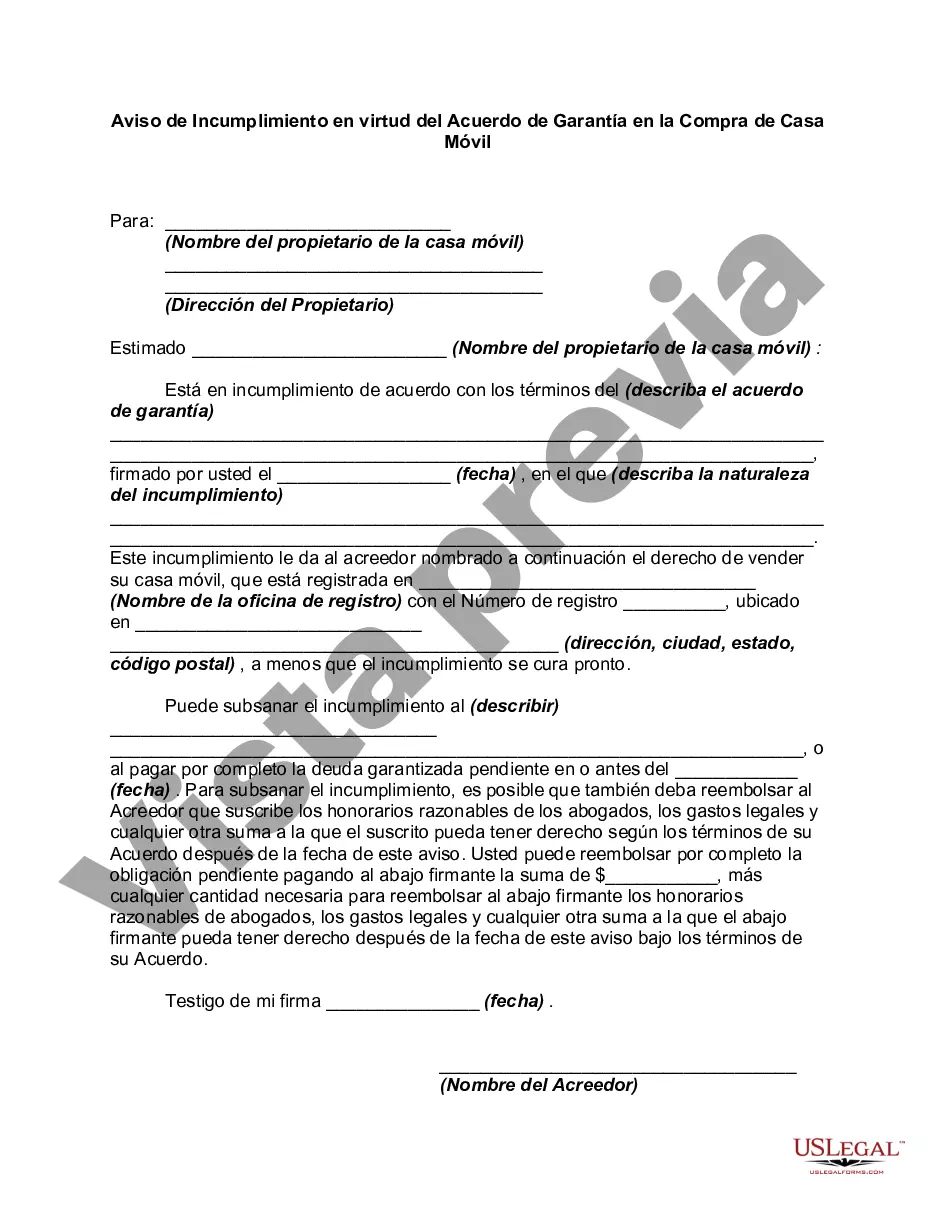

San Antonio, Texas is a vibrant city known for its rich history, diverse culture, and numerous attractions. It is located in the southern part of the state and is the second-most populous city in Texas. With a population of over 1.5 million residents, San Antonio offers a unique blend of modern city life and traditional Texan charm. The city is home to a variety of iconic landmarks, including the historic Alamo Mission, which played a significant role in Texas' fight for independence. San Antonio's famous River Walk is a picturesque downtown area lined with shops, restaurants, and beautiful waterways, making it a popular destination for locals and tourists alike. Besides its cultural significance, San Antonio is also a major economic hub. The city boasts a strong job market, particularly in industries such as healthcare, military, and tourism. It is home to several multinational corporations, including the USA, Valery Energy, and Hamburger. When it comes to real estate, San Antonio offers various housing options, including mobile homes. In the event of a default under a security agreement in the purchase of a mobile home, a Notice of Default may be issued. This notice alerts the borrower that they have failed to meet the obligations outlined in the security agreement, such as failing to make timely payments. In San Antonio, there are different types of Notices of Default under Security Agreement in the purchase of mobile homes. These may include: 1. Pre-Foreclosure Notice of Default: This notice is typically sent to the borrower when they are in arrears on their mortgage payments. It serves as a warning that if they do not rectify the situation within a specified period, foreclosure proceedings may be initiated. 2. Foreclosure Notice of Default: If the borrower fails to resolve the outstanding issues or bring their payments up to date within the given timeframe after receiving the Pre-Foreclosure Notice of Default, a Foreclosure Notice of Default may be issued. This notice indicates that legal action will be taken to repossess the mobile home. 3. Post-Foreclosure Notice of Default: Once the foreclosure process has been completed, and the mobile home has been repossessed by the lender, a Post-Foreclosure Notice of Default may be issued. This notice outlines the next steps, such as the sale of the mobile home at auction or through a real estate agent. In summary, San Antonio, Texas, is a dynamic city known for its culture, history, and economic opportunities. In the context of mobile home purchases, a San Antonio Notice of Default under Security Agreement can help protect the lender's interests when a borrower defaults on their payment obligations. These notices encompass various stages, including pre-foreclosure, foreclosure, and post-foreclosure, each indicating the progression of legal action in response to default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out San Antonio Texas Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the San Antonio Notice of Default under Security Agreement in Purchase of Mobile Home.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the San Antonio Notice of Default under Security Agreement in Purchase of Mobile Home will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the San Antonio Notice of Default under Security Agreement in Purchase of Mobile Home:

- Make sure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Antonio Notice of Default under Security Agreement in Purchase of Mobile Home on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!