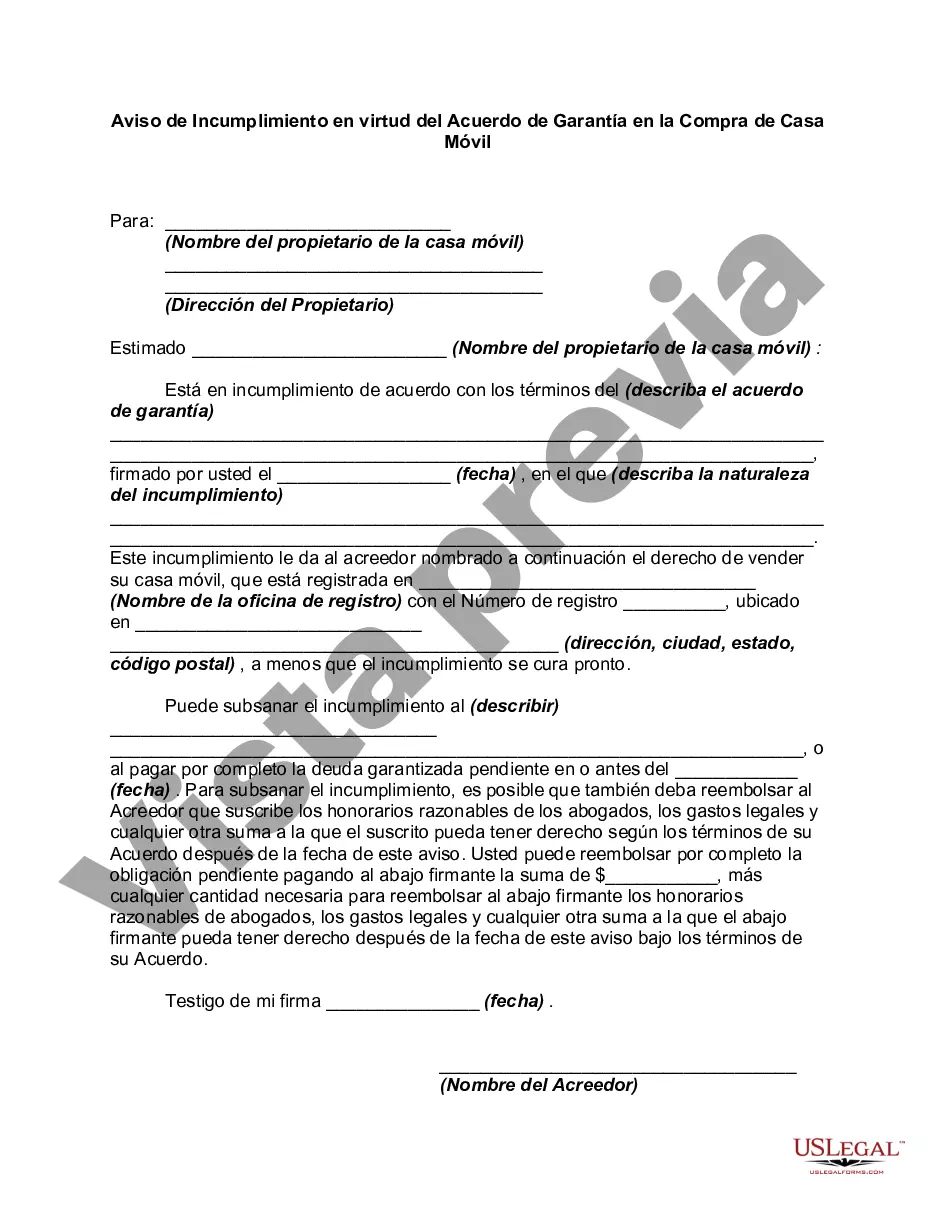

Description: An Orange California Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that outlines the default and breach of terms by the buyer in a mobile home purchase agreement. This notice serves as a formal warning to the buyer, informing them of their failure to comply with the terms and conditions set forth in the security agreement. The notice highlights the specific clauses, obligations, and conditions that have been violated by the buyer. It provides a detailed account of the defaults, including missed payments, failure to maintain insurance coverage, unauthorized alterations to the property, or any other breach that is mentioned in the security agreement. This Notice of Default under Security Agreement is typically issued by the seller or the lien holder, notifying the buyer of their non-compliance. It serves as a precursor to further legal action, such as foreclosure or repossession of the mobile home. In Orange, California, there may be different types of Notice of Default under Security Agreement in Purchase of Mobile Home, including: 1. Payment Default: This type of default occurs when the buyer fails to make timely payments as agreed upon in the security agreement. The notice will outline the number of missed payments, the amount due, and any penalties or late fees incurred. 2. Insurance Default: If the buyer fails to maintain the required insurance coverage for the mobile home, the seller or lien holder may issue a Notice of Default. This could include failure to provide proof of insurance or the cancellation of insurance coverage altogether. 3. Maintenance Default: Any unauthorized alterations, modifications, or failure to maintain the mobile home as agreed upon in the security agreement may result in a Notice of Default. This can include neglecting required repairs or disregarding specific maintenance obligations. 4. Violation of Terms and Conditions: If the buyer violates any other terms and conditions specified in the security agreement, such as renting out the mobile home without permission, the seller or lien holder may issue a Notice of Default, citing the specific breach. It is important to note that each Notice of Default under Security Agreement in Purchase of Mobile Home can vary depending on the terms and conditions mentioned in the original agreement. The purpose of this notice is to make the buyer aware of their default and provide them an opportunity to rectify the situation before further legal action is taken.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Orange California Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

Are you looking to quickly create a legally-binding Orange Notice of Default under Security Agreement in Purchase of Mobile Home or maybe any other form to take control of your own or business affairs? You can go with two options: contact a professional to write a legal document for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive professionally written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant form templates, including Orange Notice of Default under Security Agreement in Purchase of Mobile Home and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, carefully verify if the Orange Notice of Default under Security Agreement in Purchase of Mobile Home is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by using the search box in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Orange Notice of Default under Security Agreement in Purchase of Mobile Home template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the templates we provide are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!