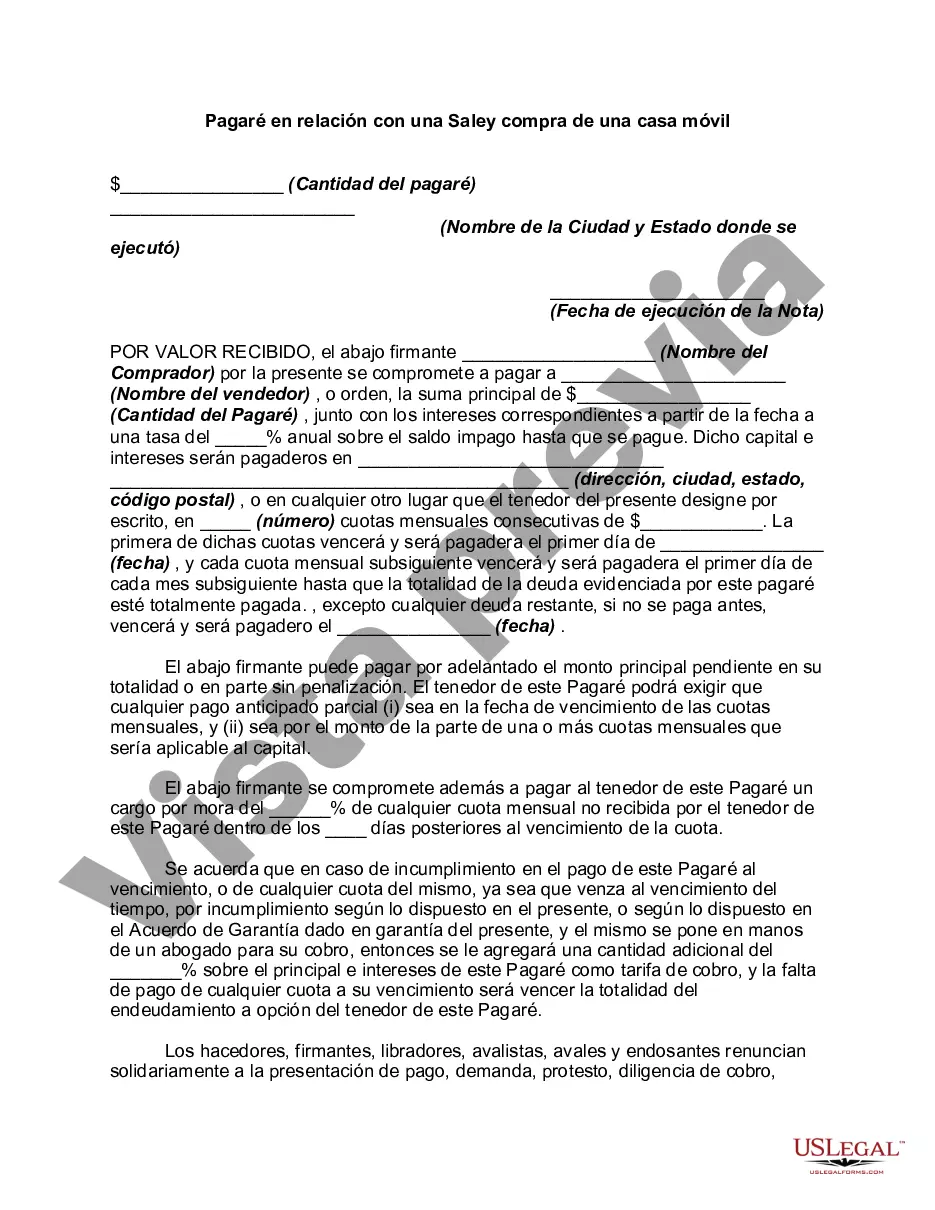

Harris Texas Promissory Note in Connection with a Sale and Purchase of a Mobile Home is a legal document that outlines the terms and conditions of a loan agreement between the seller and the buyer in a mobile home transaction. This note serves as evidence of the borrower's promise to repay the loan amount, including any interest, within a specified period. This promissory note is specifically tailored for mobile home sales within Harris County, Texas. It ensures that both parties are protected and provides a clear understanding of the financial terms involved in the sale and purchase of the property. Keywords: Harris Texas, Promissory Note, Mobile Home, Sale, Purchase, Loan Agreement, Seller, Buyer, Legal Document, Loan Amount, Interest, Specified Period, Mobile Home Sales, Harris County, Texas, Financial Terms, Property. Different Types of Harris Texas Promissory Note in Connection with a Sale and Purchase of a Mobile Home: 1. Fixed-Term Promissory Note: This type of promissory note establishes a specific repayment period in which the borrower must repay the loan amount, including interest. The terms are agreed upon upfront, providing clarity and predictability for both parties involved. 2. Adjustable-Rate Promissory Note: In this type of promissory note, the interest rate charged on the loan adjusts periodically, typically based on a predetermined index. This allows the interest rate to fluctuate as market conditions change, potentially affecting the borrower's repayment amount. 3. Balloon Payment Promissory Note: A balloon payment promissory note features lower monthly installments initially, but after a certain period, typically a few years, a larger final payment, known as a balloon payment, is due. This type of note is suitable for borrowers who expect increased income or plan to refinance before the final payment is due. 4. Installment Promissory Note: With an installment promissory note, the repayment of the loan amount, including interest, is divided into equal monthly installments over the loan term. This type of note provides a structured repayment plan to the borrower and ensures regular payments to the seller. Remember that it is essential to consult with a legal professional when drafting or signing any legal documents, such as a Harris Texas Promissory Note in Connection with a Sale and Purchase of a Mobile Home. They can provide personalized advice and ensure that the note complies with all relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Pagaré en relación con la compra y venta de una casa móvil - Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Pagaré En Relación Con La Compra Y Venta De Una Casa Móvil?

A document process consistently accompanies any legal actions you undertake. Launching a business, applying for or accepting a job position, transferring assets, and numerous other life situations demand that you prepare official documents that vary by state. This is why having everything organized in one location is exceptionally advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents. On this site, you can effortlessly find and obtain a document for any personal or commercial purpose relevant to your area, including the Harris Promissory Note in Relation to the Sale and Purchase of a Mobile Home.

Finding templates on the site is incredibly straightforward. If you already have a subscription to our library, Log In to your account, search for the template in the search bar, and click Download to save it on your device. Subsequently, the Harris Promissory Note in Relation to the Sale and Purchase of a Mobile Home will be accessible for further usage in the My documents section of your profile.

If you are utilizing US Legal Forms for the first time, adhere to this easy guideline to acquire the Harris Promissory Note in Relation to the Sale and Purchase of a Mobile Home: Make certain you have accessed the correct page containing your localized form. Utilize the Preview option (if available) and scroll through the template. Review the description (if provided) to confirm the template meets your requirements. If the example does not suit you, search for an alternative document using the search feature. Press Buy Now when you find the desired template. Choose the suitable subscription plan, then Log In or create an account. Pick the preferred payment method (using credit card or PayPal) to continue. Select the file format and save the Harris Promissory Note in Relation to the Sale and Purchase of a Mobile Home on your device. Use it as necessary: print it or fill it out digitally, sign it, and submit it where needed.

This is the simplest and most trustworthy way to obtain legal documents. All samples available in our library are professionally drafted and verified to comply with local laws and regulations. Prepare your documents and manage your legal matters efficiently with US Legal Forms!

- Ensure you are on the correct page with your localized form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then Log In or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Harris Promissory Note in Relation to the Sale and Purchase of a Mobile Home on your device.