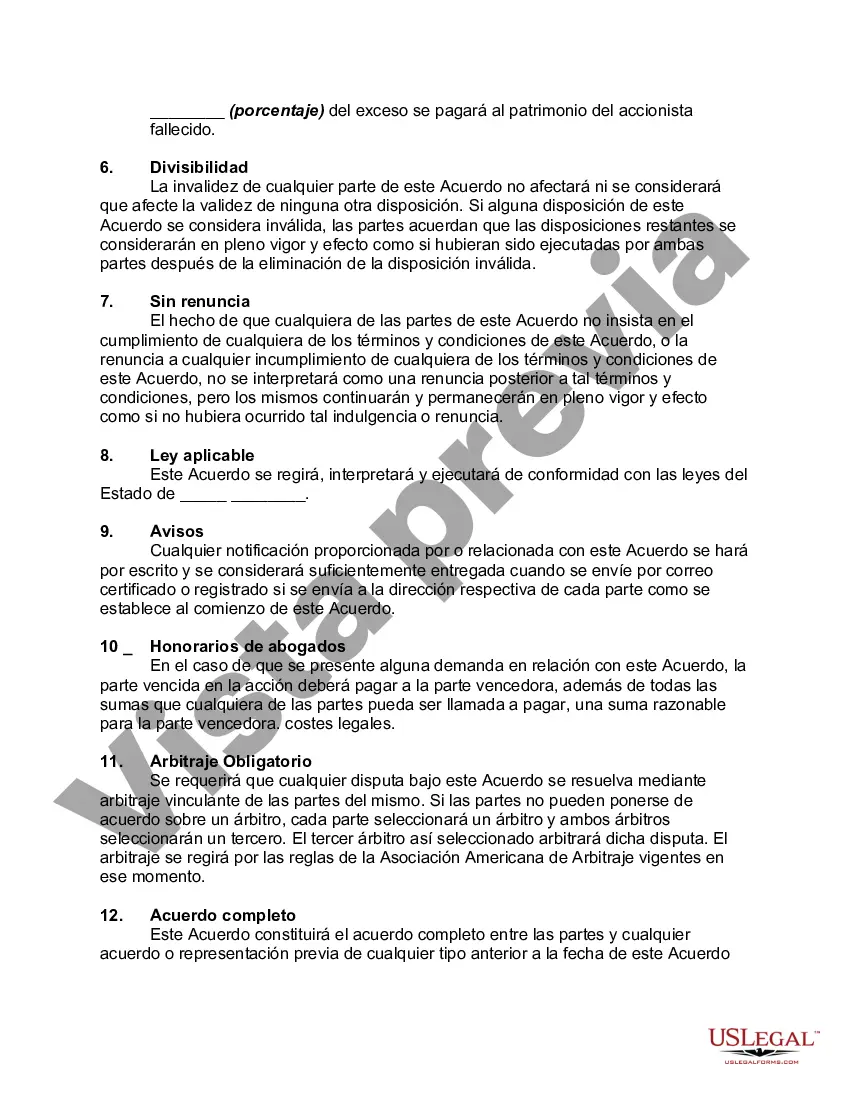

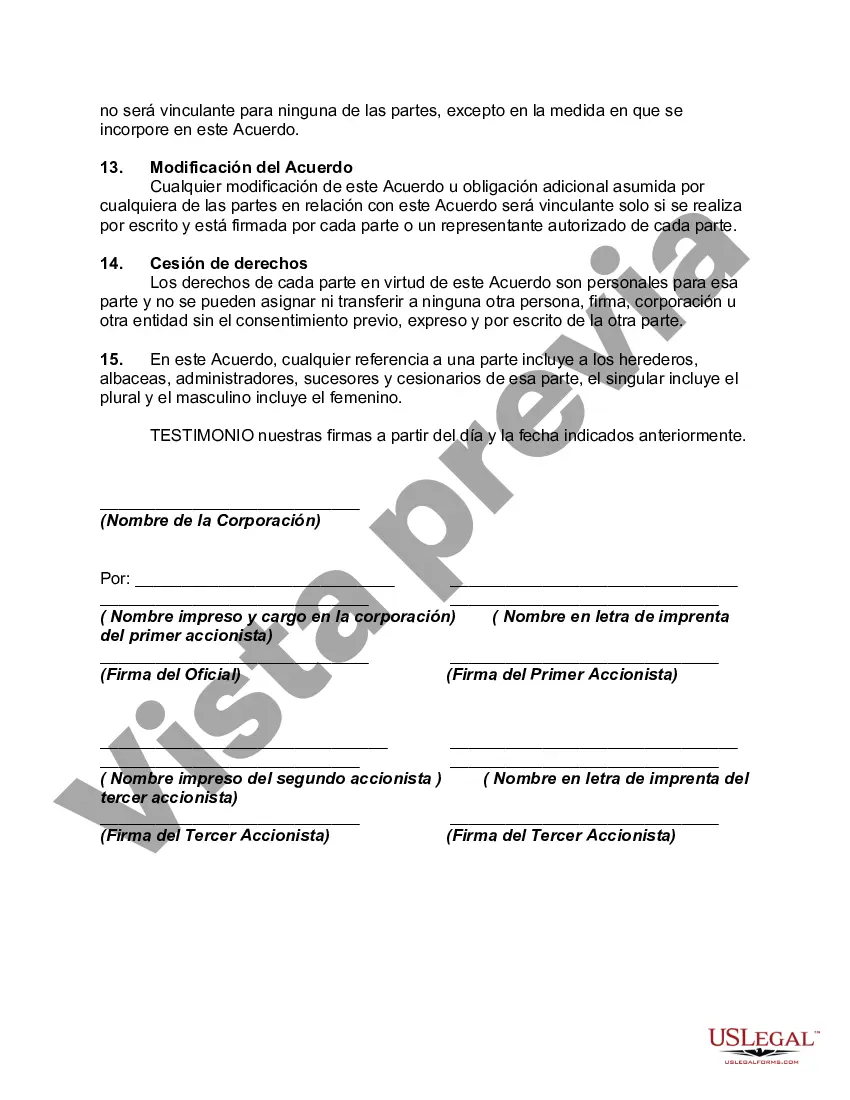

Orange California Buy-Sell Agreement between Shareholders of Closely Held Corporation is a legally binding contract designed to outline the terms and conditions related to the sale and purchase of shares within a closely held corporation based in Orange, California. This agreement exists to protect the interests of shareholders and ensure a smooth transition of ownership in the event of certain triggering events. A Buy-Sell Agreement is crucial for closely held corporations and allows shareholders to determine the rights and obligations associated with transferring or selling their shares. This agreement helps maintain corporate stability, facilitates future business planning, and provides a mechanism for resolving disputes among shareholders. Key elements that may be included in an Orange California Buy-Sell Agreement between Shareholders of Closely Held Corporation: 1. Triggering Events: The agreement should identify specific events that trigger the buy-sell provisions, such as death, disability, retirement, divorce, bankruptcy, or voluntary withdrawal from the corporation. 2. Valuation Method: This agreement should define the approach used to determine the fair market value of the shares during a buy-sell transaction. Common methods include independent appraisals, predefined formulas, or a mutually agreed-upon valuation process. 3. Purchase Terms and Conditions: The agreement must outline the terms for the purchase, including payment methods, timeframes, and any financing arrangements. 4. Rights of First Refusal: A provision may be included allowing existing shareholders to purchase shares before they are offered to outside parties, ensuring that ownership remains within the corporation. 5. Non-Compete and Non-Disclosure Clauses: The agreement may contain restrictions on shareholders who sell their shares, preventing them from engaging in competitive activities or disclosing proprietary information. 6. Dispute Resolution: A process for resolving disputes related to the agreement should be included, such as arbitration or mediation, to avoid costly litigation. Types of Orange California Buy-Sell Agreements between Shareholders of Closely Held Corporation: 1. Cross-Purchase Agreement: In this type of agreement, individual shareholders have the right to buy the shares from the selling shareholder in proportion to their existing ownership percentage. It is commonly used when there are a limited number of shareholders. 2. Redemption Agreement: This agreement allows the corporation itself to buy the shares from the selling shareholder, effectively retiring them. The corporation then typically redistributes these shares among existing shareholders. 3. Hybrid Agreement: A combination of the cross-purchase and redemption agreements, this type allows both individual shareholders and the corporation to participate in purchasing the shares, depending on certain conditions or preferences outlined in the agreement. In conclusion, an Orange California Buy-Sell Agreement between Shareholders of Closely Held Corporation is a crucial legal tool to safeguard the interests of shareholders and facilitate the smooth transfer of ownership within a closely held corporation. The specific terms and types of agreements may vary, but they all play a vital role in maintaining corporate stability and resolving ownership transitions effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Acuerdo de Compra-Venta entre Accionistas de Sociedad Anónima Cerrada - Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

How to fill out Orange California Acuerdo De Compra-Venta Entre Accionistas De Sociedad Anónima Cerrada?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Orange Buy-Sell Agreement between Shareholders of Closely Held Corporation.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Orange Buy-Sell Agreement between Shareholders of Closely Held Corporation will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Orange Buy-Sell Agreement between Shareholders of Closely Held Corporation:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Orange Buy-Sell Agreement between Shareholders of Closely Held Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!