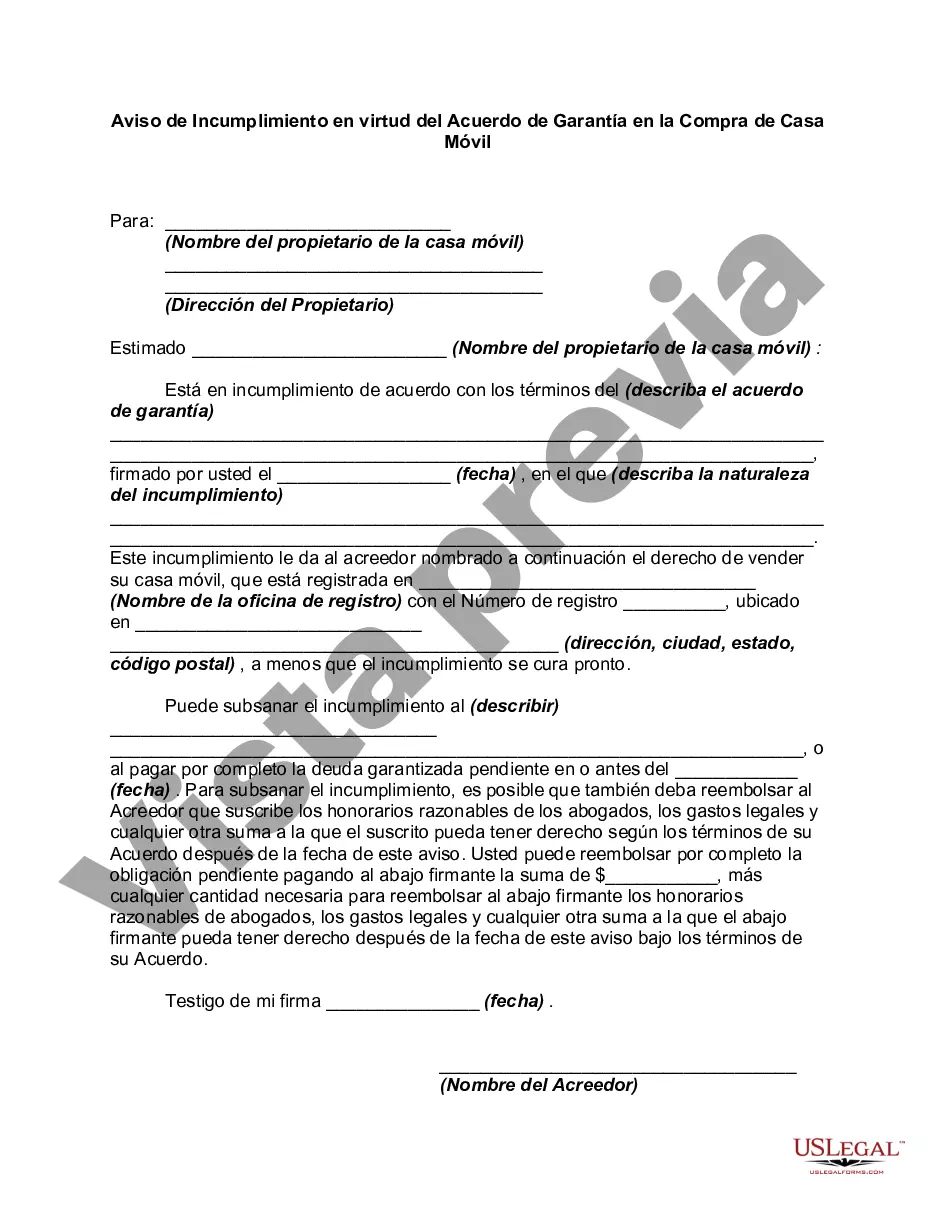

Oakland, Michigan Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that notifies the borrower of their failure to fulfill the terms and conditions outlined in the security agreement for the purchase of a mobile home in Oakland, Michigan. This notice serves as a formal communication from the lender, indicating the borrower's default and initiating the necessary legal procedures. In Oakland, Michigan, there are different types of Notice of Default under Security Agreement in Purchase of Mobile Home, including: 1. Preliminary Notice of Default: This is an initial notice sent by the lender to inform the borrower that they have fallen behind on their payments or have breached any other obligation mentioned in the security agreement. It provides the borrower with an opportunity to rectify the default before further legal action is taken. 2. Final Notice of Default: If the borrower fails to address the default within the specified timeframe provided in the preliminary notice, the lender issues a final notice of default. This notice emphasizes that immediate action is required to resolve the default; otherwise, the lender may proceed with foreclosure or other remedies available under the security agreement. 3. Cure Notice: In certain cases, when the default is due to a non-monetary breach of the security agreement, the lender may issue a cure notice. This notice informs the borrower about the specific violation or default and provides them with a specific timeframe to remedy the situation. 4. Acceleration Notice: If the borrower continues to disregard the default and fails to meet the agreed-upon obligations even after receiving the preliminary and final notices, the lender can issue an acceleration notice. This notice typically demands the immediate repayment of the entire outstanding loan balance, triggering acceleration clauses in the security agreement. 5. Notice of Foreclosure: In situations where the borrower fails to cure the default or meet the obligations outlined in the security agreement, the lender may initiate foreclosure proceedings. The notice of foreclosure informs the borrower about the lender's intent to foreclose on the mobile home, potentially leading to the sale of the property to recover the outstanding debt. When drafting an Oakland, Michigan Notice of Default under Security Agreement in Purchase of Mobile Home, it is crucial to include all relevant details concerning the borrower, the mobile home's purchase agreement, the nature of default, the amount owed, any applicable cure periods, contact information of the lender, and the necessary steps to address the default. It is important to note that legal proceedings, including notices of default, can be complex and require the guidance of a qualified attorney familiar with the laws and regulations in Oakland, Michigan. This content should be used for informational purposes only and should not substitute professional legal advice.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Oakland Michigan Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

Draftwing forms, like Oakland Notice of Default under Security Agreement in Purchase of Mobile Home, to manage your legal matters is a tough and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms created for various scenarios and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Oakland Notice of Default under Security Agreement in Purchase of Mobile Home template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting Oakland Notice of Default under Security Agreement in Purchase of Mobile Home:

- Ensure that your document is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Oakland Notice of Default under Security Agreement in Purchase of Mobile Home isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!