Title: Harris Texas Stock Purchase Agreement: A Comprehensive Guide to Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement Keywords: Harris Texas, stock purchase agreement, two sellers, one investor, transfer of title, concurrent execution Introduction: A Harris Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement is a legally binding contract that facilitates the purchase of stock by an investor from two sellers. The agreement ensures the smooth transfer of ownership while simultaneously executing the agreement itself. Let's delve into the details of this agreement type and explore any potential variations. 1. Key Elements of the Harris Texas Stock Purchase Agreement: — Parties involved: This includes the two sellers and one investor. — Stock details: Specify the exact nature and characteristics of the stock being purchased. — Purchase price: Clearly define the agreed-upon amount for the stock. — Payment terms: Outline the payment method, such as cash, check, or bank transfer. — Closing conditions: Identify any prerequisites for the agreement's execution and completion. — Representations and warranties: Stipulate the assertions made by the sellers regarding the stock's condition, legal compliance, and accuracy of information. — Indemnification provisions: Establish the responsibilities and liabilities of each party in case of breach, misrepresentation, or violation of the agreement's terms. 2. Transfer of Title Concurrent with Execution: In this type of stock purchase agreement, the transfer of title occurs simultaneously with the execution of the agreement. The sellers transfer their ownership rights to the investor upon executing the agreement, ensuring an immediate and seamless transition of stock ownership. 3. Variations of Harris Texas Stock Purchase Agreement: There may be additional types of Harris Texas Stock Purchase Agreements between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement, each with distinct specificities and circumstances. Some notable variations include: — Cash-only agreement: This type limits the payment method to cash, excluding other forms like checks or bank transfers. — Installment agreement: This arrangement allows the investor to pay the purchase price over a specified period in installments, based on agreed-upon terms. — Asset-based agreement: In certain cases, the agreement might involve the sale of stock as part of a broader transaction where additional assets are also involved. Conclusion: A Harris Texas Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement holds significance in providing a framework for the smooth transfer of stock ownership. By carefully considering the specific details and variations of the agreement, all parties involved can ensure a legally secure and mutually beneficial transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de compra de acciones entre dos vendedores y un inversionista con transferencia de título concurrente con la ejecución del acuerdo - Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

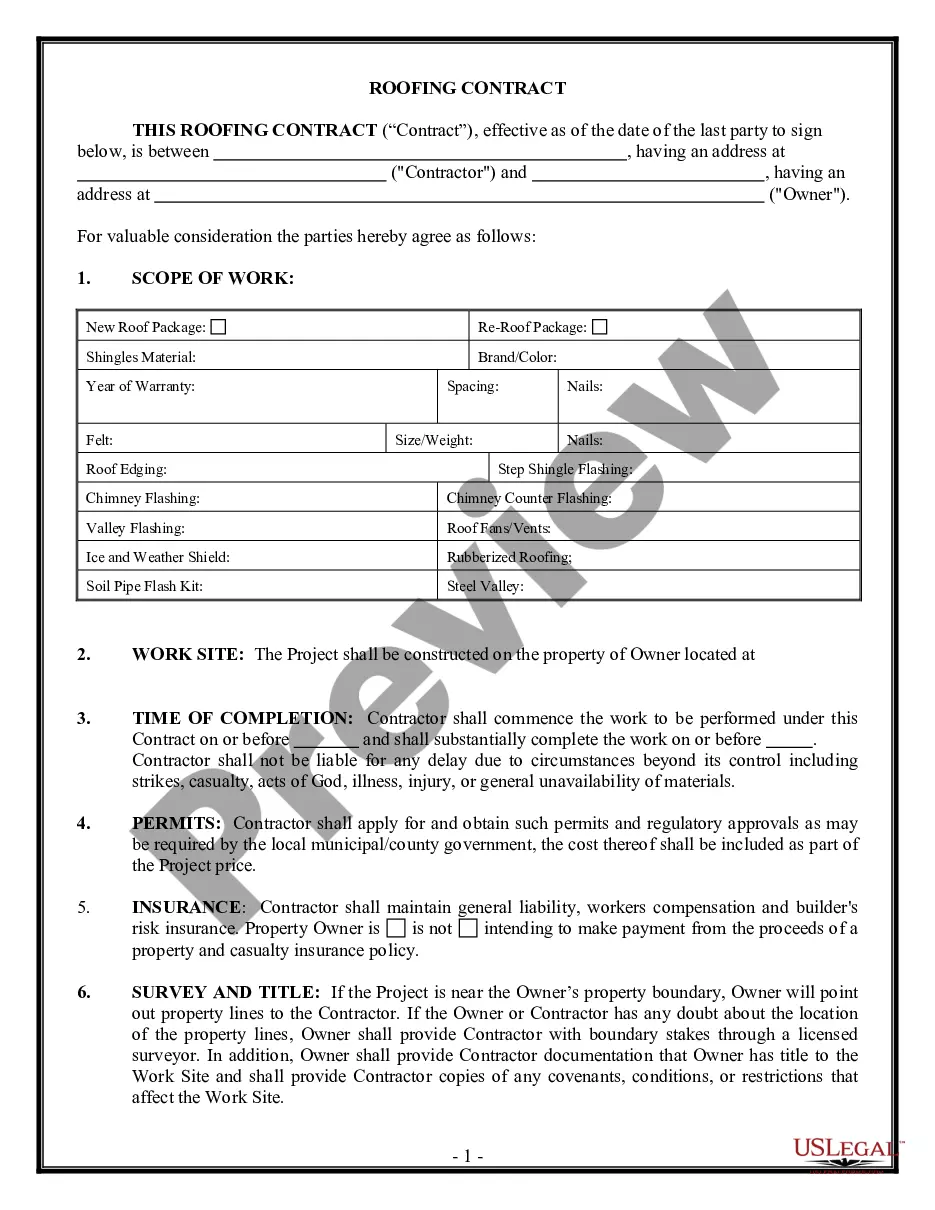

Description

How to fill out Harris Texas Acuerdo De Compra De Acciones Entre Dos Vendedores Y Un Inversionista Con Transferencia De Título Concurrente Con La Ejecución Del Acuerdo?

Drafting papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Harris Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement without expert help.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Harris Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Harris Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement:

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!