The Mecklenburg North Carolina Agreement to Partners to Incorporate Partnership is a legally binding document that outlines the terms and conditions for forming a partnership in Mecklenburg County, North Carolina. This agreement serves as a blueprint for partners seeking to incorporate their business and outlines the rights, responsibilities, and obligations of each partner involved. By incorporating a partnership, partners can enjoy various benefits, including limited liability protection and tax advantages. In a Mecklenburg North Carolina Agreement to Partners to Incorporate Partnership, there are various types that can be established based on the needs and goals of the partners involved. These types include: 1. General Partnership: This is the most common type where all partners share equal rights and responsibilities in managing the partnership. In this agreement, partners agree to pool their resources, skills, and expertise to run the business. 2. Limited Partnership: In this type, there are two categories of partners — general partners and limited partners. General partners have unlimited liability and actively manage the business, while limited partners invest capital but have limited involvement in the day-to-day operations. 3. Limited Liability Partnership (LLP): An LLP protects partners from personal liability for the partnership's debts and obligations. This agreement gives partners more flexibility in terms of management and allows them to avoid personal liability for the negligence or misconduct of other partners. 4. Limited Liability Limited Partnership (LL LP): This agreement combines the benefits of a limited liability partnership and a limited partnership. It offers limited liability protection to all partners, including those actively involved in managing the partnership. A Mecklenburg North Carolina Agreement to Partners to Incorporate Partnership typically includes essential clauses, such as: — Name and Purpose: The agreement must clearly state the name of the partnership and its primary purpose or business activity. — Contributions: Partners must outline their individual contributions, including capital, property, or services rendered, and how these will be valued and allocated. — Profit and Loss Sharing: Details on how profits and losses will be distributed among partners, which may be based on the percentage of their contributions or other agreed-upon arrangements. — Decision-making and Management: This section describes how decisions will be made within the partnership and outlines the roles, responsibilities, and authority of each partner. — Capital Accounts and Distributions: The agreement must specify how the capital accounts of each partner will be maintained, including provisions for the sharing of profits and distributions. — Dispute Resolution: In case of disagreements or disputes, the agreement can include provisions for mediation, arbitration, or the use of legal remedies. — Dissolution and Exit Strategy: The process for dissolving the partnership and the steps for distributing assets and liabilities should be clearly outlined. It's essential to consult with a legal professional experienced in business formation and partnership agreements to ensure compliance with Mecklenburg County and North Carolina laws when drafting a Mecklenburg North Carolina Agreement to Partners to Incorporate Partnership.

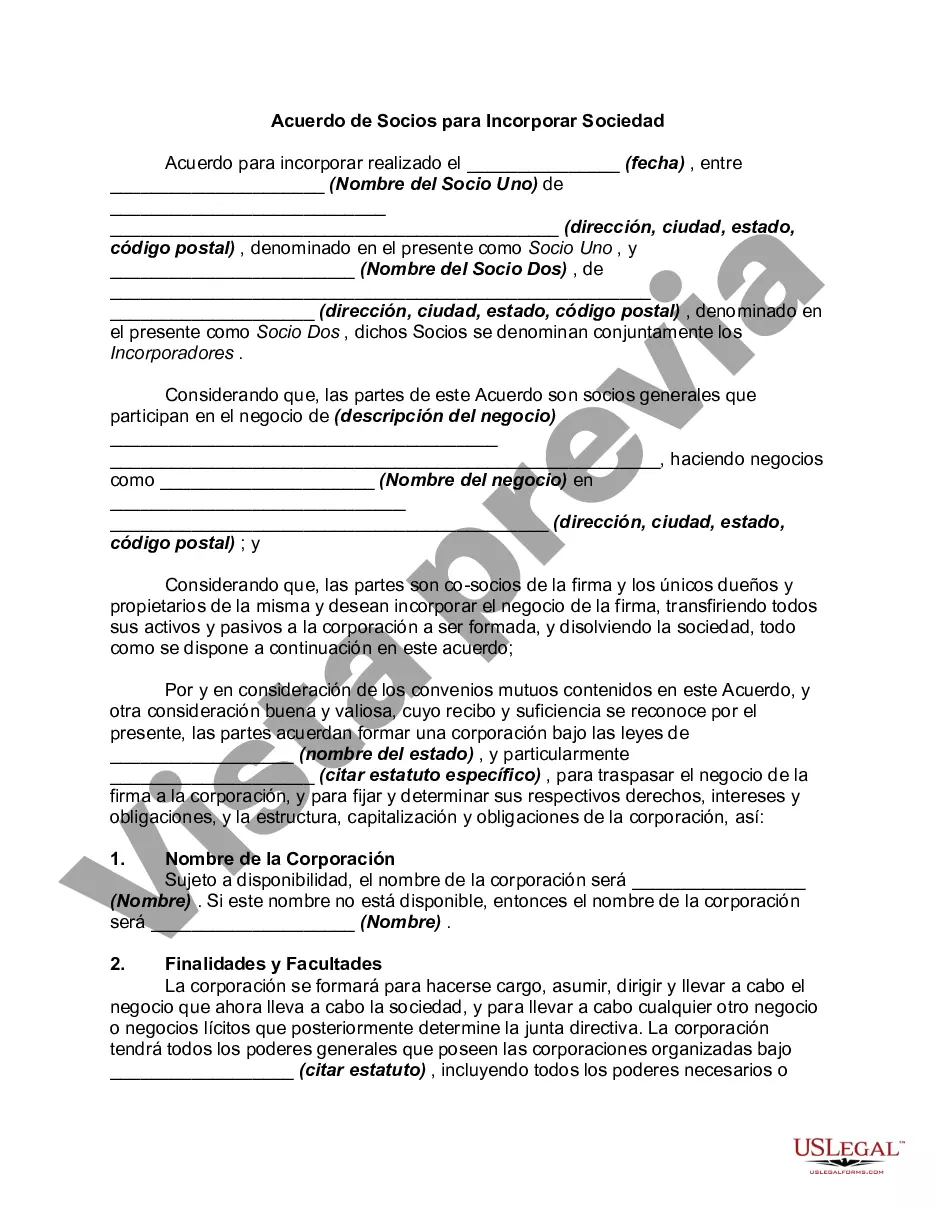

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Acuerdo de Socios para Incorporar Sociedad - Agreement to Partners to Incorporate Partnership

Description

How to fill out Mecklenburg North Carolina Acuerdo De Socios Para Incorporar Sociedad?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Mecklenburg Agreement to Partners to Incorporate Partnership, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Mecklenburg Agreement to Partners to Incorporate Partnership from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Mecklenburg Agreement to Partners to Incorporate Partnership:

- Take a look at the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!