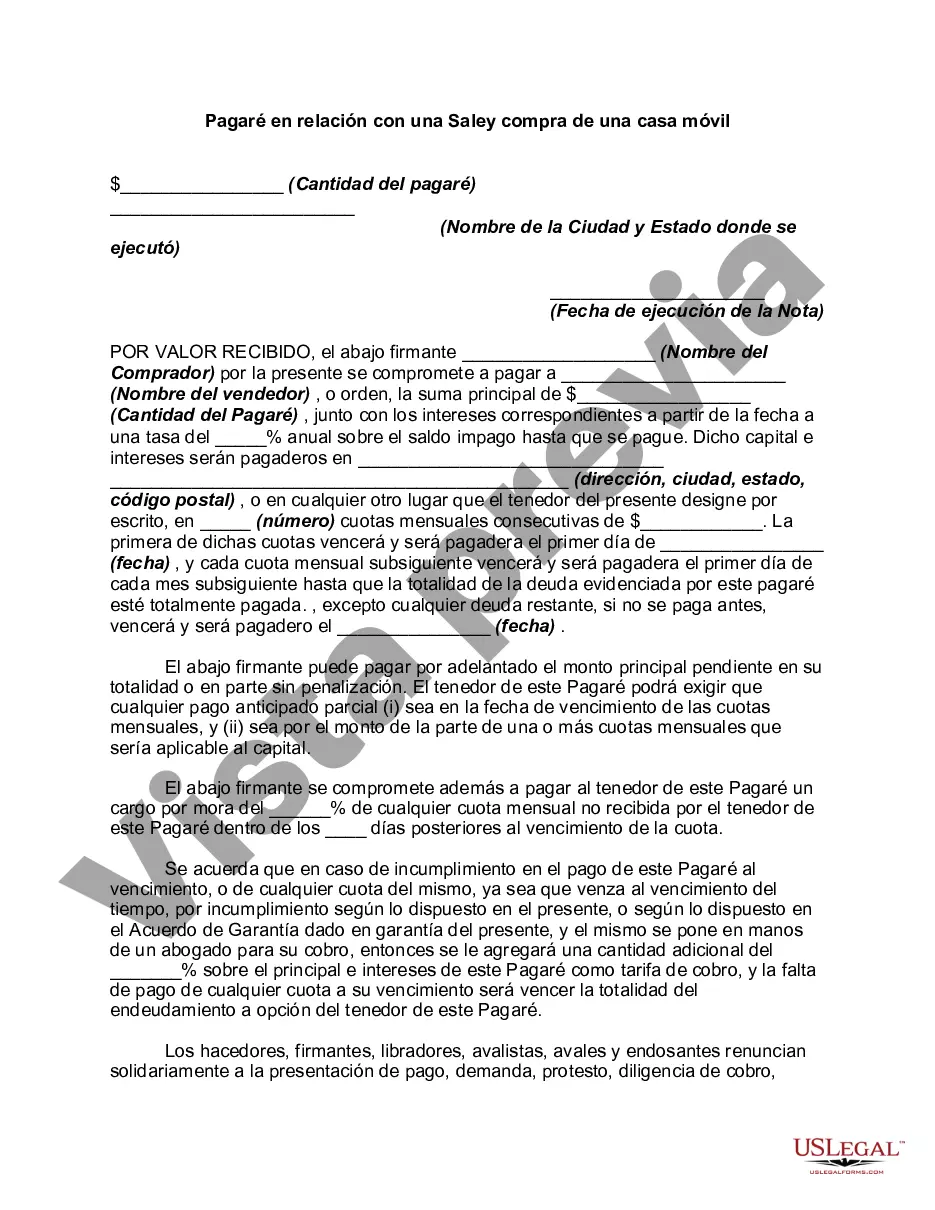

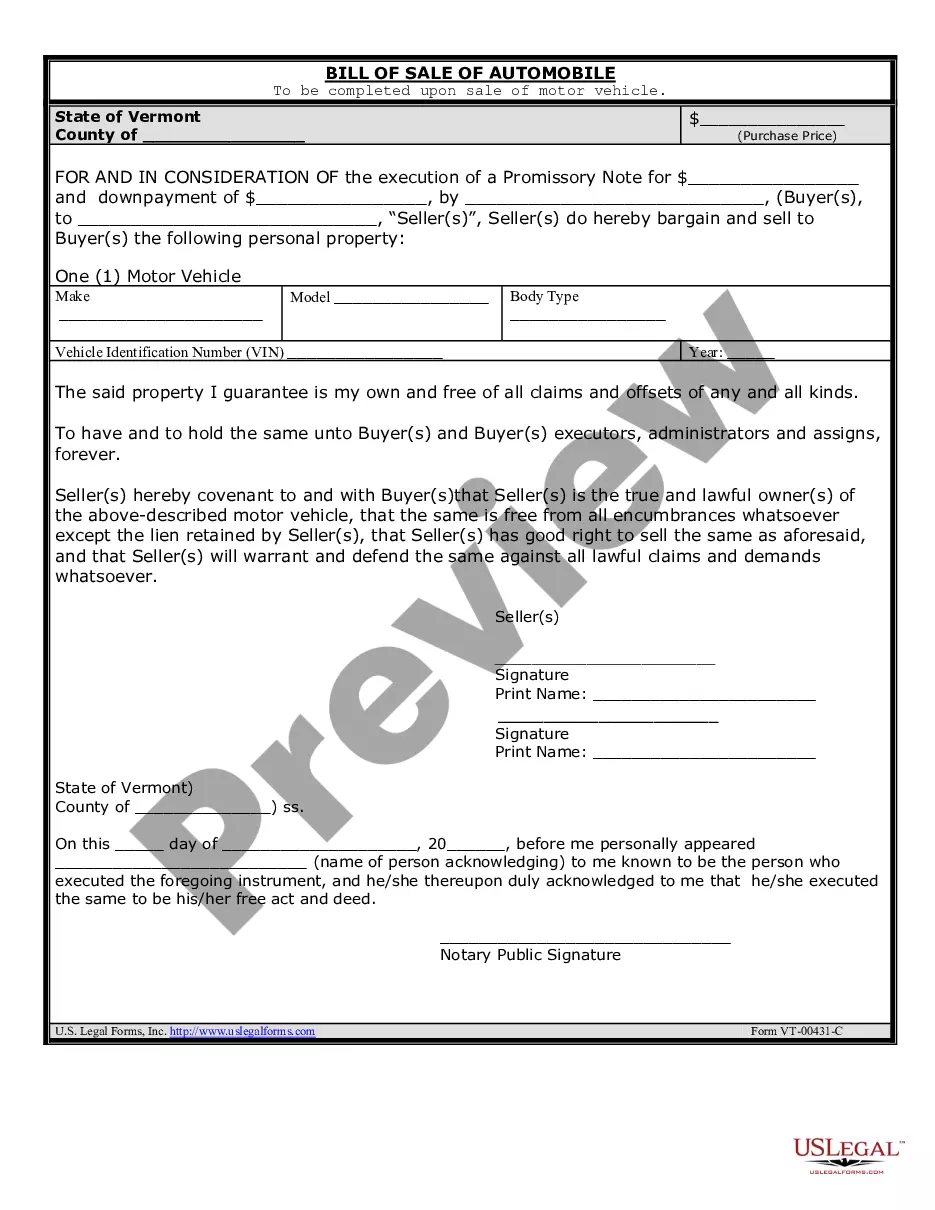

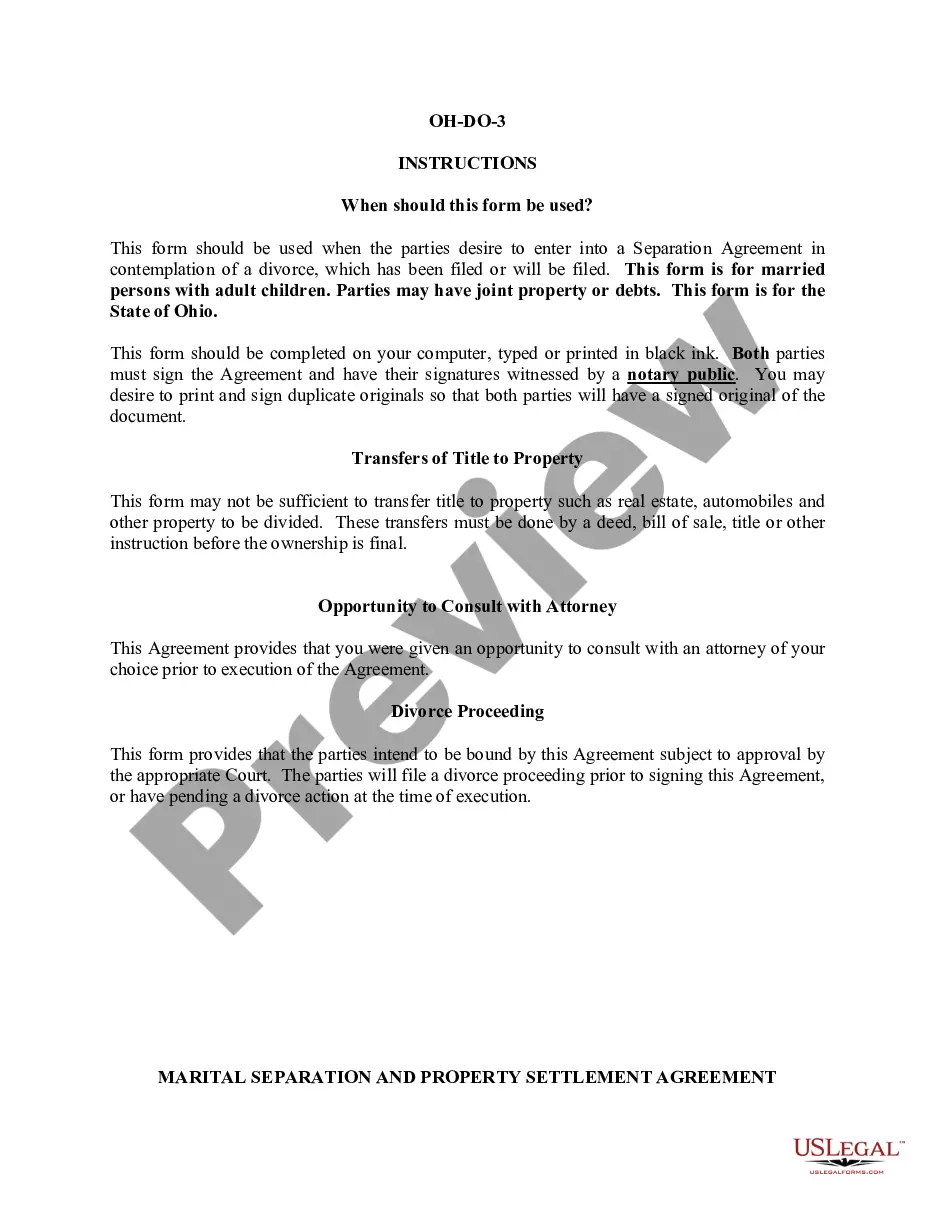

Oakland, Michigan Promissory Note in Connection with a Sale and Purchase of a Mobile Home: A Promissory Note is a legal document that serves as a written promise to repay a specific amount of money borrowed from one party (the buyer) to another party (the seller) within a specified timeline and under agreed-upon terms and conditions. When purchasing a mobile home in Oakland, Michigan, a Promissory Note is often utilized to document the financial agreement and protect the interests of both the buyer and the seller. Keyword: Oakland Michigan, Promissory Note, sale and purchase, mobile home Types of Oakland, Michigan Promissory Notes in Connection with a Sale and Purchase of a Mobile Home: 1. Fixed-Term Promissory Note: This type of Promissory Note outlines a fixed repayment period within which the buyer has to repay the borrowed funds. It includes the principal amount, interest rate, and a predetermined schedule of installment payments over a specific number of months or years. A fixed-term Promissory Note ensures a structured repayment plan for the buyer and safeguards the seller's investment. 2. Balloon Promissory Note: A Balloon Promissory Note is an agreement wherein the buyer agrees to make regular payments for a specific period, typically with lower installments, followed by a lump-sum payment of the remaining balance at the end of the term. This type of Promissory Note is commonly used when a buyer intends to refinance or sell the mobile home before the final balloon payment becomes due. 3. Secured Promissory Note: A Secured Promissory Note provides security for the seller by including a collateral provision. In the context of a mobile home purchase, the mobile home itself serves as collateral, ensuring that the seller has recourse if the buyer fails to repay the loan. In case of default, the seller can take legal action to repossess the mobile home. 4. Unsecured Promissory Note: An Unsecured Promissory Note does not include any collateral provision. This type of Promissory Note relies solely on the buyer's creditworthiness and trustworthiness, without any specific asset securing the loan. However, unsecured Promissory Notes may involve higher interest rates or more stringent borrowing criteria, as they pose higher risks for the seller. 5. Installment Promissory Note: An Installment Promissory Note outlines periodic installment payments, typically on a monthly basis, until the full loan amount is repaid. It specifies the due date, the payment amount, and the interest rate. This type of Promissory Note provides a clear payment structure, making it easier for both parties to monitor the loan's progress and repayment obligations. In conclusion, when engaging in the sale and purchase of a mobile home in Oakland, Michigan, it is essential to establish a Promissory Note to outline the terms and conditions of the loan. The type of Promissory Note chosen depends on the specific circumstances and preferences of the parties involved, ensuring a secure and transparent transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Pagaré en relación con la compra y venta de una casa móvil - Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Oakland Michigan Pagaré En Relación Con La Compra Y Venta De Una Casa Móvil?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Oakland Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Oakland Promissory Note in Connection with a Sale and Purchase of a Mobile Home will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to obtain the Oakland Promissory Note in Connection with a Sale and Purchase of a Mobile Home:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Oakland Promissory Note in Connection with a Sale and Purchase of a Mobile Home on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Si la vivienda se ha instalado correctamente y es de calidad, una casa prefabricada o modular puede durar tanto como una convencional construida directamente en el suelo. Existe cierto consenso entre el tiempo medio de vida de este tipo de viviendas: entre los 50 y los 70 anos .

La respuesta es si. Necesitas obtener una licencia para instalar tu casa movil y es que, a efectos urbanisticos si es considerada una edificacion. Por ejemplo, en la normativa urbanistica de la Comunidad Autonoma de Madrid esta regulado, especificamente en la Ley 9/2001 referente al suelo de Madrid.

Las placas Durlock® no tienen vencimiento y una obra ejecutada siguiendo las indicaciones del manual tecnico y los documentos especificos duran toda la vida.

Debes obtener una matricula o permiso de casa movil registrado por el estado. Tener la matricula vigente al pagar el importe establecido. Obtener titulo de propiedad de la casa movil por si deseas venderla despues. Autorizacion del condado para ubicar la casa en estacionamientos para casas moviles.

La duracion de un Mobil Home puede ser de 15 a 25 anos segun la calidad del Mobil Home y de su mantenimiento.

La duracion de un Mobil Home puede ser de 15 a 25 anos segun la calidad del Mobil Home y de su mantenimiento.

Para una nueva casa movil de entrada, cuenta entre 15.000 y 30.000 euros. Este precio puede llegar a 50 000 euros o incluso 60 000 euros para una nueva casa movil de alta gama. El costo de una casa movil es por lo tanto mucho mas bajo que el de una segunda casa clasica.

¿Como encontrar el ano de fabricacion de un mobil home ? Cada mobil home dispone de un codigo de identificacion grabado en el chasis. Este numero de serie le permite saber el ano de fabricacion del mobil home.

Casa Movil de 4 Habitaciones Desde $51,899 Mejor precio garantizado.

Las casas prefabricadas son tan seguras como las construcciones de ladrillo. La ventaja principal de las primeras, respecto a las segundas, reside en el coste y tiempo de ejecucion.

Interesting Questions

More info

2 MB] Download Trailer [20.2 MB] Download Trailer [20.2 MB] Download Trailer [40.2 MB] Download Trailer [20.2 MB] Download Trailer [20.2 MB] Download Trailer [40.2 MB] Download Trailer [20.2 MB] Download Trailer [20.2 MB] Download Trailer [20.2 MB] Download Trailer [20.2 MB] Download Trailer [20.2 MB] Download Trailer [20.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] 6 Photos, 10 Videos Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailer [23.2 MB] Download Trailers / Videos [23.2 MB] Download Trailer [23.2 MB] Download Trailers / Videos [23.2 MB] 7 Photos, 10 Videos Download Trailer [38.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.