The articles of incorporation is a document that must be filed with a state in order to incorporate. Information typically required to be included are the name and address of the corporation, its general purpose and the number and type of shares of stock to be issued.

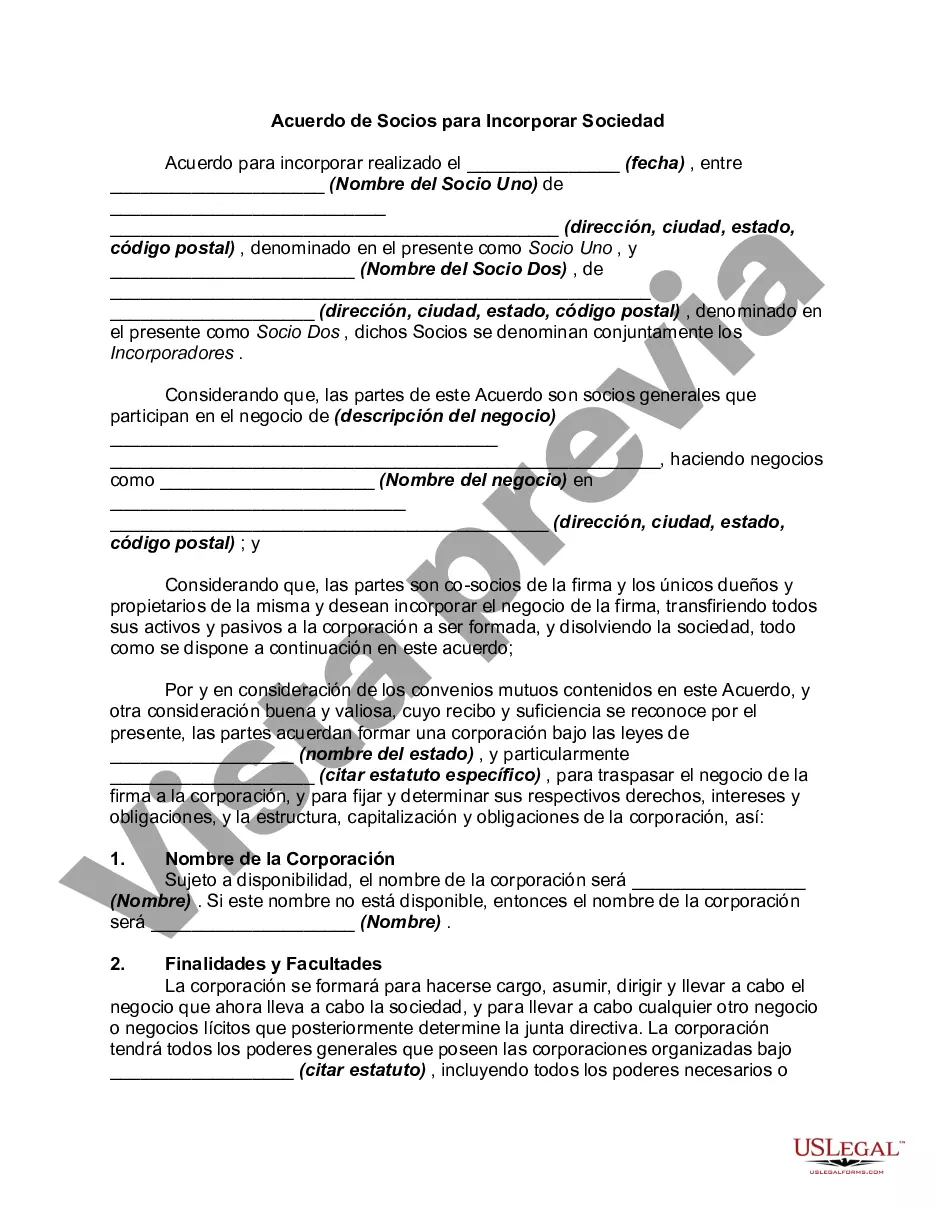

The Collin Texas Agreement to Partners to Incorporate Partnership is a legal document that outlines the process of incorporating a partnership in Collin County, Texas. This agreement provides a detailed description of the terms and conditions under which the partnership will be formed and operated. It serves as a guideline for the partners involved in the incorporation process, ensuring that all parties have a clear understanding of their rights, obligations, and responsibilities. Keywords: Collin Texas, agreement, partners, incorporate, partnership, legal document, terms and conditions, formed, operated, guideline, rights, obligations, responsibilities. There are several types of Collin Texas Agreements to Partners to Incorporate Partnership, including: 1. General Partnership Incorporation Agreement: This type of agreement is suitable for businesses where all partners have equal authority and liability. It outlines the roles, capital contributions, profit sharing, decision-making processes, and dissolution procedures for the partnership. 2. Limited Partnership Incorporation Agreement: This agreement is applicable when there are both general partners and limited partners involved. General partners have unlimited liability while limited partners have limited liability. The agreement specifies the rights and responsibilities of each partner category, as well as the extent of liability. 3. Limited Liability Partnership Incorporation Agreement: This type of agreement limits the personal liability of partners involved in professional services firms, such as law firms or accounting practices. It establishes the partnership's structure, profit distribution, decision-making authority, and the scope of each partner's liability. 4. Limited Liability Limited Partnership Incorporation Agreement: This agreement combines features of both a limited partnership and a limited liability partnership. It allows partners to have limited liability while also providing the flexibility of a limited partnership structure. These various types of Collin Texas Agreement to Partners to Incorporate Partnership cater to different business needs and offer partners the ability to tailor the agreement to their specific circumstances. It is important for partners to consult with an attorney experienced in partnership law to determine the most suitable agreement type for their business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.