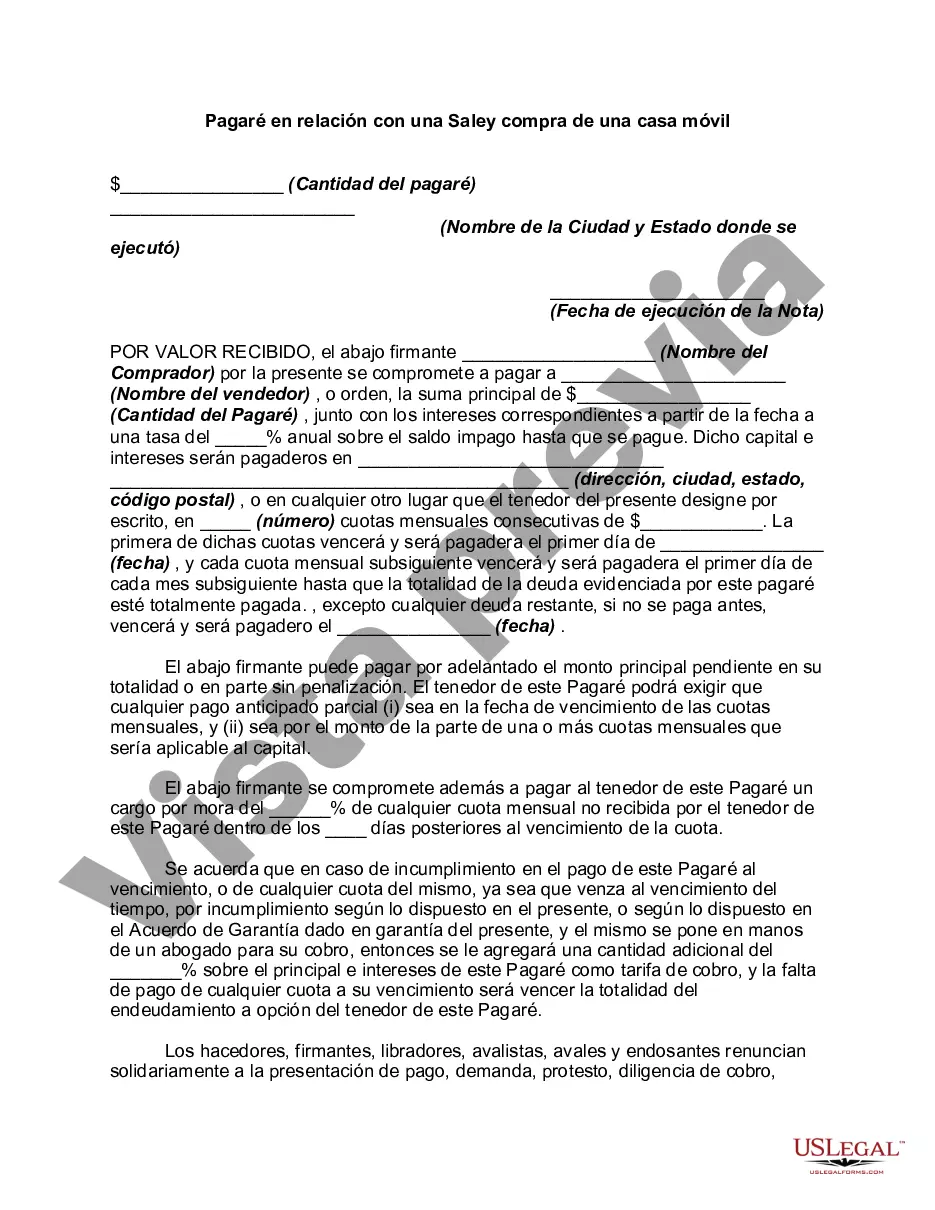

A Cook Illinois Promissory Note in Connection with a Sale and Purchase of a Mobile Home is a legal document that outlines the terms and conditions of a loan agreement between the seller and the buyer of a mobile home located within Cook County, Illinois. This promissory note serves as evidence of the borrower's promise to repay the loan amount, incorporating specific details such as repayment terms, interest rates, and any other conditions agreed upon by both parties involved in the transaction. The Cook Illinois Promissory Note provides a comprehensive framework for the sale and purchase of a mobile home, ensuring transparency and legal protection for both the seller and the buyer. By detailing all essential aspects of the loan agreement, this document helps prevent any confusion or disputes that may arise during the transaction process. Here are some essential components typically included in a Cook Illinois Promissory Note: 1. Loan amount: This specifies the total amount borrowed by the buyer for the mobile home purchase. 2. Interest rate: The interest rate determines the costs associated with borrowing the funds and is calculated based on the principal amount. 3. Repayment terms: This section outlines the schedule and method of repayment, including the frequency of payments (monthly, quarterly, etc.) and the length of the repayment period. 4. Late payment fees: In the event of late payments, this component details any penalties or fees that may apply. 5. Default consequences: This section defines the consequences if the buyer fails to meet the repayment obligations or defaults on the loan. 6. Security interest: If applicable, a Cook Illinois Promissory Note may include information about any collateral or security interest agreed upon, such as the mobile home itself or other assets. Types of Cook Illinois Promissory Note in Connection with a Sale and Purchase of a Mobile Home: 1. Fixed-rate promissory note: This type of promissory note establishes a fixed interest rate for the loan duration, meaning the rate remains constant regardless of any fluctuations in the market. 2. Adjustable-rate promissory note: An adjustable-rate promissory note allows for the interest rate to vary over time, typically tied to a specific financial index or benchmark rate. The interest rate may adjust periodically, usually annually, reflecting market conditions. 3. Balloon promissory note: This promissory note structure involves regular payments over the loan term, with a large final payment known as a balloon payment. The balloon payment is significantly larger than the regular installment payments, providing a more affordable repayment schedule until the final payment comes due. It's important for both the seller and the buyer to carefully review and understand the terms outlined in a Cook Illinois Promissory Note before signing it to ensure compliance with applicable laws and a smooth transaction process. It is highly recommended consulting with legal professionals specializing in real estate or mobile home transactions to ensure all legal requirements are met and the parties involved are adequately protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Pagaré en relación con la compra y venta de una casa móvil - Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Cook Illinois Pagaré En Relación Con La Compra Y Venta De Una Casa Móvil?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Cook Promissory Note in Connection with a Sale and Purchase of a Mobile Home, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Cook Promissory Note in Connection with a Sale and Purchase of a Mobile Home from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Cook Promissory Note in Connection with a Sale and Purchase of a Mobile Home:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Partes de un pagare Fecha y lugar de emision del pagare Nombre de la entidad y oficina librada. Nombre completo o razon social del beneficiario (puede ser una persona fisica o juridica) Importe expresado en numeros y letras. Fecha y lugar de vencimiento. Numero de cuenta y Codigo IBAN de la cuenta del emisor.

En un pagare se deben diligenciar los siguientes conceptos: El valor o monto del pago. La fecha en que se debe pagar. Los intereses si los hay. Nombre del beneficiario (a quien se paga) Lugar en que se pagara. Firma del otorgante (quien se compromete a pagar).

Formato y partes de un pagare El nombre de la persona natural, juridica o empresa que cobrara el pagare. La cantidad del importe a pagar escrita tanto en letras como en numeros. Fecha y lugar donde se emitio el documento. Los datos bancarios y/o el numero de cuenta del emisor para que reciba el dinero del pagare.

¿Como llenar un pagare? Importe a pagar: Escribe tanto en numeros como en letras el importe que queda pendiente de pago.Fecha de vencimiento: Es importante indicar la fecha en que se realizara el pago.Nombre del beneficiario:Lugar de pago:Porcentaje de interes:La palabra pagare:Firma:Barra de truncabilidad:

1- Denominacion de la entidad y oficina librada. 2- El vencimiento es una de las mas partes mas importantes. 3- Identificacion de la persona a la cual se debe dirigir el pago. 4- Numero de serie y numero de documento del pagare. 5- Codificacion del numero de serie y documento. 6- La fecha y lugar de emision del pagare.

Debes obtener una matricula o permiso de casa movil registrado por el estado. Tener la matricula vigente al pagar el importe establecido. Obtener titulo de propiedad de la casa movil por si deseas venderla despues. Autorizacion del condado para ubicar la casa en estacionamientos para casas moviles.

En conclusion, una mobil home es: primero, un bien mueble; segundo, se requiere de licencia urbanistica; tercero, en el supuesto de instalar una mobil home sin licencia urbanistica, se abrira expediente administrativo de disciplina urbanistica; cuarto, habra que tener en cuenta la prescripcion, es decir, si ha

Para averiguar como obtener este documento y para otras preguntas sobre como mudarse de una casa movil, visite - sol. htm o llame al Departamento de Vivienda y Asuntos Comunitarios de Texas al (512) 475-2200.

¿Como encontrar el ano de fabricacion de un mobil home ? Cada mobil home dispone de un codigo de identificacion grabado en el chasis. Este numero de serie le permite saber el ano de fabricacion del mobil home.

La duracion de un Mobil Home puede ser de 15 a 25 anos segun la calidad del Mobil Home y de su mantenimiento.