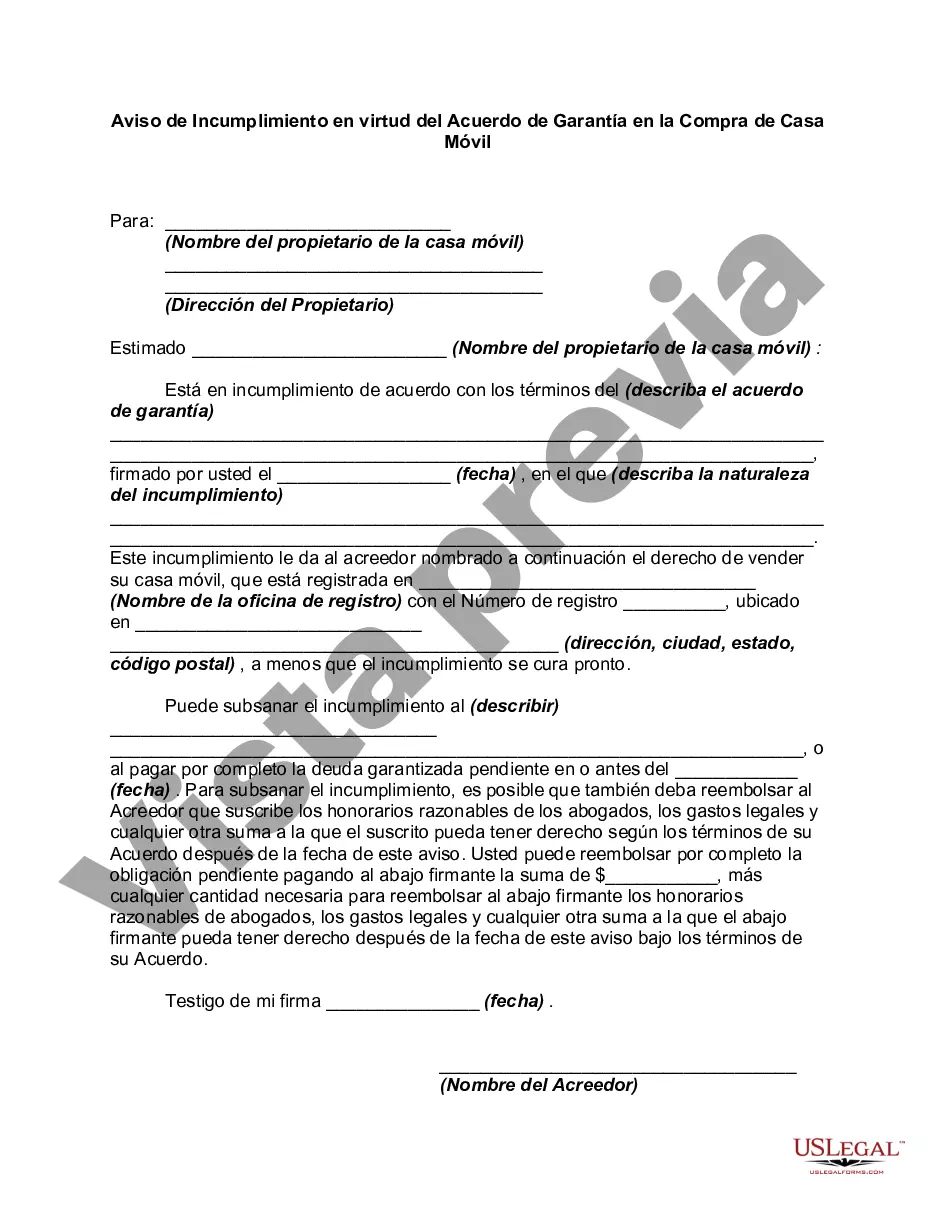

Harris Texas Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that serves as a formal notice to borrowers who have defaulted on their mobile home purchase agreement in Harris County, Texas. This notice is typically issued by the lender or the financing company involved in the transaction. The purpose of this notice is to inform the borrower that they have failed to meet their obligations under the security agreement, which includes the timely payment of installments, insurance premiums, property taxes, and any other related fees or charges. It outlines the specific terms and conditions of the default and highlights the actions that will be taken in response to the borrower's failure to comply. Keywords: Harris Texas, Notice of Default, Security Agreement, Purchase of Mobile Home, legal document, formal notice, defaulted, mobile home purchase agreement, Harris County, Texas, lender, financing company, obligations, installments, insurance premiums, property taxes, fees, charges, terms and conditions, actions. Different types of Harris Texas Notice of Default under Security Agreement in the Purchase of Mobile Home can include: 1. Initial Notice of Default: This is the first notice sent to the borrower when they default on their payments or fail to comply with the terms of the security agreement. It outlines the specific reasons for the default, the required actions to rectify the situation, and the consequences if the borrower fails to take appropriate measures within a specified timeframe. 2. Final Notice of Default: If the borrower fails to rectify the default despite receiving the initial notice, a final notice of default may be issued. This notice reiterates the consequences of non-compliance and provides the borrower with a final opportunity to bring their payments up to date or resolve any outstanding issues before more severe actions are taken. 3. Notice of Foreclosure: If the borrower does not resolve the default or meet the terms outlined in the initial and final notices, the lender may proceed with the foreclosure process. This notice informs the borrower that the lender intends to sell the mobile home in order to recover the outstanding debt, and provides information regarding the time and place of the foreclosure sale. 4. Reinstatement Notice: In some cases, a borrower may be given the opportunity to reinstate the loan by bringing all overdue payments and charges up to date. This notice outlines the specific conditions and requirements for loan reinstatement, including the deadline by which the borrower must comply to avoid further legal consequences. 5. Notice of Cure: If the borrower can resolve the default by making the necessary payments or rectifying the breach of contract, this notice confirms that the default has been cured and the loan is back in good standing. It may include specific provisions related to future compliance and potential consequences if the borrower defaults again. Note: The specific types and names of the notices mentioned above may vary depending on the lender or financing company and the terms outlined in the security agreement. It is essential to consult the relevant documentation for accurate information on the notices of default in a specific transaction involving Harris Texas and the purchase of a mobile home.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Harris Texas Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Harris Notice of Default under Security Agreement in Purchase of Mobile Home, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with document execution simple.

Here's how you can find and download Harris Notice of Default under Security Agreement in Purchase of Mobile Home.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Check the similar document templates or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Harris Notice of Default under Security Agreement in Purchase of Mobile Home.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Harris Notice of Default under Security Agreement in Purchase of Mobile Home, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional completely. If you have to cope with an extremely difficult situation, we advise getting a lawyer to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!