Queens New York Agreement to Partners to Incorporate Partnership is a legally binding agreement that establishes a partnership entity within the Queens borough of New York City. This agreement outlines the terms, conditions, and obligations for multiple parties coming together to form a partnership and legally operate a business venture in Queens. The agreement sets forth the rules and regulations that govern the partnership, including the roles and responsibilities of each partner, profit and loss distribution, decision-making processes, and more. It ensures that all partners are on the same page, have a clear understanding of their rights and obligations, and work together towards shared goals. There are different types of Queens New York Agreement to Partners to Incorporate Partnership, including: 1. General Partnership: This is the most common type of partnership, where all partners share equal responsibilities and have unlimited liability for the partnership's debts and obligations. 2. Limited Partnership: In this type of partnership, there are two categories of partners. General partners manage the day-to-day operations and have unlimited liability, while limited partners contribute capital but have limited involvement in management and liability, restricted to the extent of their investment. 3. Limited Liability Partnership (LLP): This partnership structure provides limited liability protection to all partners, shielding them from personal responsibility for the partnership's debts and liabilities resulting from the actions of other partners. 4. Professional Corporation Partnership: This type of partnership is specifically designed for licensed professionals such as doctors, lawyers, architects, etc., allowing them to form a partnership while still maintaining personal liability protection for their professional actions. The Queens New York Agreement to Partners to Incorporate Partnership ensures that the partnership is legally recognized and enables partners to conduct business in the Queens borough, adhering to the local regulations and requirements. It is essential to engage legal professionals while drafting this agreement to ensure compliance with applicable laws and protect the interests of all partners involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Acuerdo de Socios para Incorporar Sociedad - Agreement to Partners to Incorporate Partnership

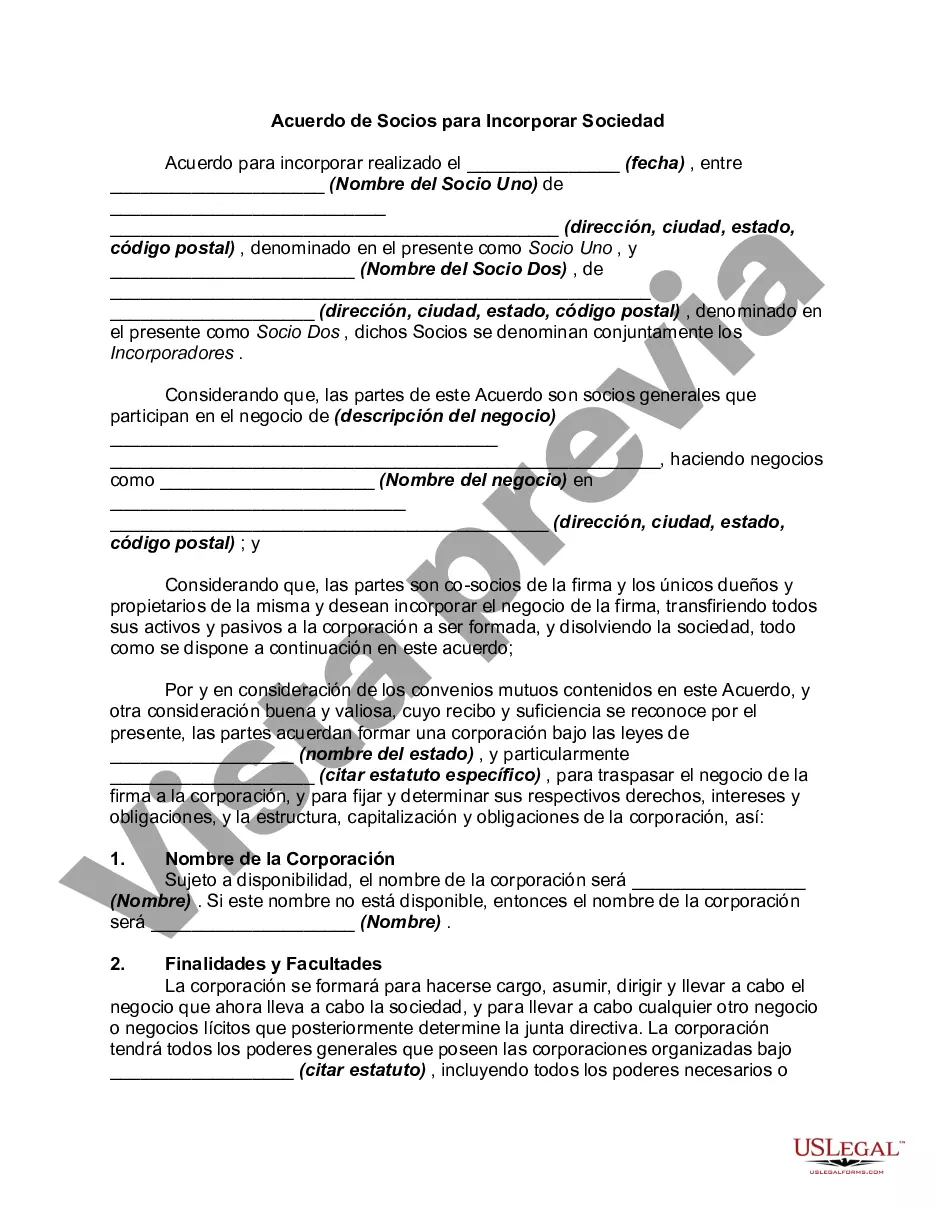

Description

How to fill out Queens New York Acuerdo De Socios Para Incorporar Sociedad?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Queens Agreement to Partners to Incorporate Partnership, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Therefore, if you need the current version of the Queens Agreement to Partners to Incorporate Partnership, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Queens Agreement to Partners to Incorporate Partnership:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Queens Agreement to Partners to Incorporate Partnership and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!