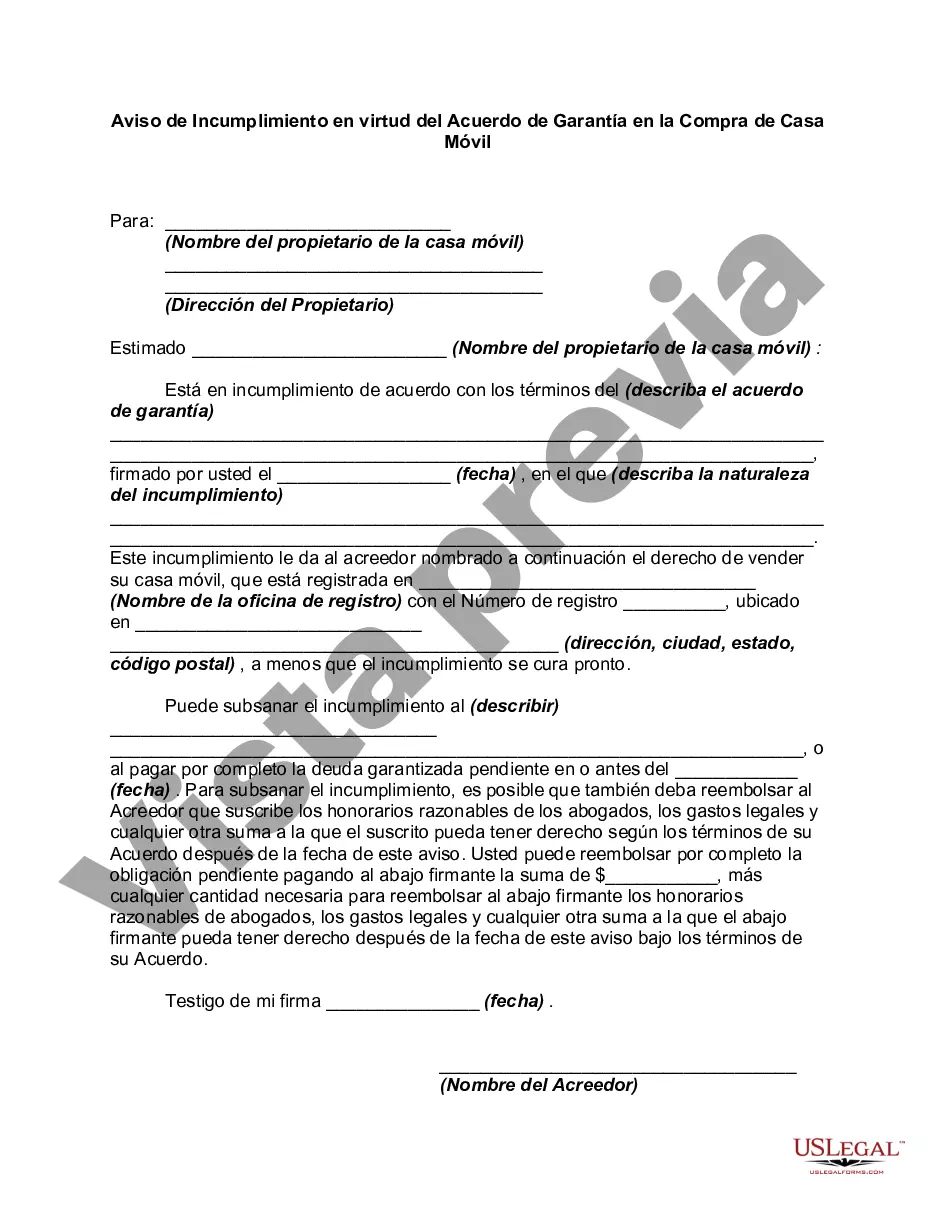

Cuyahoga Ohio Notice of Default under Security Agreement in Purchase of Mobile Home A Notice of Default under Security Agreement in Purchase of Mobile Home is an essential legal document that notifies a borrower or buyer of a mobile home, known as the "debtor," that they have failed to meet their financial obligations outlined in the security agreement. In Cuyahoga County, Ohio, this notice serves as a crucial step in the foreclosure process for mobile homes purchased with a loan or financed through a security agreement. A Notice of Default under Security Agreement initiates the procedure to repossess the mobile home due to the debtor's failure to make timely loan payments, comply with the terms of the security agreement, or uphold other contractual obligations. The document outlines the specific reasons for default and highlights the actions required of the debtor to rectify the situation. In Cuyahoga County, Ohio, the default notice may apply to various types of security agreements in the purchase of mobile homes, including: 1. Installment Sale Contracts: This type of default notice is issued when a buyer has entered into an installment sale agreement for the purchase of a mobile home. It notifies the debtor of their failure to make the required payments according to the agreed-upon terms. 2. Chattel Mortgages: A Chattel Mortgage is a security agreement that pledges the mobile home as collateral for a loan. If the debtor defaults on their mortgage payments, the lender may issue a Notice of Default to protect their rights and initiate the foreclosure process. 3. Lease Agreements with Option to Purchase: In cases where a mobile home is obtained through a lease agreement with an option to purchase, a Notice of Default may be served if the lessee fails to fulfill their payment obligations or breaches other terms of the agreement. Regardless of the specific type of Notice of Default under Security Agreement in Purchase of Mobile Home, there are crucial elements that should be included: 1. Identification and contact information of the debtor and creditor. 2. Description of the mobile home, including its make, model, identification numbers (such as the vehicle identification number (VIN)), and location. 3. Details of the defaulted obligations, such as missed payments, violation of specific terms, or failure to maintain insurance. 4. A deadline for the debtor to cure the default by making the required payments or taking corrective actions. 5. Consequences of not resolving the default within the stated timeframe, including potential repossession and legal actions taken by the creditor. It is important to note that the specific requirements and procedures for a Notice of Default under Security Agreement in Purchase of Mobile Home in Cuyahoga County, Ohio may vary. Therefore, it is advisable for debtors and creditors to consult legal professionals experienced in Ohio law to ensure adherence to the appropriate processes and legal obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Cuyahoga Ohio Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Cuyahoga Notice of Default under Security Agreement in Purchase of Mobile Home, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Cuyahoga Notice of Default under Security Agreement in Purchase of Mobile Home, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Notice of Default under Security Agreement in Purchase of Mobile Home:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Cuyahoga Notice of Default under Security Agreement in Purchase of Mobile Home and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!