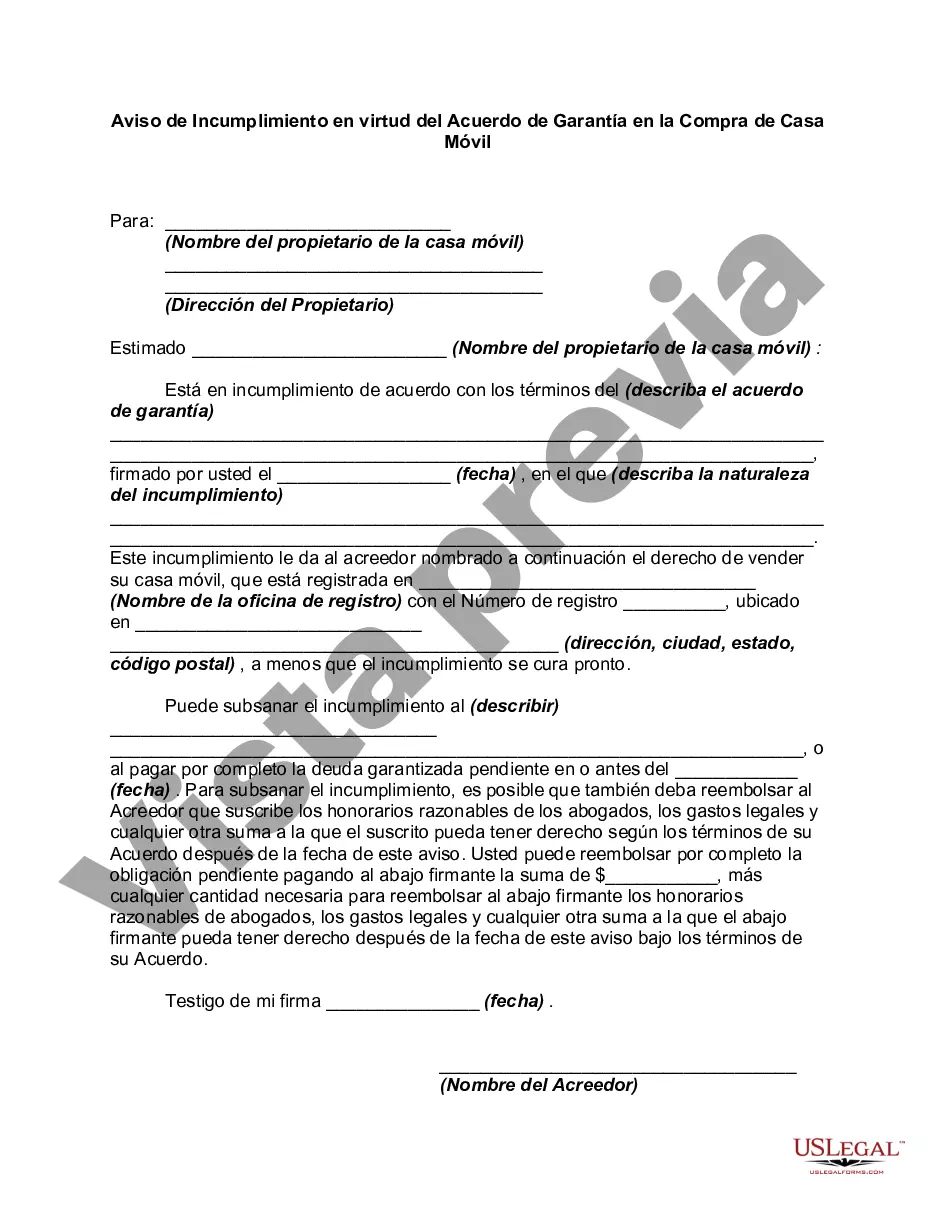

Wayne Michigan Notice of Default under Security Agreement in Purchase of Mobile Home is an important legal document that outlines the rights and obligations of the parties involved in a mobile home purchase agreement. It serves as a notice to the borrower, known as the debtor, that they have defaulted on their obligations under the security agreement. The Notice of Default is typically issued by the lender, known as the secured party, when the debtor fails to make timely payments or breaches any other terms and conditions outlined in the security agreement. The purpose of this notice is to inform the debtor of their default status and provide them with an opportunity to remedy the situation within a specified timeframe. In Wayne, Michigan, there are several types of Notice of Default under Security Agreement in Purchase of Mobile Home that may be issued based on the nature of the default: 1. Payment Default: This type of default occurs when the debtor fails to make timely payments towards the loan or mortgage related to the mobile home purchase. The lender may issue a Notice of Default to notify the debtor of their non-payment and the outstanding amount due. 2. Breach of Terms: If the debtor breaches any terms and conditions outlined in the security agreement, such as failing to maintain adequate insurance coverage or using the mobile home for unauthorized purposes, the lender may issue a Notice of Default stating the specific breach and demanding corrective action. 3. Default Cure: In some cases, the Notice of Default may include a default cure clause, which allows the debtor to rectify the default within a specified period. This clause will outline the conditions for curing the default, such as making all overdue payments or fulfilling any outstanding obligations. Upon receiving the Notice of Default, the debtor should carefully review the document and assess the options available to them. They may have the opportunity to reinstate the loan, negotiate a repayment plan, or seek legal advice if they disagree with the lender's claims. It's important for both parties involved in a purchase of a mobile home to understand the implications of a Notice of Default under Security Agreement. The lender must follow specific legal requirements when issuing the notice, and the debtor should be aware of their rights and options available in resolving the default. In conclusion, a Wayne Michigan Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that highlights a borrower's default on their obligations under a mobile home purchase agreement. By issuing this notice, the lender aims to inform the debtor of their default status and provide them with an opportunity to rectify the situation. Various types of defaults may lead to the issuance of this notice, including payment defaults, breaches of terms, and defaults that allow for a cure period. It's crucial for both parties to understand their rights and seek appropriate advice when faced with a Notice of Default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Wayne Michigan Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Wayne Notice of Default under Security Agreement in Purchase of Mobile Home meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Aside from the Wayne Notice of Default under Security Agreement in Purchase of Mobile Home, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can get the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Wayne Notice of Default under Security Agreement in Purchase of Mobile Home:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Notice of Default under Security Agreement in Purchase of Mobile Home.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!