A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

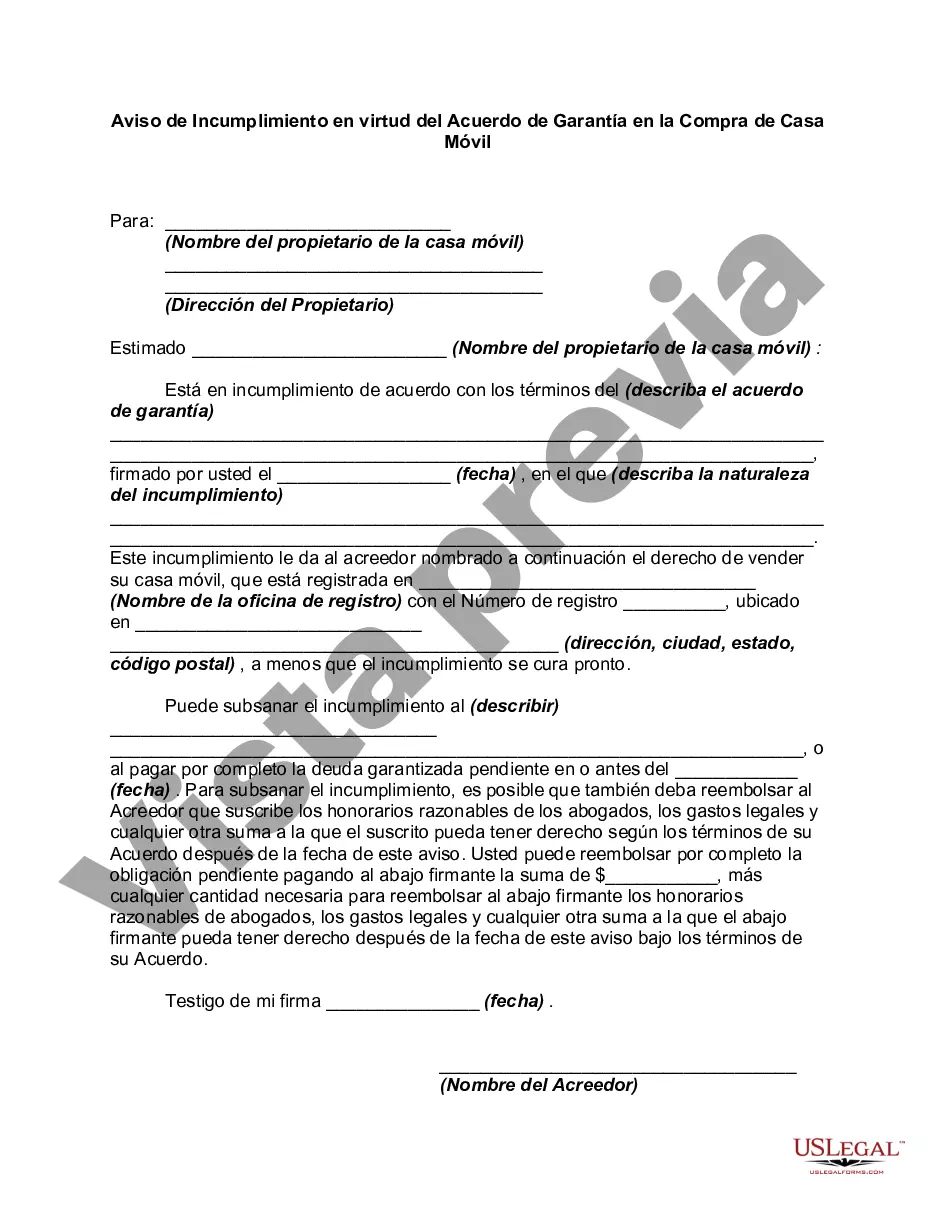

King Washington Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that serves as a notification to the borrower that they have defaulted on their loan agreements related to a mobile home purchase. This notice highlights the lender's intent to exercise their rights and remedies as outlined in the security agreement. The King Washington Notice of Default is a critical step in the foreclosure process, allowing the lender to initiate legal proceedings to recover their investment. When it comes to different types of King Washington Notice of Default under Security Agreement in Purchase of Mobile Home, there are primarily two main categories: 1. Pre-Foreclosure Notice of Default: This type of notice is given when a borrower misses consecutive loan payments or violates specific terms stated in the security agreement. The Pre-Foreclosure Notice of Default serves as an opportunity for the borrower to rectify their default by paying the overdue amount along with any applicable penalties or charges within a particular grace period. Failure to comply may result in further legal action, including the initiation of foreclosure proceedings. 2. Foreclosure Notice of Default: If the borrower fails to cure the default within the grace period provided in the Pre-Foreclosure Notice of Default, the lender may proceed with initiating foreclosure on the mobile home. The Foreclosure Notice of Default specifies the lender's intent to sell the property at a public auction to recover the outstanding loan amount, along with any associated fees and charges. It outlines the necessary steps, timelines, and instructions for the borrower to request a meeting or respond to the notice, providing them with a final opportunity to address the default before the foreclosure process advances. In summary, the King Washington Notice of Default under Security Agreement in Purchase of Mobile Home is a crucial legal document that notifies the borrower of their default on loan agreements related to a mobile home purchase. It lays out the lender's intention to enforce the security agreement, giving the borrower an opportunity to cure the default or face potential foreclosure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.