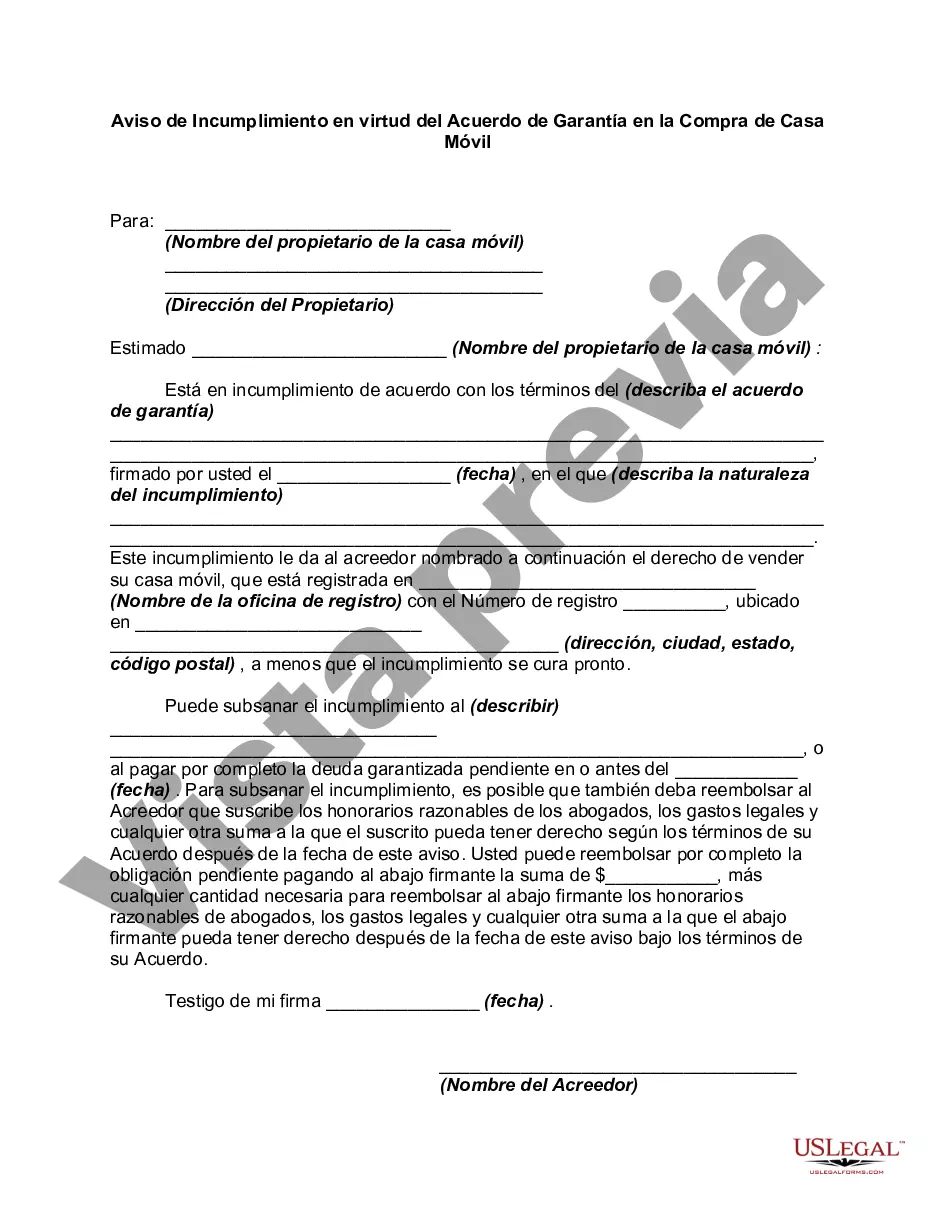

Miami-Dade County, located in southeastern Florida, is known for its vibrant culture, stunning beaches, and thriving real estate market. However, in certain instances, situations may arise where a Notice of Default under Security Agreement in the purchase of a mobile home becomes necessary. This legal document informs the mobile homeowner that they have defaulted on their loan or failed to meet their contractual obligations. It serves as a warning that if the payments are not rectified within a specific timeframe, serious consequences may follow. The Miami-Dade Florida Notice of Default under Security Agreement in the Purchase of a Mobile Home is a vital part of the foreclosure process. When an individual borrows funds to buy a mobile home in Miami-Dade County, they often enter into a security agreement with the lender. This agreement grants the lender certain rights to the property as security for the loan. If the borrower fails to make the required payments or violates other terms of the agreement, the lender has the authority to initiate the default process. Typically, there are two types of Miami-Dade Florida Notices of Default under Security Agreement in the Purchase of a Mobile Home: 1. Pre-Foreclosure Notice of Default: This notice is issued when the borrower defaults on their loan payments. It officially informs the borrower of the breach and allows them a specific period, usually 30 days, to rectify the default by making the outstanding payments. Failure to do so within the given timeframe can lead to further legal action. 2. Post-Foreclosure Notice of Default: If the borrower fails to cure the default within the specified period mentioned in the pre-foreclosure notice, the lender can proceed with the next stage — post-foreclosure. In this case, the lender typically serves a Notice of Default under Security Agreement in the Purchase of a Mobile Home, which informs the borrower that the lender is taking actions to reclaim the property. This notice includes information about the sale or auction of the mobile home to satisfy the outstanding loan amount. It is important to note that the specifics of a Miami-Dade Florida Notice of Default under Security Agreement in the Purchase of a Mobile Home may vary based on the individual circumstances, the terms of the security agreement, and applicable state laws. Therefore, it is crucial for borrowers and homeowners to seek legal counsel to understand the implications, potential remedies, and options available to them during this process. In summary, a Miami-Dade Florida Notice of Default under Security Agreement in the Purchase of a Mobile Home is a legal document that notifies borrowers of their default on loan payments or violations of the security agreement. With pre-foreclosure and post-foreclosure notices being the main types, borrowers must take prompt action to rectify their default or face potential foreclosure proceedings. Seeking professional advice when encountering such a situation is essential to protect their rights and understand available options.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

State:

Multi-State

County:

Miami-Dade

Control #:

US-02459BG

Format:

Word

Instant download

Description

A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

Miami-Dade County, located in southeastern Florida, is known for its vibrant culture, stunning beaches, and thriving real estate market. However, in certain instances, situations may arise where a Notice of Default under Security Agreement in the purchase of a mobile home becomes necessary. This legal document informs the mobile homeowner that they have defaulted on their loan or failed to meet their contractual obligations. It serves as a warning that if the payments are not rectified within a specific timeframe, serious consequences may follow. The Miami-Dade Florida Notice of Default under Security Agreement in the Purchase of a Mobile Home is a vital part of the foreclosure process. When an individual borrows funds to buy a mobile home in Miami-Dade County, they often enter into a security agreement with the lender. This agreement grants the lender certain rights to the property as security for the loan. If the borrower fails to make the required payments or violates other terms of the agreement, the lender has the authority to initiate the default process. Typically, there are two types of Miami-Dade Florida Notices of Default under Security Agreement in the Purchase of a Mobile Home: 1. Pre-Foreclosure Notice of Default: This notice is issued when the borrower defaults on their loan payments. It officially informs the borrower of the breach and allows them a specific period, usually 30 days, to rectify the default by making the outstanding payments. Failure to do so within the given timeframe can lead to further legal action. 2. Post-Foreclosure Notice of Default: If the borrower fails to cure the default within the specified period mentioned in the pre-foreclosure notice, the lender can proceed with the next stage — post-foreclosure. In this case, the lender typically serves a Notice of Default under Security Agreement in the Purchase of a Mobile Home, which informs the borrower that the lender is taking actions to reclaim the property. This notice includes information about the sale or auction of the mobile home to satisfy the outstanding loan amount. It is important to note that the specifics of a Miami-Dade Florida Notice of Default under Security Agreement in the Purchase of a Mobile Home may vary based on the individual circumstances, the terms of the security agreement, and applicable state laws. Therefore, it is crucial for borrowers and homeowners to seek legal counsel to understand the implications, potential remedies, and options available to them during this process. In summary, a Miami-Dade Florida Notice of Default under Security Agreement in the Purchase of a Mobile Home is a legal document that notifies borrowers of their default on loan payments or violations of the security agreement. With pre-foreclosure and post-foreclosure notices being the main types, borrowers must take prompt action to rectify their default or face potential foreclosure proceedings. Seeking professional advice when encountering such a situation is essential to protect their rights and understand available options.

Free preview