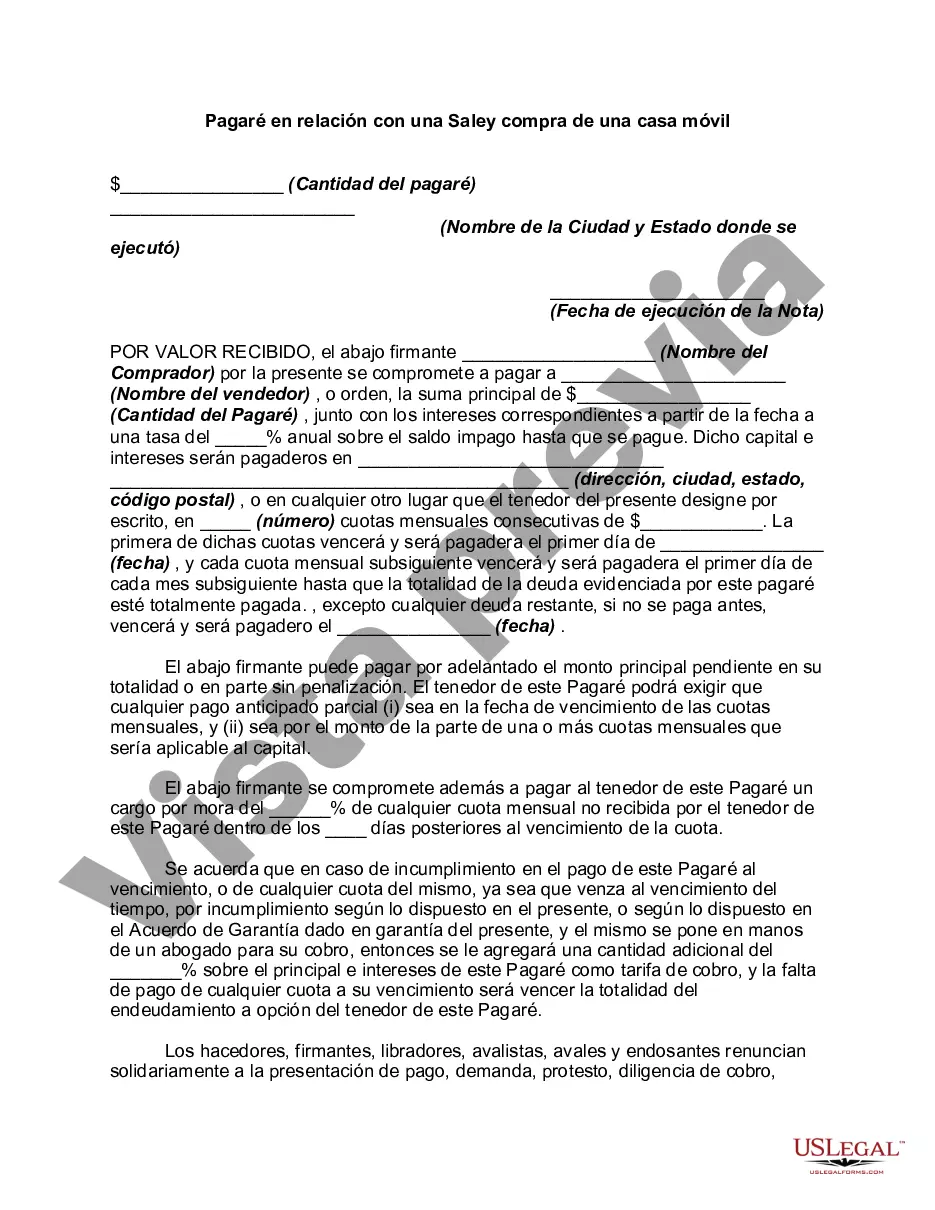

A Chicago Illinois Promissory Note in Connection with a Sale and Purchase of a Mobile Home is a legal document that outlines the terms and conditions of a loan between a buyer and a seller in the context of a mobile home purchase. This note serves as evidence of the debt owed by the buyer to the seller and the promise to repay the loan under specific terms. The Chicago Illinois Promissory Note for a mobile home sale typically includes essential details such as the names and addresses of the buyer and seller, the date of the agreement, and a clear description of the mobile home being sold. It also outlines the total purchase price, any down payment made, and the loan amount. The promissory note in this context specifies the interest rate, the number of monthly or regular installment payments, and the due dates for each payment. It may also include information regarding late payment penalties, acceleration clauses, and the events that lead to default and potential consequences. One type of Promissory Note in Connection with a Sale and Purchase of a Mobile Home in Chicago is a fixed-rate promissory note. This type of note establishes a fixed interest rate that is known from the beginning, providing the buyer with predictability in their loan repayments. Another type is an adjustable-rate promissory note, where the interest rate is subject to change over time based on specified indexes or market conditions. This type of note offers flexibility but brings potential fluctuations in the buyer's monthly repayments. Additionally, a balloon payment promissory note might be used in Chicago Illinois in connection with the sale and purchase of a mobile home. This note allows the buyer to make lower monthly payments for a set period, followed by a large lump sum payment, usually known as the "balloon payment," at the end of the loan term. It is important for both the buyer and seller to understand the terms and obligations outlined in the Chicago Illinois Promissory Note in Connection with a Sale and Purchase of a Mobile Home before entering into the agreement. Consulting with an attorney can be beneficial to ensure compliance with local laws and regulations and to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Pagaré en relación con la compra y venta de una casa móvil - Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Chicago Illinois Pagaré En Relación Con La Compra Y Venta De Una Casa Móvil?

Creating forms, like Chicago Promissory Note in Connection with a Sale and Purchase of a Mobile Home, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for various cases and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Chicago Promissory Note in Connection with a Sale and Purchase of a Mobile Home form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Chicago Promissory Note in Connection with a Sale and Purchase of a Mobile Home:

- Make sure that your form is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Chicago Promissory Note in Connection with a Sale and Purchase of a Mobile Home isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start using our service and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

El cierre, tambien llamado acuerdo, es cuando usted y todas las demas partes firman los documentos necesarios para completar una transaccion hipotecaria. Despues de firmar estos documentos, usted se hace responsable por el prestamo hipotecario.

En un pagare se deben diligenciar los siguientes conceptos: El valor o monto del pago. La fecha en que se debe pagar. Los intereses si los hay. Nombre del beneficiario (a quien se paga) Lugar en que se pagara. Firma del otorgante (quien se compromete a pagar).

Al primer trimestre del 2022, el precio de un inmueble fue de 1,466,000 pesos, lo que representa un incremento de 7.7% respecto al ano anterior. Para poder adquirir un inmueble con estos valores, las personas deben ganar al menos 60,000 pesos, de acuerdo al simulador de credito de La Haus.

¿Como llenar un pagare? Importe a pagar: Escribe tanto en numeros como en letras el importe que queda pendiente de pago.Fecha de vencimiento: Es importante indicar la fecha en que se realizara el pago.Nombre del beneficiario:Lugar de pago:Porcentaje de interes:La palabra pagare:Firma:Barra de truncabilidad:

Determinando Tu Down Payment o Pago Inicial del Mortgage Tipicamente un prestamos convencional requiere un down payment the por lo menos 5% del valor de la propiedad a comprar. Los prestamos FHA requieren solo un 3,5%.

Un pagare se puede cobrar por via judicial al dia siguiente de su vencimiento, a traves de a la Acciones cambiarias en el pagare las cuales pueden ser: Directa. Se da contra el suscriptor y el aval si existe. Prescribe en tres anos, contados a partir del vencimiento.

1- Denominacion de la entidad y oficina librada. 2- El vencimiento es una de las mas partes mas importantes. 3- Identificacion de la persona a la cual se debe dirigir el pago. 4- Numero de serie y numero de documento del pagare. 5- Codificacion del numero de serie y documento. 6- La fecha y lugar de emision del pagare.

Partes de un pagare Fecha y lugar de emision del pagare Nombre de la entidad y oficina librada. Nombre completo o razon social del beneficiario (puede ser una persona fisica o juridica) Importe expresado en numeros y letras. Fecha y lugar de vencimiento. Numero de cuenta y Codigo IBAN de la cuenta del emisor.

Estados Unidos - Tasa hipotecaria Estados UnidosUltimoReferenciaTasa hipotecaria5.45Aug 2022Solicitudes De Hipotecas-2.30Aug 2022Indice de compras MBA203.80Aug 2022Indice de refinanciamiento hipotecario MBA627.10Aug 20221 more row

En la mayoria de los casos, necesitaras un down payment de entre el 20 % y el 25 % para calificar. Si tienes una puntuacion de credito mayor de 720, puedes calificar para un prestamo de propiedad de inversion con un down payment del 15 %.