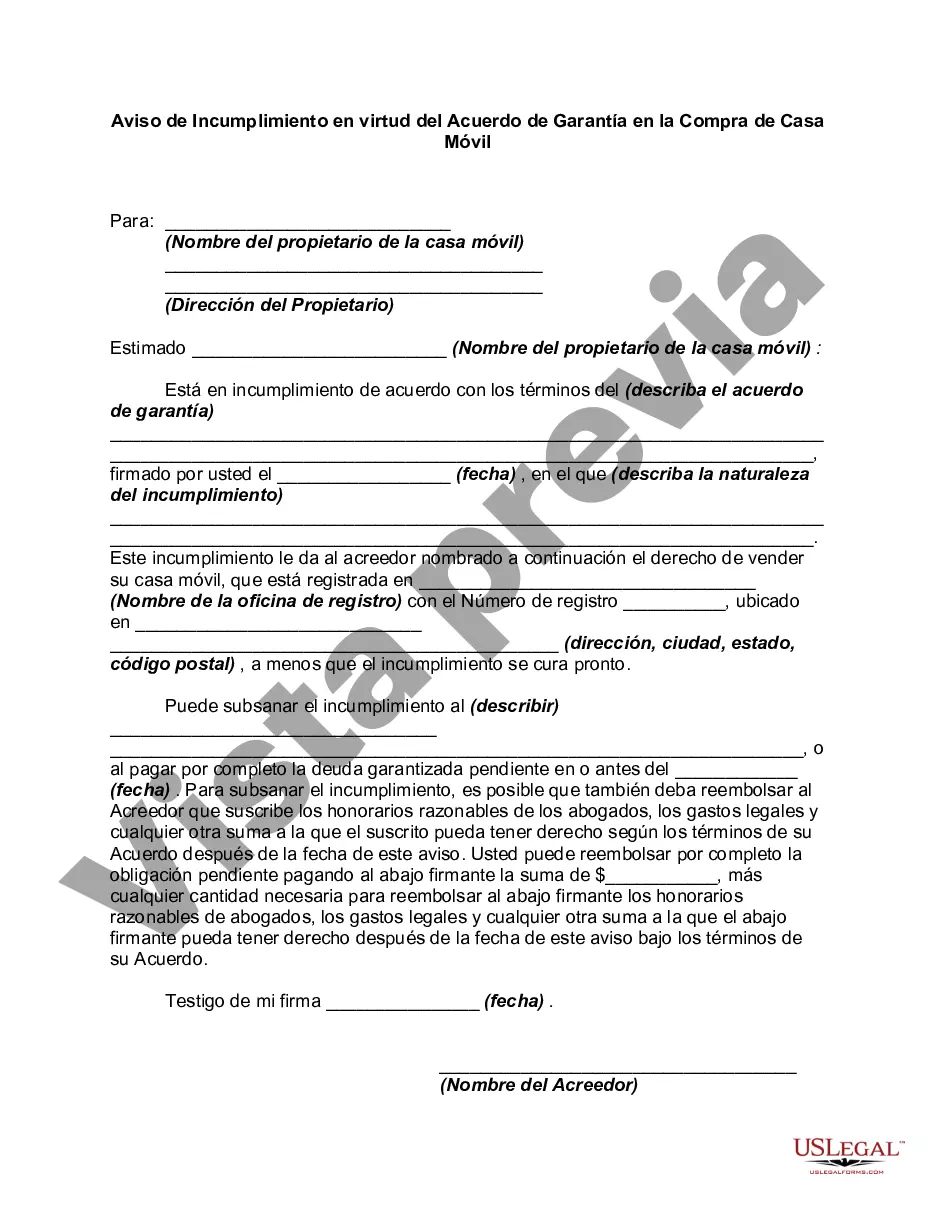

Los Angeles California Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that outlines the default and enforcement provisions in the event of non-payment or breach of a security agreement related to the purchase of a mobile home in Los Angeles, California. The Notice of Default serves as a formal communication from the lender to the borrower, notifying them of their default status and potential consequences. It typically includes details such as the borrower's name and address, the lender's name and address, the date of the agreement, and a description of the mobile home. In Los Angeles, California, there are various types of Notice of Default under Security Agreement in Purchase of Mobile Home, including: 1. Judicial Notice of Default: This type of notice is issued when the lender initiates a legal action or foreclosure proceeding through the court system. The process includes serving the Notice of Default to the borrower and filing a lawsuit if the default is not cured within a specified timeline. 2. Non-judicial Notice of Default: This is the most common type of notice used in California, including Los Angeles. It is a pre-foreclosure notice given to the borrower when they are in default on their loan. It does not involve court proceedings, but it is a mandatory step in the foreclosure process. 3. Intent to Cure Notice: This type of notice is sent to the borrower after a Notice of Default has been issued, providing them with an opportunity to cure the default by paying the overdue amounts within a specific timeframe. It outlines the required payment amount, due date, and the consequences of failing to cure the default. 4. Notice of Sale: If the borrower fails to cure the default as specified in the previous notices, the lender can proceed with the sale of the mobile home through a public auction. The Notice of Sale informs the borrower and the public about the upcoming auction, specifying the date, time, and location. It is essential to consult legal professionals or specialists in mobile home transactions to ensure compliance with all legal requirements when dealing with a Notice of Default under Security Agreement in Purchase of Mobile Home in Los Angeles, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Los Angeles California Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Los Angeles Notice of Default under Security Agreement in Purchase of Mobile Home is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to get the Los Angeles Notice of Default under Security Agreement in Purchase of Mobile Home. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Notice of Default under Security Agreement in Purchase of Mobile Home in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!