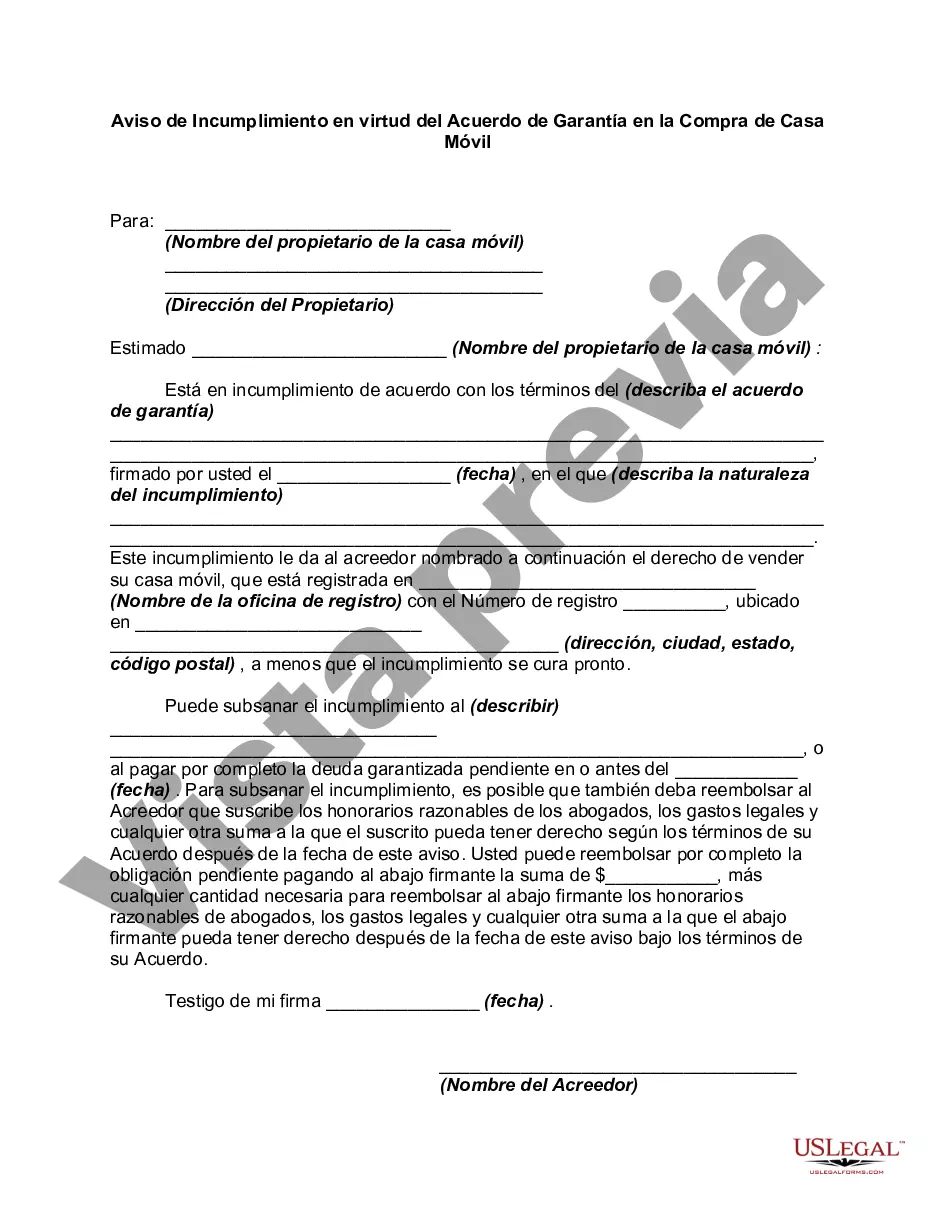

Fairfax Virginia Notice of Default under Security Agreement in Purchase of Mobile Home is an essential legal document that outlines the rights and responsibilities of both the buyer and the seller in the event of default or non-payment. This notice is specific to the state of Virginia, particularly the Fairfax County area, and covers situations where a mobile home has been purchased using a security agreement. A Notice of Default serves as a warning to the defaulting party and informs them of the imminent consequences for failing to meet their financial obligations under the security agreement. It clearly outlines the terms of the agreement, including the payment terms, consequences of default, and steps that may be taken by the seller to rectify the situation. Under Virginia law, there are primarily two types of Fairfax Virginia Notice of Default under Security Agreement in Purchase of Mobile Home: 1. Prepossession Notice of Default: This type of notice is issued to the buyer when they have missed one or more payments on their mobile home purchase. It serves as an official communication, notifying the buyer that they are in default and that they must cure the default within a specific period, typically 30 days, to avoid further legal consequences. 2. Post-Repossession Notice of Default: If the buyer fails to cure the default within the specified timeframe, the seller may initiate repossession proceedings. Once the mobile home is repossessed, the seller is required to provide the buyer with a Post-Repossession Notice of Default. This notice includes details of the repossession, including the outstanding balance, cost of repossession, and the timeframe within which the buyer has to reclaim the mobile home by making the outstanding payments. It is important to note that the specific details and requirements of the Fairfax Virginia Notice of Default under Security Agreement in Purchase of Mobile Home may vary depending on the terms agreed upon in the purchase agreement and the specific jurisdiction within Fairfax County. Therefore, it is crucial to consult an attorney or legal professional to ensure compliance with local laws and regulations. In conclusion, the Fairfax Virginia Notice of Default under Security Agreement in Purchase of Mobile Home is a critical document that protects the rights of both buyers and sellers in mobile home purchase transactions. It serves as an official notification to the buyer outlining the consequences of default and provides an opportunity to rectify the situation before repossession proceedings are initiated.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Fairfax Virginia Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Fairfax Notice of Default under Security Agreement in Purchase of Mobile Home, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Fairfax Notice of Default under Security Agreement in Purchase of Mobile Home from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Fairfax Notice of Default under Security Agreement in Purchase of Mobile Home:

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!