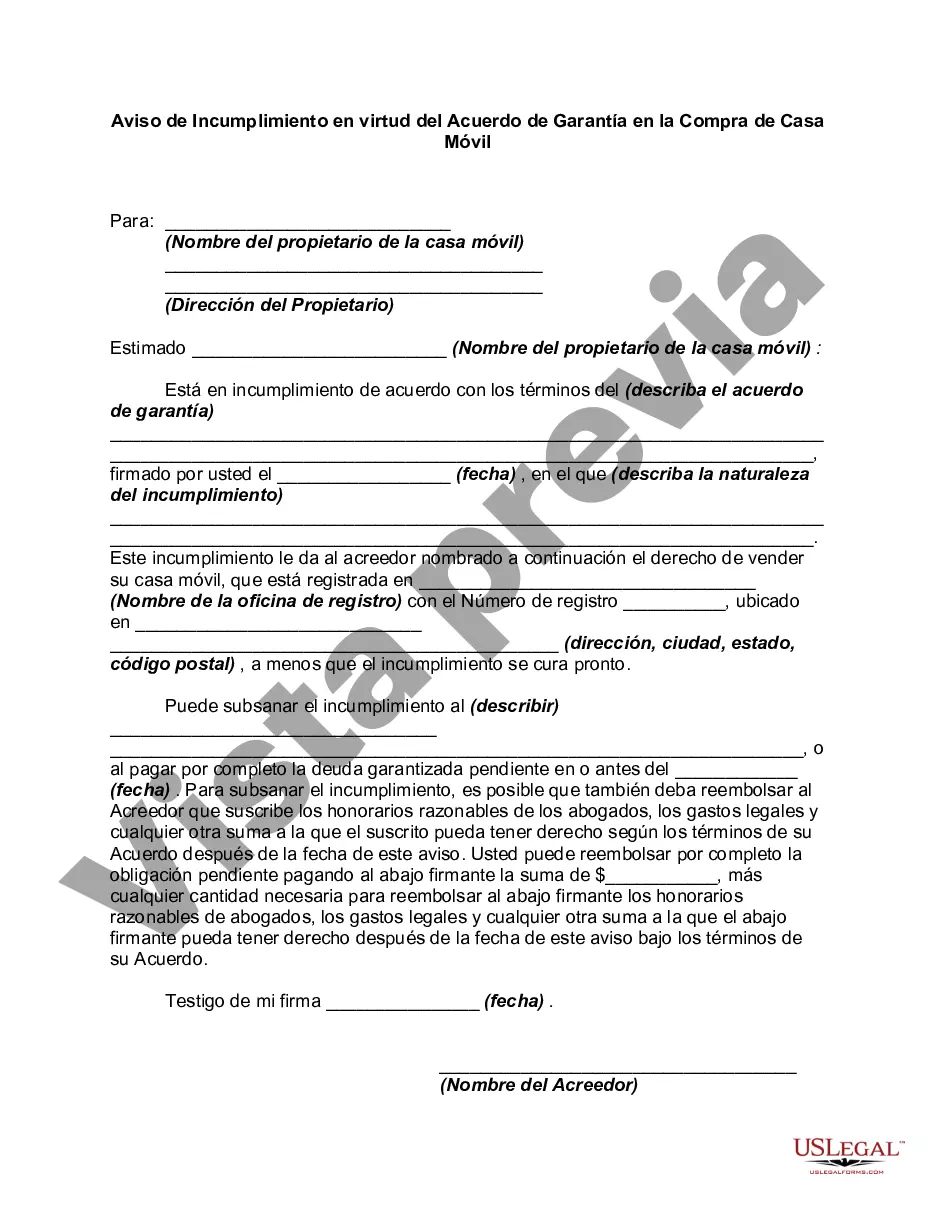

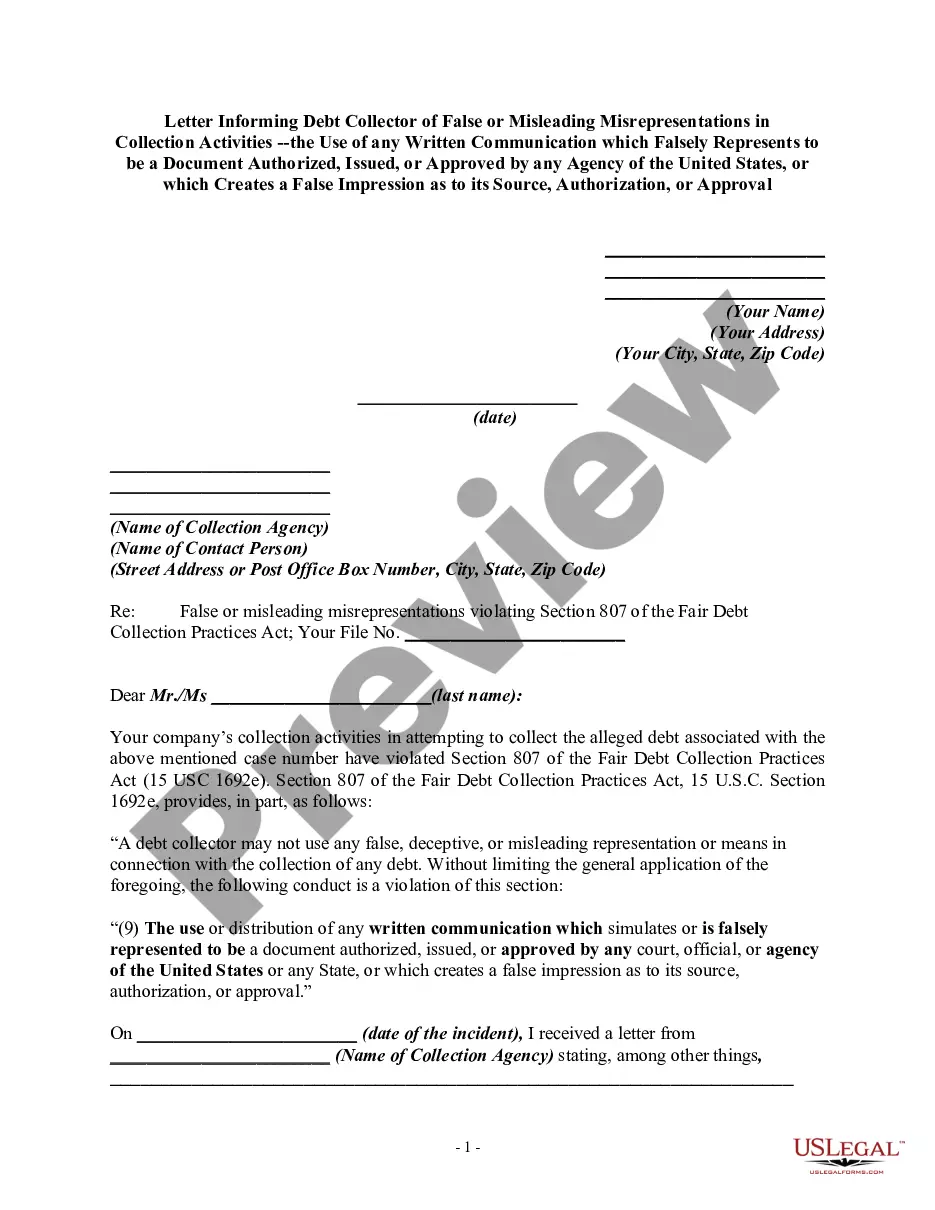

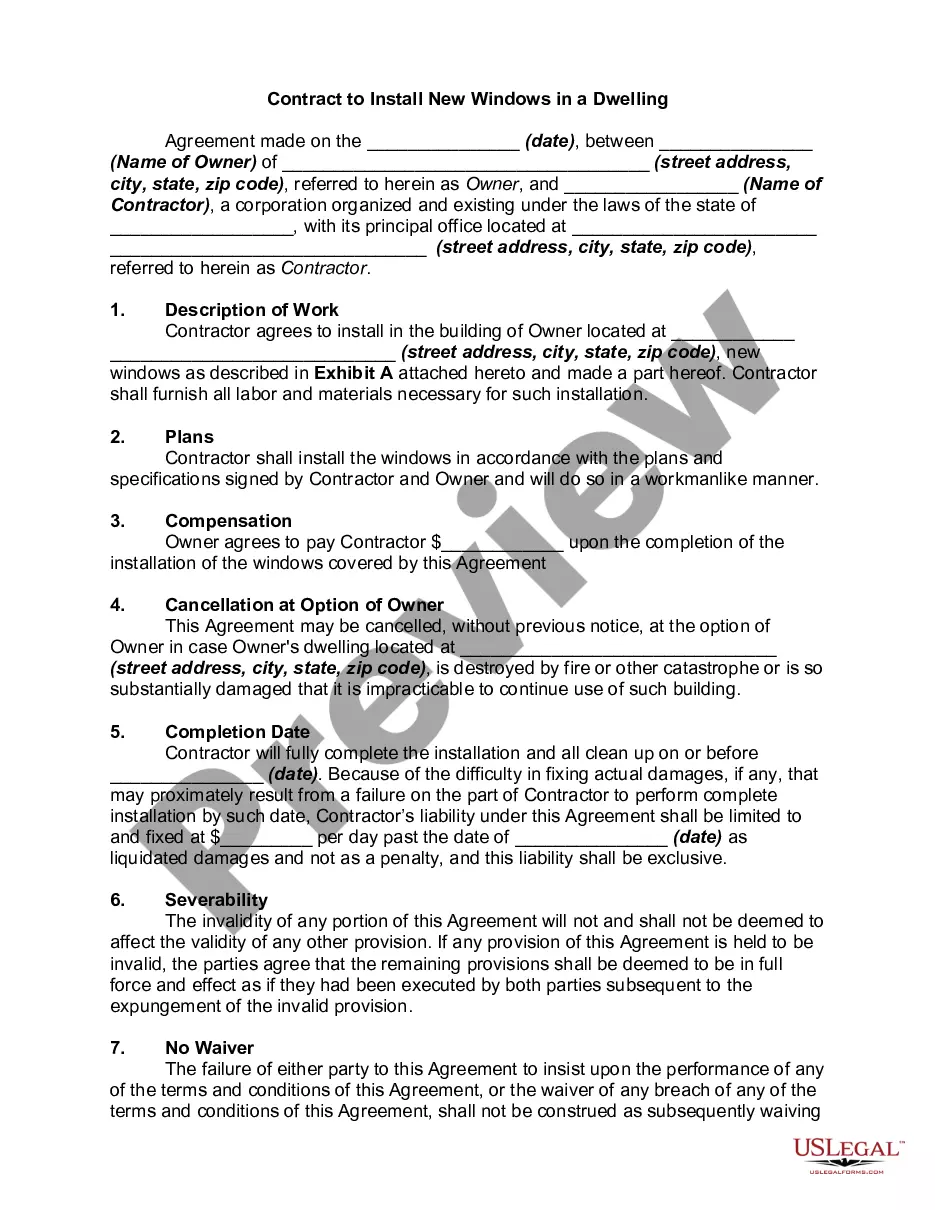

A Collin Texas Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that notifies borrowers of their default in making payments on the purchase of a mobile home, as stated in their security agreement. This notice serves as a formal communication from the lender to the borrower, emphasizing their default status and asserting their rights under the agreement. Keywords: Collin Texas, Notice of Default, Security Agreement, Purchase, Mobile Home. There are different types of Collin Texas Notice of Default under Security Agreement in Purchase of Mobile Home based on the specific circumstances involved: 1. Pre-open Notice of Default: This type of notice is typically sent prior to the creation of a lien on the mobile home. It serves as a warning to the borrower of their impending default and provides an opportunity to rectify the situation before legal action is taken. 2. Formal Notice of Default: This notice is issued when the borrower has already defaulted on their payment obligations as per the security agreement. It emphasizes the need for immediate action to remedy the default and prevent further legal consequences. 3. Notice of Default Cure: In the event that the borrower demonstrates a willingness to address their default, this notice provides them an opportunity to cure the default by making the necessary payments within a specified timeframe. By doing so, they can avoid further legal proceedings and potential repossession of the mobile home. 4. Notice of Default Acceleration: If the borrower fails to cure their default within the allowed time frame, this notice is sent to accelerate the repayment of the total outstanding balance. It highlights the lender's intention to enforce the security agreement and potentially take legal action to recover the debt. 5. Notice of Default Consequences: This notice outlines the potential consequences that the borrower might face if they fail to remediate their default. These consequences may include repossession of the mobile home, damage to their credit score, and potential legal actions initiated by the lender. 6. Notice of Default Sale: If the borrower fails to cure their default within the specified time frame, the lender may proceed with a sale of the mobile home. This notice provides information on the date, time, and location of the sale, allowing the borrower an opportunity to redeem the mobile home before its auction. In conclusion, a Collin Texas Notice of Default under Security Agreement in Purchase of Mobile Home is a crucial legal document that safeguards the rights of lenders while informing borrowers of their default status. Understanding the various types of notices associated with default helps both parties navigate the process effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Collin Texas Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Collin Notice of Default under Security Agreement in Purchase of Mobile Home, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Collin Notice of Default under Security Agreement in Purchase of Mobile Home from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Collin Notice of Default under Security Agreement in Purchase of Mobile Home:

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!