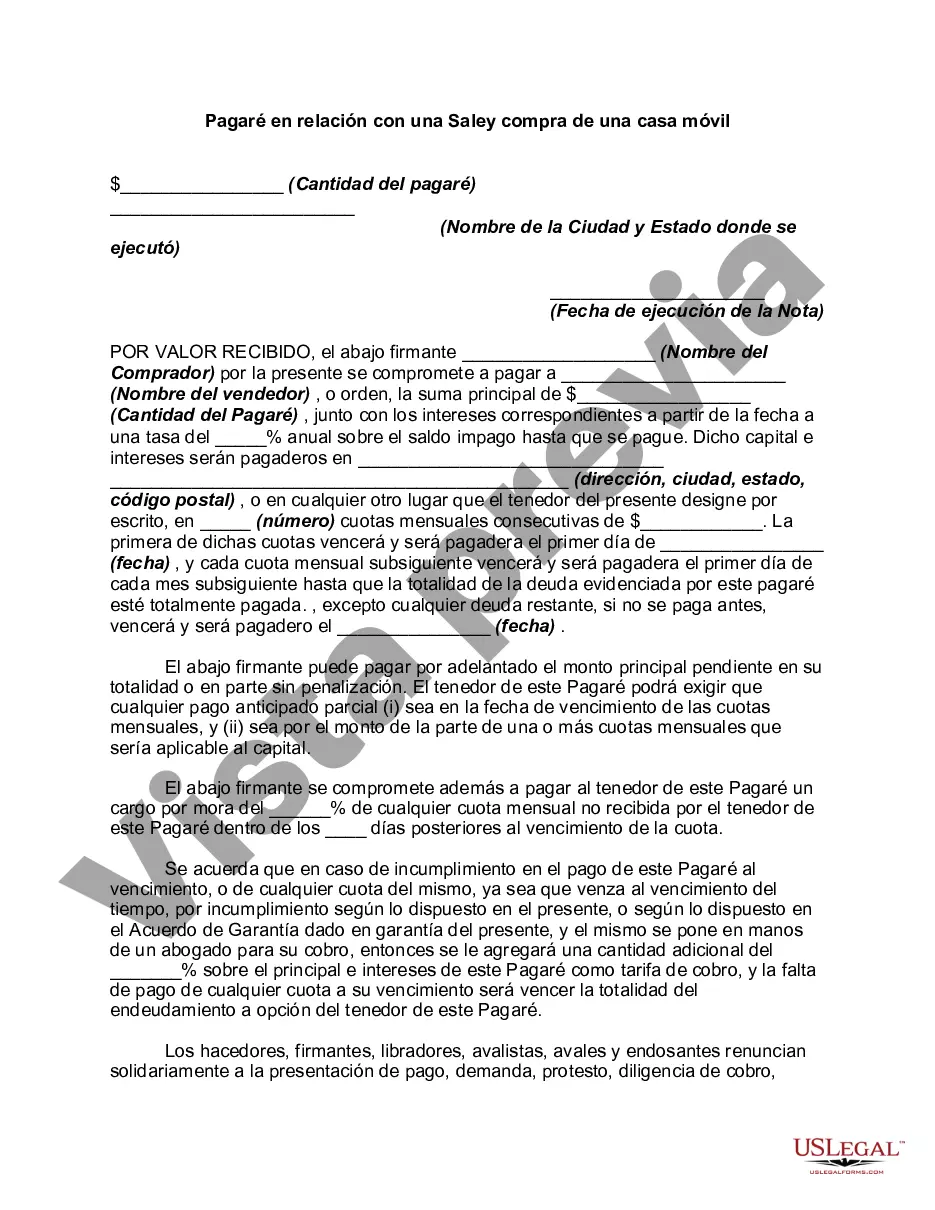

A Fulton Georgia Promissory Note in connection with a sale and purchase of a mobile home is a legal document that outlines the terms and conditions of a loan agreement between a buyer (borrower) and a seller (lender) for the sale and purchase of a mobile home in Fulton, Georgia. This contract serves as evidence of the loan, specifying the loan amount, interest rate, repayment schedule, and any other important details that both parties agree upon. In Fulton, Georgia, there are different types of Promissory Notes that can be used in connection with the sale and purchase of a mobile home. These include: 1. Installment Promissory Note: This type of Promissory Note establishes a fixed repayment schedule, typically in monthly installments, outlining the principal amount borrowed, interest rate, and the duration of the loan. The buyer agrees to repay the loan in equal payments over a specified period until the loan is fully paid off. 2. Balloon Promissory Note: In a balloon Promissory Note, the initial payments are typically lower, similar to an installment Promissory Note. However, the loan term is shorter, and at the end, a large "balloon" payment is due. This type of note might be beneficial for buyers who expect to have the means to make a lump sum payment in the future or plan to refinance the loan. 3. Adjustable-Rate Promissory Note: This type of Promissory Note establishes an interest rate that can fluctuate over time. The interest rate is tied to an index, such as the prime rate or the federal funds rate, and may be adjusted periodically. This allows for potential changes in interest rates, which can be advantageous or disadvantageous depending on market conditions. 4. Secured Promissory Note: This type of Promissory Note includes a provision for collateral, often the mobile home itself or other assets belonging to the buyer, which can be seized in the event of default. It provides the lender with additional security, reducing their risk. A Fulton Georgia Promissory Note in connection with a sale and purchase of a mobile home is a crucial tool for both buyers and sellers to protect their respective interests and ensure a clear understanding of the loan agreement. It is recommended to consult with legal professionals to draft and review the applicable Promissory Note to comply with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Pagaré en relación con la compra y venta de una casa móvil - Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Fulton Georgia Pagaré En Relación Con La Compra Y Venta De Una Casa Móvil?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Fulton Promissory Note in Connection with a Sale and Purchase of a Mobile Home, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork completion straightforward.

Here's how you can purchase and download Fulton Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the validity of some records.

- Check the similar forms or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and purchase Fulton Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Fulton Promissory Note in Connection with a Sale and Purchase of a Mobile Home, log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you need to deal with an extremely complicated case, we advise getting an attorney to examine your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!