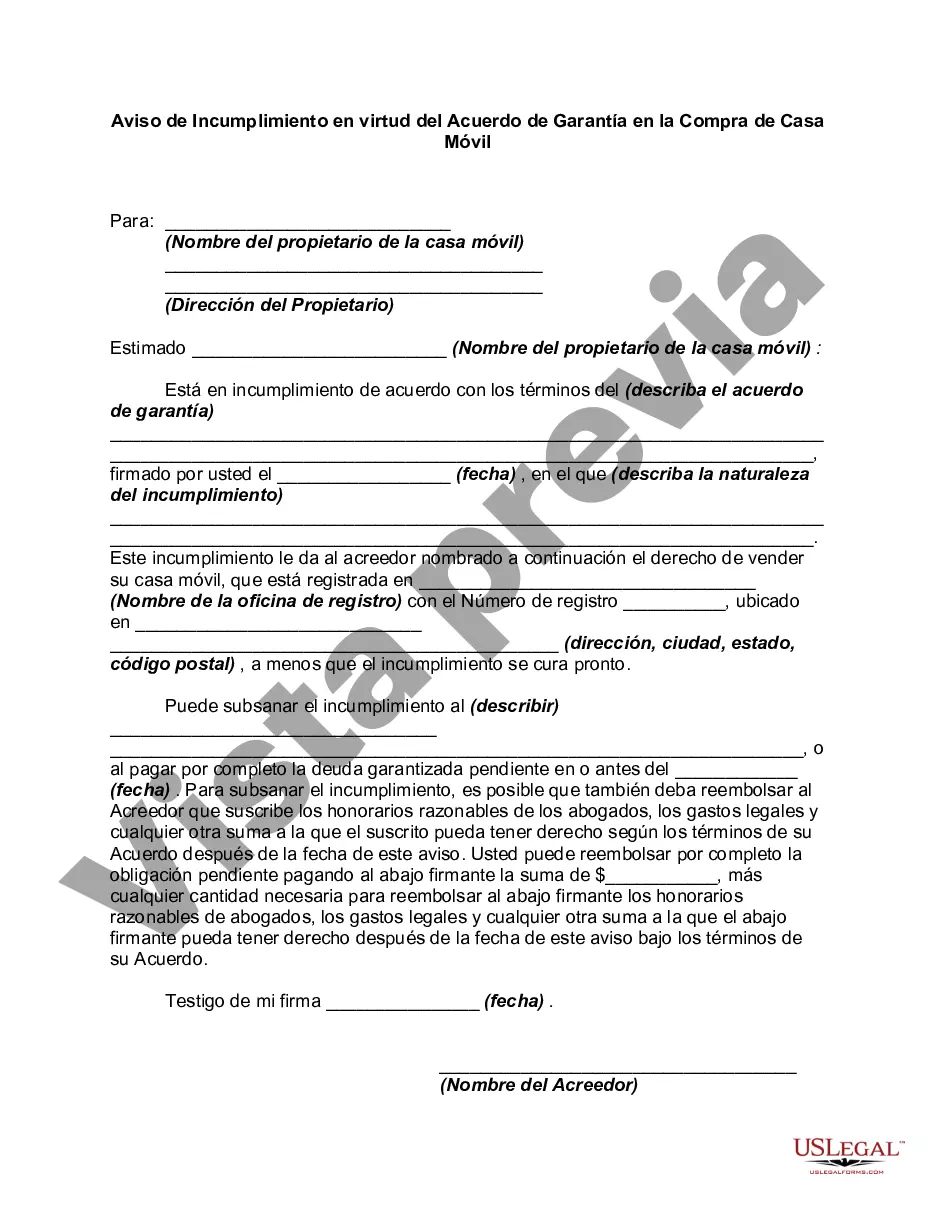

A Wake North Carolina Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that outlines the default of payment or violation of terms and conditions in a purchase agreement related to a mobile home. This document serves as a formal notice by the lender or security holder to the borrower or purchaser, notifying them of their default and demanding remedial action to rectify the situation. In Wake County, North Carolina, there are two different types of Notice of Default under Security Agreement in purchase of mobile homes: 1. Judicial Notice of Default: This type of notice is filed with the court system and initiates a legal action against the borrower or purchaser who has defaulted on the security agreement. It involves legal proceedings to resolve the matter, potentially including foreclosure or repossession of the mobile home to recover the outstanding debt. 2. Non-Judicial Notice of Default: This type of notice is issued by the lender or security holder without involving the court system. It typically includes details about the default, the amount owed, and the steps required to cure the default. The borrower or purchaser is given a specific timeframe to meet the obligations before further legal action, such as foreclosure, is pursued. Keywords: Wake North Carolina, Notice of Default, Security Agreement, Purchase of Mobile Home, judicial, non-judicial, default, payment, violation, terms and conditions, court system, legal action, foreclosure, repossession, outstanding debt, lender, borrower, security holder.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Wake North Carolina Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the Wake Notice of Default under Security Agreement in Purchase of Mobile Home.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Wake Notice of Default under Security Agreement in Purchase of Mobile Home will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Wake Notice of Default under Security Agreement in Purchase of Mobile Home:

- Make sure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Wake Notice of Default under Security Agreement in Purchase of Mobile Home on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!