A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

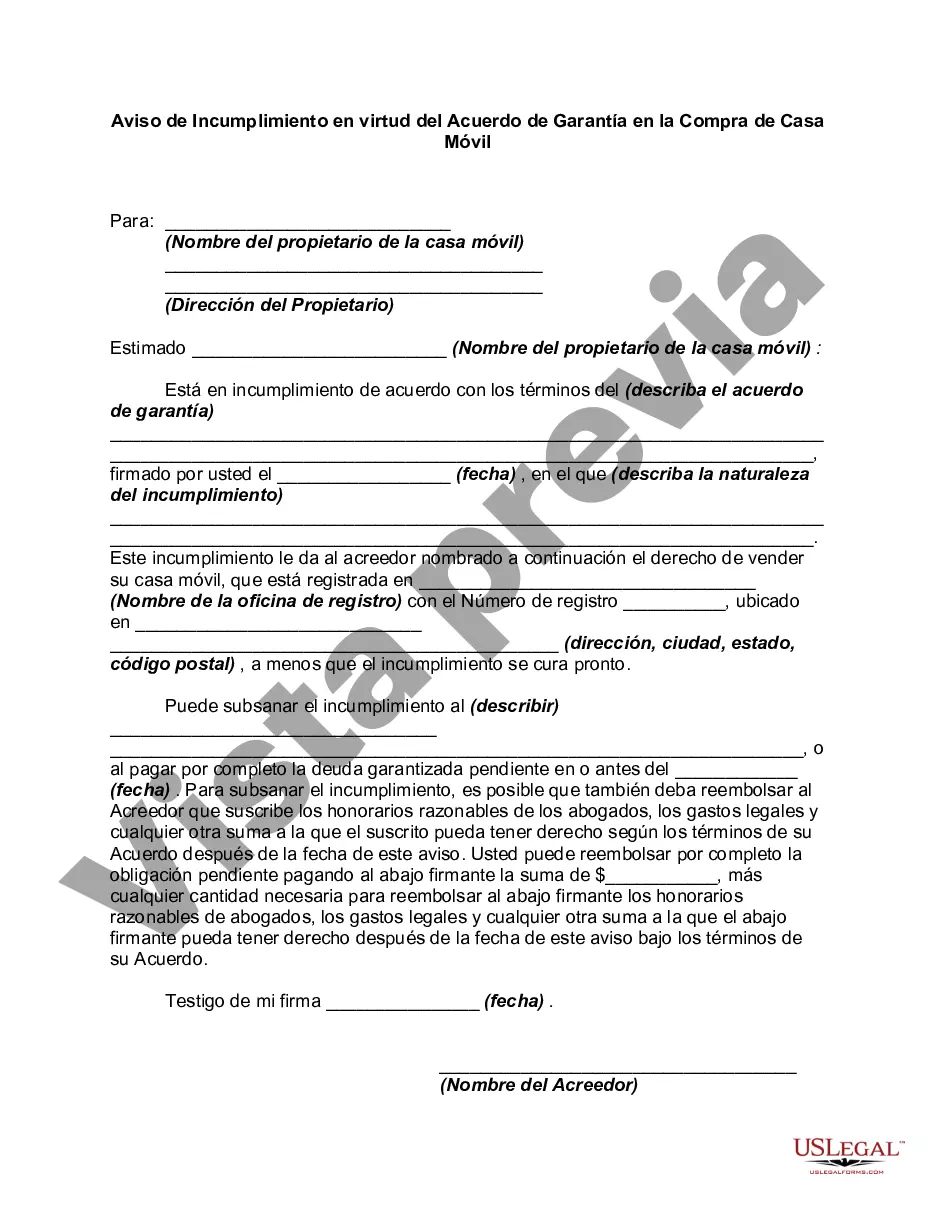

Philadelphia, Pennsylvania is a vibrant city located in the northeastern United States. Known for its rich history, iconic landmarks, and diverse culture, Philadelphia is a popular destination for both locals and tourists alike. One particular legal document that may arise in Philadelphia, Pennsylvania, is the Notice of Default under Security Agreement in Purchase of Mobile Home. This document plays a crucial role in cases where a borrower has defaulted on their loan agreement when purchasing a mobile home. A Notice of Default under Security Agreement in Purchase of Mobile Home is a legal notice sent by the lender to the borrower, notifying them of their failure to fulfill the terms of their loan agreement. It primarily pertains to mobile home purchases and serves as a formal warning that the borrower has defaulted on their obligations. This notice provides the borrower with a specified period to remedy the breach or risk further legal actions, such as repossession or foreclosure. In Philadelphia, Pennsylvania, the Notice of Default under Security Agreement in Purchase of Mobile Home can vary based on specific circumstances. Here are a few potential types: 1. Standard Notice of Default: This is the most common type of notice sent to a borrower who has failed to make timely payments or breached other terms of the purchase agreement. 2. Notice of Default to Cure Breach: This notice is issued when the borrower has violated specific terms of the security agreement and offers them an opportunity to rectify the breach within a specified timeframe. 3. Notice of Default and Intent to Accelerate: If the borrower has consistently failed to fulfill their payment obligations or repeatedly breached the purchase agreement, this notice informs them of the lender's intention to accelerate the loan, demanding full payment within a set period. 4. Notice of Default and Intent to Repossess: When the borrower has persistently defaulted on their payments or breached significant terms of the agreement, this notice notifies them of the lender's intent to repossess the mobile home in order to satisfy the outstanding loan. It is essential to seek legal advice and consult Philadelphia-specific regulations when dealing with a Notice of Default under Security Agreement in Purchase of Mobile Home. Each case may have individual nuances, so understanding the local laws and regulations is vital for both the borrower and lender involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.