Hennepin County, Minnesota, Agreement to Partners to Incorporate Partnership is a legally binding document that outlines the terms and conditions for individuals or businesses looking to form a partnership in Hennepin County, Minnesota. This partnership agreement serves as a foundation for establishing roles, responsibilities, and legal obligations of each partner involved. One type of Hennepin Minnesota Agreement to Partners to Incorporate Partnership is the General Partnership Agreement. In this arrangement, all partners share equal responsibility, liability, and decision-making power. Each partner contributes their skills, capital, or resources to the partnership, and profits and losses are divided among the partners according to the agreed-upon terms. Another type of Hennepin Minnesota Agreement to Partners to Incorporate Partnership is the Limited Partnership Agreement. Unlike a general partnership, a limited partnership includes both general partners and limited partners. General partners actively manage the business and take on personal liability for any debts or obligations. Limited partners, on the other hand, have limited liability and are typically passive investors who contribute capital without taking part in day-to-day operations or decision-making. The Hennepin County Agreement to Partners to Incorporate Partnership typically includes several key provisions. First, it states the purpose of the partnership and the duration, specifying whether it is a fixed-term partnership or ongoing until dissolved. The agreement also addresses the capital contributions required from each partner and the method of distributing profits and losses. Roles and responsibilities of partners are outlined, including any specific duties, obligations, or limitations. The agreement may detail how decisions will be made, whether through unanimous consent, majority vote, or other predetermined mechanisms. It may establish guidelines for partner compensation, withdrawal, retirement, or death, and include provisions for dispute resolution and mediation. Furthermore, the Hennepin Minnesota Agreement to Partners to Incorporate Partnership often incorporates provisions relating to the dissolution of the partnership. It may specify the process for winding up business affairs, distributing assets, and settling liabilities. Additionally, it may outline any non-compete clauses or confidentiality agreements relevant to the partnership. It's important to note that drafting a thorough and legally sound partnership agreement should involve consultation with an attorney or legal expert familiar with Hennepin County and Minnesota partnership laws. This will ensure that all statutory requirements are met, and the agreement provides appropriate protection for partners in accordance with their specific business needs and circumstances.

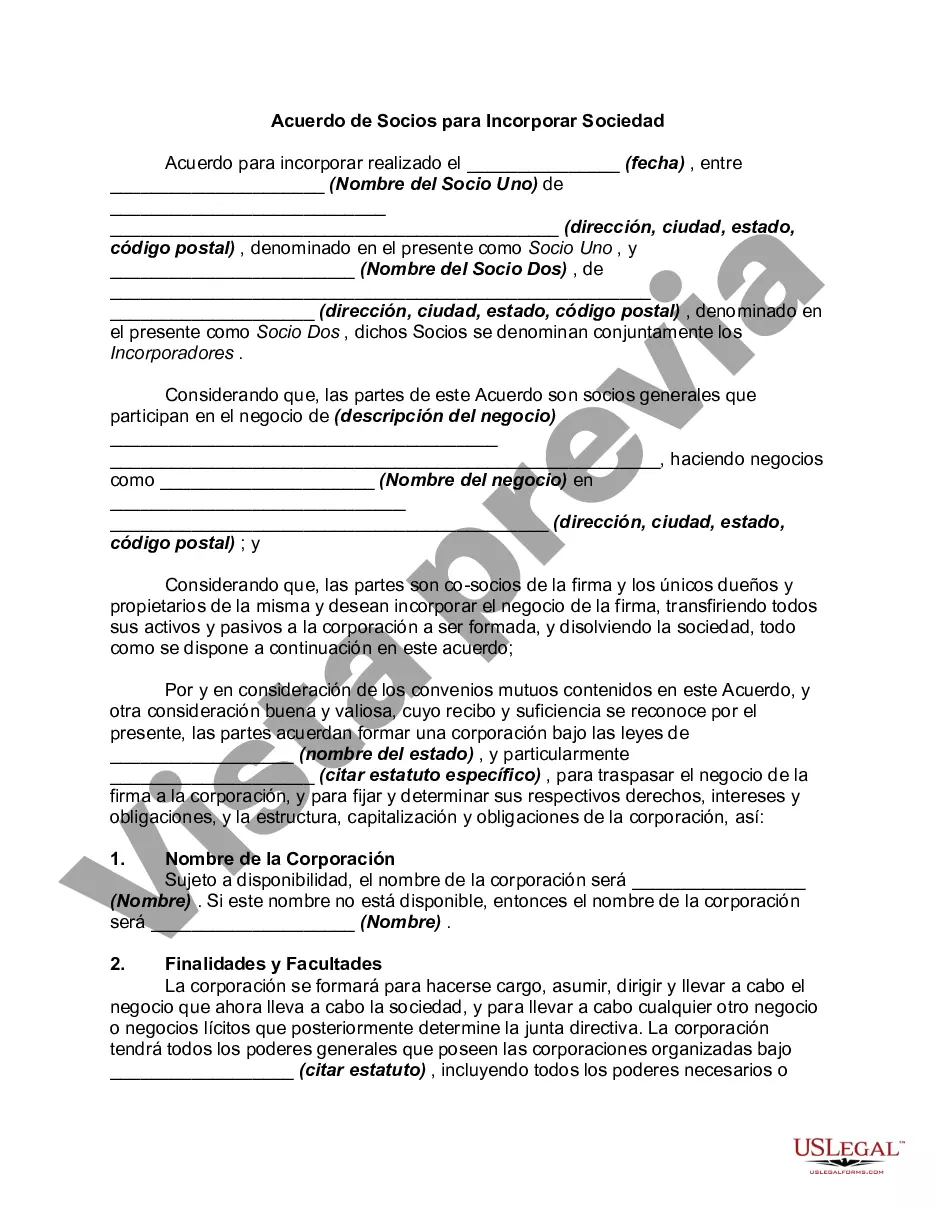

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuerdo de Socios para Incorporar Sociedad - Agreement to Partners to Incorporate Partnership

Description

How to fill out Hennepin Minnesota Acuerdo De Socios Para Incorporar Sociedad?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Hennepin Agreement to Partners to Incorporate Partnership suiting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the Hennepin Agreement to Partners to Incorporate Partnership, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Hennepin Agreement to Partners to Incorporate Partnership:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Hennepin Agreement to Partners to Incorporate Partnership.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!