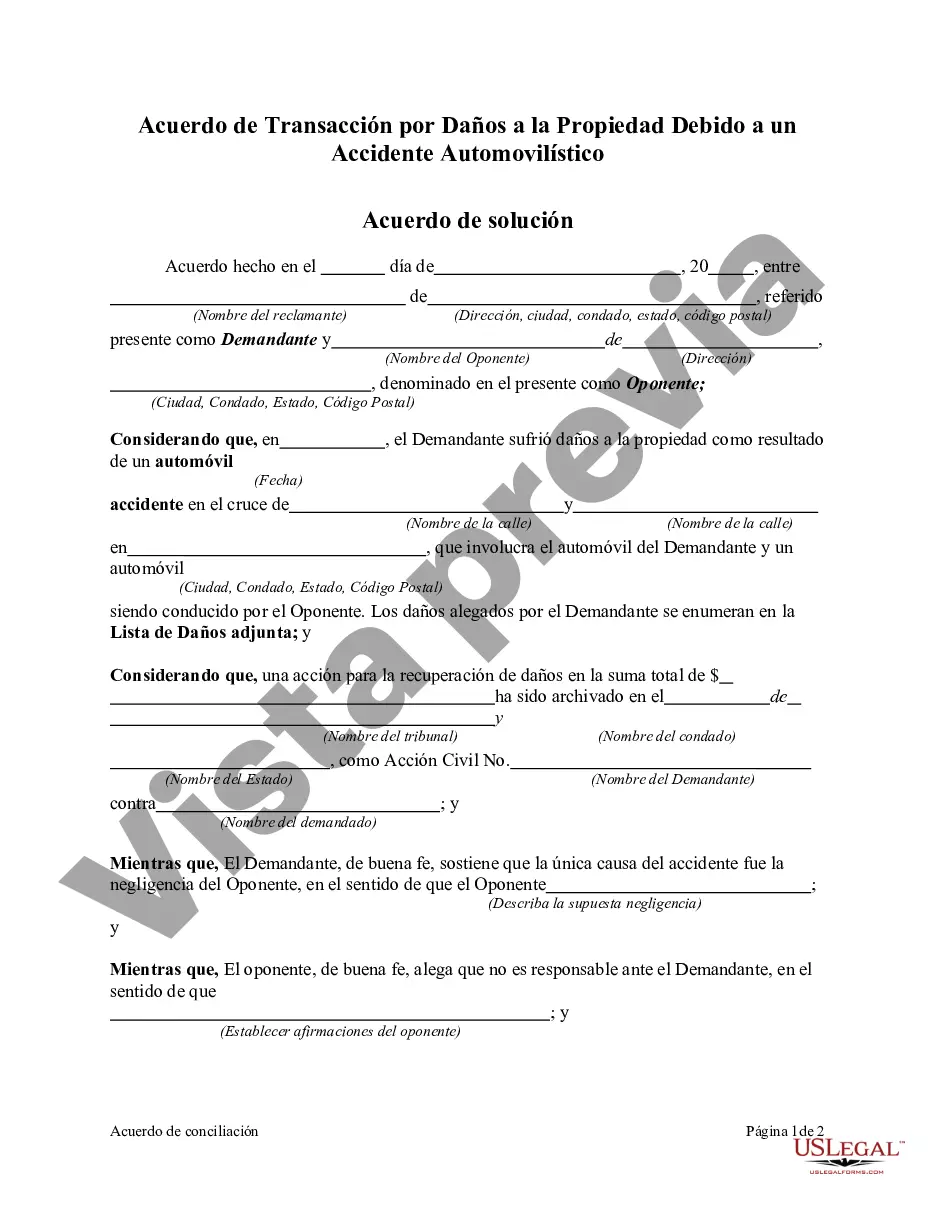

Lima Arizona Settlement Agreement Regarding Property Damages due to an Automobile Accident is a legal document that outlines the terms and conditions for resolving property damage claims resulting from a car accident in the town of Lima, Arizona. This agreement serves as a contractual agreement between the parties involved, typically the driver at fault and the affected property owner, ensuring fair compensation for the damages incurred. Key details addressed within the settlement agreement may include the identification of the involved parties, their contact information, and their respective legal representation. The agreement should also specify the date and location of the accident, along with a detailed description of the property damage sustained, including photographs and repair estimates if available. Different types of settlement agreements may be outlined based on the extent of property damage and the negotiation between the parties involved. These agreements can be categorized into: 1. Full Repayment Agreement: In cases where the at-fault driver accepts full responsibility for the property damage, this agreement ensures that the responsible party will fully reimburse the property owner for the cost of repairs or replacement of the damaged property. The repayment amount may include actual repair costs, rental vehicle expenses, towing charges, and any applicable deductibles. 2. Partial Repayment Agreement: Occasionally, there may be disputes about the extent of responsibility for the property damage. In such cases, the settlement agreement may outline a partial repayment arrangement whereby the at-fault driver agrees to reimburse a portion of the expenses incurred by the property owner, while accepting some level of shared blame for the accident. 3. Installment Recovery Agreement: In situations where the at-fault driver is unable to provide immediate reimbursement, an installment recovery agreement may be established. This arrangement breaks down the total amount owed into manageable installments over an agreed-upon period, ensuring that the property owner receives compensation at regular intervals. 4. Insurance Company Facilitated Settlement Agreement: If either party involved has insurance coverage, a settlement agreement can be structured through the involvement of their respective insurance companies. This type of settlement agreement typically involves negotiations between insurance adjusters to determine a fair payout for the property damage. It is crucial for both parties to carefully review the settlement agreement and seek legal advice before signing to ensure that their rights are protected and the terms are fair.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Acuerdo de conciliación sobre daños a la propiedad debido a un accidente automovilístico - Settlement Agreement Regarding Property Damages due to an Automobile Accident

Description

How to fill out Pima Arizona Acuerdo De Conciliación Sobre Daños A La Propiedad Debido A Un Accidente Automovilístico?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Pima Settlement Agreement Regarding Property Damages due to an Automobile Accident, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Consequently, if you need the recent version of the Pima Settlement Agreement Regarding Property Damages due to an Automobile Accident, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Pima Settlement Agreement Regarding Property Damages due to an Automobile Accident:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Pima Settlement Agreement Regarding Property Damages due to an Automobile Accident and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!